Wall Street is on edge as Nvidia prepares to release its Q3 earnings on Wednesday. The company sits at the heart of the global AI boom, and its results often influence the entire tech market.

Investors are looking for clues on chip demand, hyperscaler spending, and how quickly AI infrastructure is growing.

Nvidia is expected to report adjusted earnings of $1.26 per share and $55.28 billion in revenue, each up more than 55% from the same period last year, according to Visible Alpha estimates.

Meanwhile, Nvidia also recently became the first company to exceed a $5 trillion market cap.

Why Nvidia result is the ‘Super bowl of stock market’

Wedbush Securities analyst Dan Ives says this moment is massive for the market. Speaking with CNBC on Monday, he described the earnings report as “a Super Bowl not just for tech,” but for the entire market. He added that trading floors around the world will go silent as investors wait for the results.

“It all comes down to on Wednesday night, you’re going to be able to hear a pin drop on trading floors around the world,” Ives told CNBC.

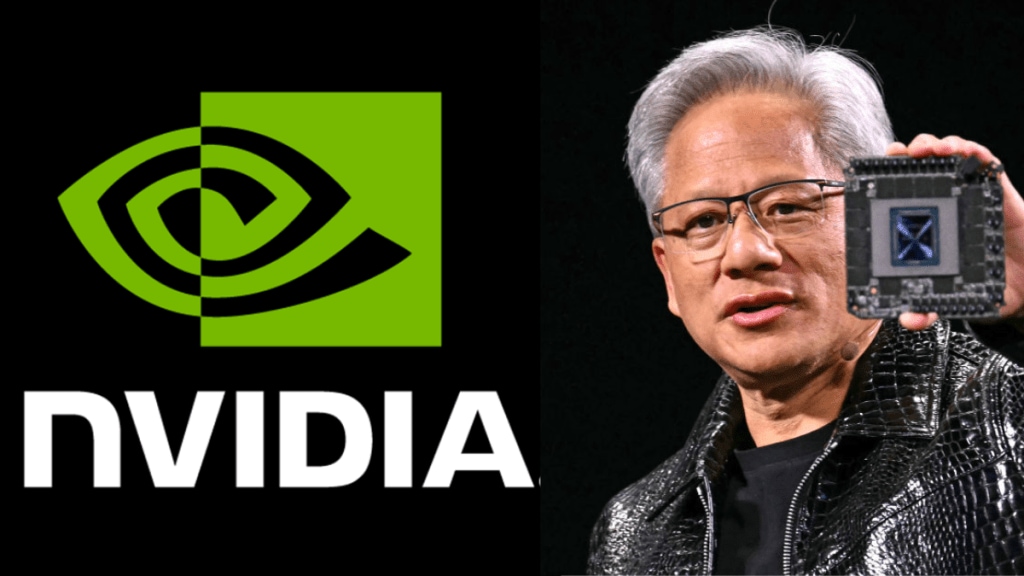

He also praised Nvidia’s unmatched dominance, calling CEO Jensen Huang the “godfather of AI.” Ives said demand for Nvidia’s chips is running at roughly 12-to-1, meaning supply — not interest — is the main barrier.

Nvidia and AI bubble

The anticipation comes at a time when billionaire investor Peter Thiel recently exited his Nvidia holdings. Nvidia CEO Jensen Huang revealed that the company already has $500 billion in orders for 2025 and 2026, showing Nvidia expects the AI boom to continue strongly.

“This is how much business is on the books. Half a trillion dollars’ worth so far,” Huang said at Nvidia’s GTC conference in Washington.

He explained that the $500 billion includes revenue already booked for 2025, plus sales of current Blackwell chips, next year’s Rubin chips, and related hardware such as networking equipment.

Nvidia’s quarterly revenue has grown nearly 600% over the past four years, due to AI demand. Growth is expected to slow slightly as the company moves into its next generation of chips, but analysts say the long-term outlook remains exceptional.