The deal to acquire CJS Solutions Group is small in the company’s context ($ 114 million rev; ~3% of TechM). Our concern on the stock is around concentration risks (Telecom: ~47% of rev) and challenges to profitable growth—directionally, the move to diversify is a positive but execution, realisation of synergies and thus margin leverage will be key.

Acquisition of CJS Solutions Group: Tech Mahindra announced that the Investment Committee of its Board has approved the proposal to acquire CJS Solutions Group LLC (CJS) through its subsidiary company in the US. CJS had revenues of $114m in TTM ending Sep’16. Management indicated that Ebitda margins are in the high single digits. The company has 500+ employees.

US-based healthcare services firm: CJS is a US-based healthcare consulting company, which does its business as ‘The HCI Group’. It works with Tier-1 healthcare service providers primarily in the US and UK, focusing on providing end-to-end implementation of Electronic Health Record (EHR) and Electronic Medical Record (EMR) software, training and support services.

You may also like to watch:

Contours of the deal: The deal is at a present EV of $110m with the entire consideration payable in cash. $89.5m is being paid upfront for acquisition of 84.7% membership units in CJS. For acquiring the remaining 15.3%, a contingent consideration of a maximum of $130.5m is payable in CY18, CY19 and CY20 based on revenue and Ebitda achieved in 2017-19.

Other key takeaways: (i) The transaction is subject to approval under the Hart-Scott-Rodino Antitrust Improvements Act in the US among others, and closing is expected before end Apr’17; (ii) CJS had revenues of $75.6m in CY15, up 8.6% y-o-y; (iii) TechM currently has ~ $10m business from the healthcare provider space.

High level of M&A activity continues in the sector: We expect M&A and free cash flow to be among the key themes in the sector in 2017 . Companies are undertaking multiple steps around capital allocation as core growth slows. While cash usage seems to be improving across the sector, we would also be mindful of the consequent increase in integration/execution-related risks.

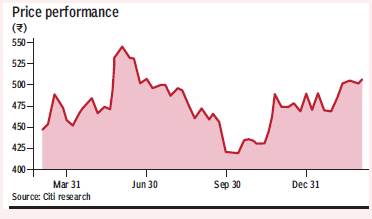

Valuation: Our target price of Rs 445 is based on ~12.5x Sep’18e EPS. This is at a ~15 discount to our target multiple for HCL Tech. TechM continues to see a lower organic growth profile and higher vertical/client concentration risks with continued headwinds in the telecom vertical, but there seem to be renewed expectations of a recovery. We believe PE remains the most appropriate valuation measure given the profitable track record of these large IT services companies.

Risks: Key upside risks that could cause the shares to trade above our target price include: (i) any significant depreciation of the rupee against the USD/ EUR/ GBP; (ii) a sharp upturn in IT spending among TSPs; (iii) large deal announcements; and (iv) inorganic activity.