The past week saw major banking companies in the news for varied reasons – be it better-than-expected quarter results or probe on discrepancy cases. In the last month, the Bank Nifty has risen nearly 8 per cent in 5 days and 9 per cent and it has gained over 8 per cent so far in 2025 and the Index has yielded more than 15 per cent returns on a 1-year basis.

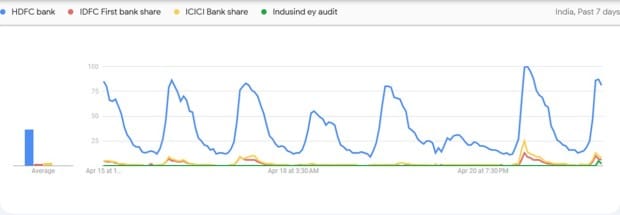

Here are the four top-most searched banks on Google in the last seven days.

HDFC Bank: HDFC Bank released its fiscal fourth quarter earnings showcasing strong growth amid solid loan growth. The private sector lender posted a 6.7 per cent year-on-year rise in standalone net profit to Rs 17,616 crore for Q4FY25. HDFC Bank’s net interest income (NII) for the quarter went up by 10.3 per cent to Rs 32,070 crore from Rs 29,080 crore recorded during the previous quarter last year. Gross non-performing asset (NPA) ratio of the bank stood at 1.33 per cent as on March 31, 2025, as compared to 1.42 per cent as on December 31, 2024.

IDFC First Bank share: IDFC First Bank recently announced that its board has approved raising up to Rs 7,500 crore through the issuance of preferential shares to affiliate firms of private equity group Warburg Pincus and the Abu Dhabi Investment Authority (ADIA) sovereign wealth fund. Currant Sea Investments BV, an affiliate of Warburg Pincus, will invest Rs 4,876 crore for a 9.8% stake, the bank said in an exchange filing. V Vaidyanathan, managing director and CEO, IDFC First Bank, said that this will mean a dilution of about 15 per cent, but maintained that the company earnings will grow faster than that. Shares of IDFC First Bank were up 1.85 per cent at 12:40 pm today at a trading price of Rs 67.88.

ICICI Bank share: ICICI Bank released its financial results for the fourth quarter of FY25 wherein it posted a growth of 18 per cent year-on-year in standalone net profit at Rs 12,629.58 crore. On a sequential basis, net profit rose 7.1 per cent. The Bank reported a net interest income (NII) of Rs 21,193 crore in Q4FY25, up 11 per cent YoY from Rs 19,093 crore in Q4FY24.The net interest margin rose marginally on year to 4.41 per cent. The Bank had also declared a dividend of Rs 11 per share of face value of Rs 2 each, subject to requisite approvals. Shares of ICICI Bank were down 0.17 per cent at 12:40 pm today at a trading price of Rs 1,406.95.

IndusInd EY audit: IndusInd Bank’s board has reportedly brought in Ernst & Young (EY) to conduct a second forensic audit, that will focus on a Rs 600 crore discrepancy related to accrued interest income from the bank’s microfinance portfolio. Shares of IndusInd Bank dropped as much as 6 per cent to Rs 776 apiece on April 22 following this. This will be launched in parallel with an ongoing investigation by Grant Thornton Bharat (GTB) which is examining irregularities in how IndusInd Bank accounted for its forex derivatives portfolio.