The passenger vehicle (PV) segment continued its good performance in August, with original equipment manufacturers (OEMs) witnessing a surge in volumes owing to a strong order book and an increase in production due to better semiconductor supply.

Even two-wheeler companies reported relatively higher wholesale despatches during the month as inventory build-up started at dealerships ahead of the festive season in anticipation of strong demand.

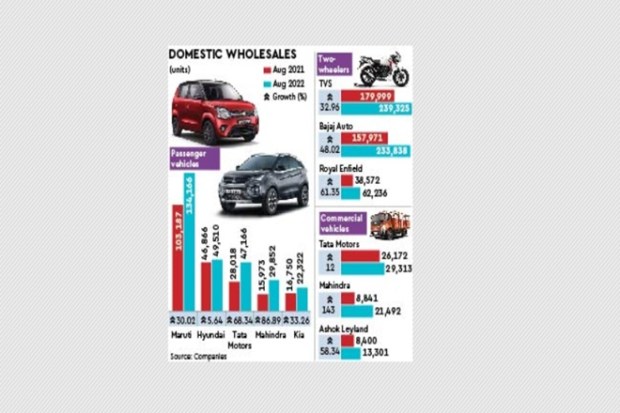

The country’s largest PV maker, Maruti Suzuki India, recorded a jump of 30.02% year-on-year (y-o-y) in domestic despatches as shortage of electronic components only had a minor impact on the production of vehicles. The company’s volumes are expected to increase further with the launch of the Alto K10 hatchback and Grand Vitara mid-size SUV.

Also Read: MMF enters EV space with startup acquisition, to invest Rs 200 cr

Hyundai Motor India’s wholesales grew 5.64% y-o-y driven by stable customer response to its sport utility vehicles (SUVs) like Venue, Creta, Alcazar and the newly launched Tucson. Director for sales, marketing and service Tarun Garg said with the continuously improving semiconductor situation, supplies are going up, enabling the company to serve the customer in the festival season that has kicked off with Onam and Ganesh Chaturthi.

Closely following Hyundai was Tata Motors, which posted a growth of 68.34% y-o-y in PV despatches. The homegrown auto major’s SUVs like Nexon and Punch recorded highest-ever volumes at 15,085 units and 12,006 units, respectively.

Fuelled by its highest-ever SUV volumes in a month, Mahindra & Mahindra’s PV sales increased 86.89% y-o-y, while that of Kia India rose 33.26% y-o-y in August.

“August was a very exciting month with launches across many segments for us. Demand across our portfolio remains strong and is enhanced with blockbuster launches of Scorpio-N, Scorpio Classic and new Bolero Maxx Pik-Up,” said Veejay Nakra, president, automotive division, Mahindra & Mahindra.

Kia vice president and sales and marketing head Hardeep Singh Brar said the company has been observing upward sales momentum since the beginning of this year. “Comparing the quarters, our monthly average so far for Q3 of CY22 stands at 7.8% over Q2 and 10.9% over Q1 of this year, indicating gradual improvement in supply chain constraints and healthy consumer sentiment,” he said.

While Toyota Kirloskar Motor’s domestic despatches increased 17.12% y-o-y, Honda Cars India posted a decline of 30.49% y-o-y.

Optimistic about demand picking up during the festive season, two-wheeler manufacturers have increased wholesale despatches to dealerships. The improvement in semiconductor supply has also aided the sales of more premium models.

TVS Motor Company’s domestic two-wheeler volumes jumped 32.96% y-o-y in August, while that of Bajaj Auto 48.02% y-o-y. Suzuki Motorcycle India and Royal Enfield posted a growth of 4.6% y-o-y and 61.35% y-o-y, respectively.

“With positive market sentiments and the upcoming festive season, the company is optimistic about the demand in the domestic two-wheeler market,” TVS said.

He said the availability of semiconductors has helped in reaching a balanced supply chain.

B Govindarajan, CEO, Royal Enfield, said, “We launched the Hunter 350 early this month (August), and the motorcycle has received an unprecedented response since then. We are seeing incremental volumes with this launch, and the initial bookings for the new motorcycle have been very promising. With excellent reviews from experts across the globe and increasing consumer demand, we are confident that the Hunter will continue this momentum into the upcoming festive season in India.”

The commercial vehicle segment carried on the growth momentum from the previous months amid a sturdy performance from cargo and M&HCV segments. Among the OEMs, Tata Motors posted a rise of 12% y-o-y in wholesale despatches, while Mahindra recorded a jump of 143.09% y-o-y and Ashok Leyland of 58.34% y-o-y.