The Securities and Exchange Board of India (SEBI) has banned Sanjiv Bhasin, the former Director of IIFL Securities, among others, from securities trading for taking stock positions contrary to his public recommendations.

The case is related to stock recommendations made through various platforms, including media channels, Telegram, and IIFL’s own platforms.

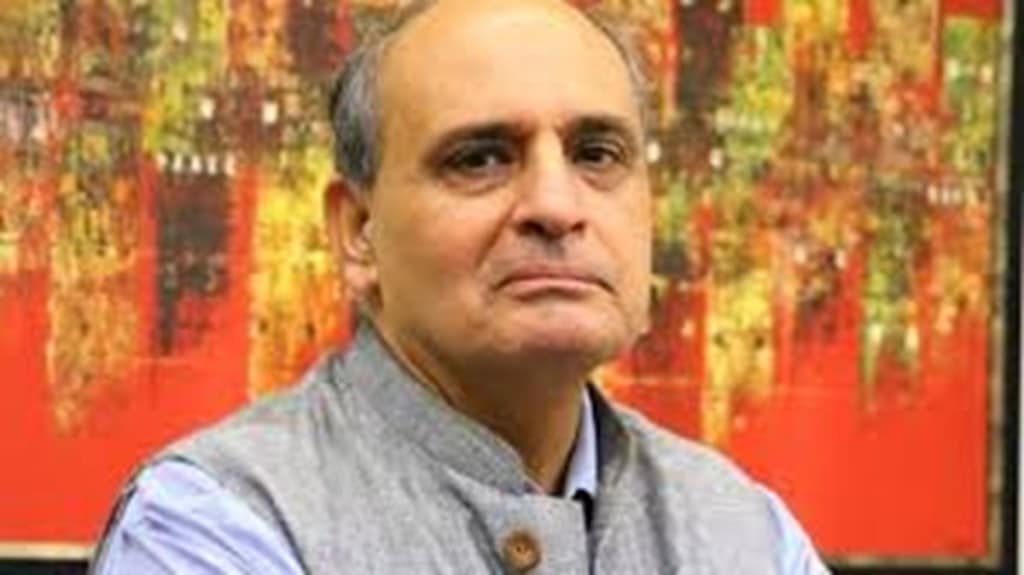

Here is a look at Sanjiv Bhasin’s career thus far and implications of the SEBI move-

Who is Sanjiv Bhasin?

Sanjiv Bhasin, the former director of IIFL Securities, has been offering stock recommendations through various platforms, including media channels, Telegram, and IIFL’s own platforms. At IIFL Securities, he had served as a Director from April 1, 2017 to November 30, 2022, and later as a Consultant from December 1, 2022, to June 17, 2024.

Before IIFL, Bhasin was the director at Deutsche Bank as well as the HB Group. Bhasin, who has created model portfolios accessible to retail investors on platforms like Smallcase, used to also personally oversee sizable portfolios for high-net-worth individuals.

SEBI ban on Sanjiv Bhasin

Investigations by SEBI revealed that Bhasin would strategically buy orders in the trading accounts of Gemini Portfolios, Venus Portfolios, and HB Stock Holdings Ltd—executed through dealers at RRB Master Securities Delhi Ltd—just before his appearances in the media.

His stock recommendations during these appearances had a notable impact on both price and trading volume. Leveraging this influence, Bhasin would then place sell orders in the same accounts, taking the opposite position of his public buy calls to profit from the resulting price increase.

SEBI has also ordered them to return unlawfully earned profits amounting to Rs 11.37 crore.

Sanjiv Bhasin: A look at his academic records

After finishing school, Sanjiv Bhasin had two paths to choose from: follow in his father’s footsteps by attending St. Stephen’s College at Delhi University to pursue cricket, or enroll at Shri Ram College of Commerce. He opted for the latter. After college, Bhasin cleared his chartered accountancy course. He also pursued LLB for two years but did not complete it. Bhasin started going to the trading floor in 1985. “In my life, I’ve had no second choices, only the stock market. And that’s why I withstood all the trials and errors over a period of 33 years,“ he had told Mint in an earlier interview.

Sanjiv Bhasin: What’s unique about the investment strategy

In terms of the first few stocks he had invested in, turns out Bhasin was very keen on holding multinational company stocks. During those years, pharma MNCs were very much in demand and so, Bhasin opted for Glaxo, which made him a lot of money.

In an earlier interaction with FinancialExpress.com, he had talked about his investing strategy. “As for investments, 50-55 per cent is always in large-caps, run-of-the-mill stocks or those that have always performed. Second, I like to keep 30 per cent cash because that gives me plenty of small trading opportunities,” he had said.

Sanjiv Bhasin got married in 1991 to Rashi Bhasin and has three children – 2 sons and 1 daughter.