Investors are wondering if the AI boom is real or just a bubble. Some, including Peter Thiel, have even sold their AI stocks. Amidst all these confusions, now everyone is waiting for something huge today, Nvidia’s results day, what experts call as the ‘Super Bowl of the stock market.’

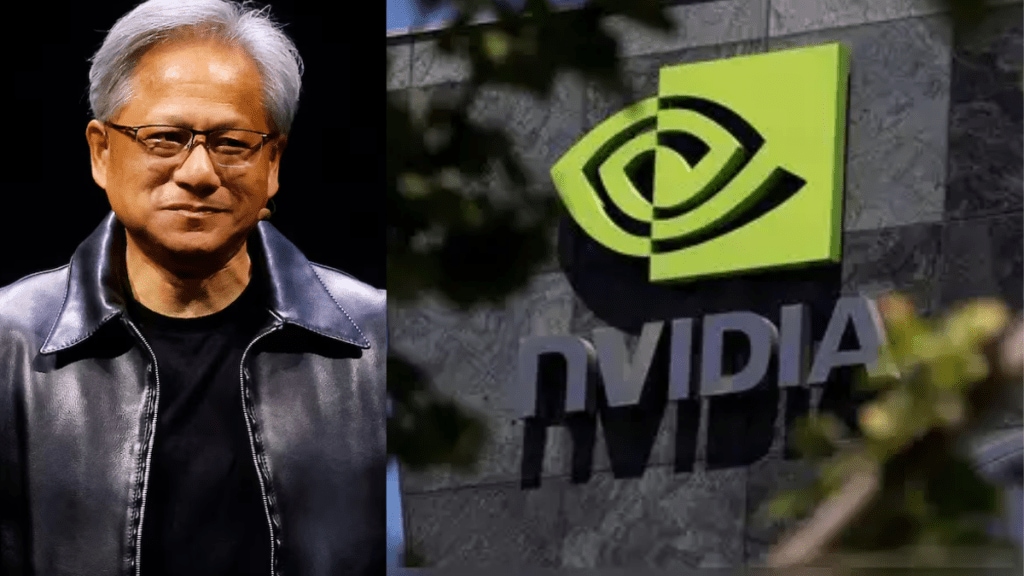

Nvidia is one of the world’s biggest AI companies. In October, it became the first company to reach a $5 trillion value. Its CEO, Jensen Huang, also said Nvidia already has $500 billion in orders for 2025 and 2026, showing the company believes AI will keep growing.

The chipmaker’s revenue has risen almost 600% in the past four years. With all these happening, here are 5 things to watch out for as Nvidia announces its Q3 earnings:

Profit and revenue should be above 50%

Analysts think Nvidia will show more than 50% growth in both profit and revenue this quarter. This is mainly because big companies like Microsoft, Amazon, Alphabet, and Meta, which together make up over 40% of Nvidia’s sales, are spending on AI.

As reported by Bloomberg, these companies are expected to increase their AI spending by 34%, reaching $440 billion in the next year.

Even though the market has been shaky, many investors still believe Nvidia is strong. “This is a ‘so goes Nvidia, so goes the market’ kind of report,” said Scott Martin, chief investment officer at Kingsview Wealth Management, which owns shares of Nvidia and several other Big Tech companies.

Some investors also think Nvidia’s forecast could be a ‘solid’ one. “We are expecting them to report a pretty solid print,” said Jake Seltz, portfolio manager at Allspring Global Investments, which owns a large position in Nvidia.

Seltz said he will be watching the company’s guidance for next quarter closely and that revenue will likely be higher than Wall Street expects, although “it’s hard to know if they’ll put a conservative guide out there,” he told Bloomberg.

Company’s guidance for next quarter

Investors are paying close attention to Nvidia’s guidance because it will strongly influence how the market reacts. Seltz has also told Bloomberg that “it’s hard to know if they’ll put a conservative guide out there.”

Nvidia’s outlook is especially important because investors are becoming more nervous about AI spending over the repeated conversations around the AI bubble and want signs that demand will stay strong.

Even if Nvidia reports strong current results, the stock may not rise unless the upcoming guidance is positive. The guidance will help show whether Nvidia can keep its growth going, as analysts expect sales to slow in the next few years.

Meanwhile, Michael O’Rourke, chief market strategist at Jonestrading, told Bloomberg, “These players in the AI space have gone out of their way to continually raise the expectations bar, and now they have to not only deliver on the numbers, but continue to feed the market’s rising expectations. It is a dangerous game for public companies to play.”

On the other hand, Martin adds that “there are certainly people who think that if Nvidia’s results are strong, projecting bigger sales and activity, then everything is going to be OK,.” he told Bloomberg.

Investors will be looking for strong numbers from Nvidia’s Blackwell series

The Blackwell series is expected to drive the next phase of Nvidia’s growth, and investors see it as a key product line that will show whether the company can keep its strong momentum. According to Bloomberg, analysts expect strong earnings overall, and Blackwell will play a major role in that performance.

Its success will also affect margin expansion, especially in data centers, which made up nearly 90% of Nvidia’s revenue last quarter. As reported by Bloomberg, the Blackwell results will shape the overall takeaway from the earnings report, especially now that people are becoming more nervous about AI stocks.

If demand for Blackwell is strong, it could help ease investor concerns about slowing AI spending and high valuations.

Blackwell chips bring huge improvements to AI performance. They include a new Transformer Engine that supports 4-bit precision, making training and running very large AI models much faster.

Blackwell also delivers up to 30 times better inference performance while using far less energy, helping companies cut costs and power use. Major cloud providers, server makers, and AI leaders like Meta are already using it for training and deploying advanced models.

The chips also come with strong security features to protect sensitive data. Blackwell makes it possible to build the next generation of AI systems, from smarter research tools to fast, interactive AI agents.

Margin expansion will also be key

Margin expansion is a key focus for Wall Street, especially in Nvidia’s data centre division, which made up nearly 90% of its revenue in Q2. Investors expect strong results from the new Blackwell series, which is likely to drive the next phase of growth and help improve margins.

These margin trends are important because data centre GPUs are the main engine of Nvidia’s success during the AI spending boom.

How margins move will play a big role in how the market reacts to Nvidia’s earnings, especially with concerns about AI spending and rising competition.

Even if earnings are strong, any sign of margin pressure could hurt investor confidence. CEO Jensen Huang recently said the company has about $500 billion in Blackwell and Rubin orders, which could support healthy margins if spending continues.

Data center performance

Performance of data centers is key to Nvidia’s growth. In its Q3 2025 result revenue reached a record $35.1 billion, which is 17% higher than the previous quarter and 94% higher than last year.

The data center business made $30.8 billion on its own, growing 17% from the last quarter and 112% from a year ago. This shows that data centers are the main source of Nvidia’s growth as demand for AI infrastructure stays high.

Hence, investors will be keen to understand its current growth situation. As reported by Bloomberg, data centers now make up nearly 90% of Nvidia’s revenue.

Big tech companies such as Microsoft, Amazon, and Meta are driving this growth by rapidly expanding their AI data centers.