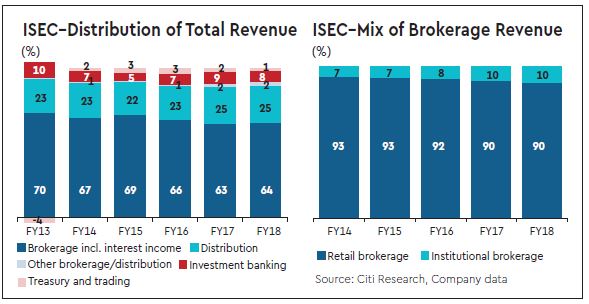

We initiate coverage on ICICI Securities (ISEC) with a Buy rating and TP of Rs 425 (18x Sep-19e P/E). Investment thesis: (i) we expect it to be a key beneficiary of a shift to financial (from physical) avenues of savings by individuals; (ii) cross-selling to ICICI Bank customers can drive growth in client base; (iii) its diversified business model across broking (~65% of revenues in FY18), financial product distribution (~25%), and investment banking/other (~10%), along with operating leverage, should drive ~16% CAGR in revenue and ~21% in profit over FY18-21e. It trades at 13x FY20e P/E, which we find attractive.

Leading retail broking franchise: ISEC has built a strong retail broking franchise on the back of its ICICI Direct platform and is a market leader with 10% market share in broking by number of clients (as of Mar-18) and 9% share in trading volumes (ex-proprietary). It is leveraging its base of 4.1 m customers to cross-sell mutual funds and insurance, and the share of this business has risen from 23% to 25% of revenue over FY13 to FY18, though market share is still low (~4% in MF commissions in FY18).

Client franchise can benefit from ICICI group: ISEC offers the 3-in-1 account (savings bank, demat and trading) in partnership with ICICI Bank. It acquires customers through 2,700+ ICICI Bank branches, in addition to 200 own branches. As of Jun-18, it had a total of 0.8m/4.1m active/total clients, which is a fraction of ICICI Bank’s ~40 million customers. Even if we assume that ~50% is a potential target market, it suggests a large growth opportunity.

Attractive growth: We believe ISEC can deliver 16% revenue CAGR over FY18-21e led by its distribution business. This in turn should drive 21% CAGR in earnings as the company realises operating leverage on a largely technology-led business.

Risks: Any market weakness which can result in declines in trading volumes and impact revenue/earnings; competition; dependence on ICICI Bank; regulation.