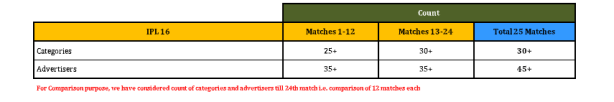

The latest edition of the Indian Premier League (IPL) may have started slow in terms of association of advertisers and sponsors but has gradually gained momentum throughout the tournament. According to the recent update on IPL-16 from TAM Sports, a sports division of TAM Media research, the number of categories and advertisers have subsequently increased during matches 13–24 as compared to matches 1–12, where the first 12 matches of the Indian Premier League (IPL)–16 saw more than 35 advertisers advertising across more than 25 categories.

While the number of advertisers during the matches 1-12 and 13-24 in IPL-16 remained almost stable, the count of categories grew from more than 25 in matches 1-12 to more than 30 in matches 13-24.

The report further stated that gaming and Pan Masala retained their first and second positions, respectively throughout all 25 matches. However, gaming retained first position during all 25 matches during IPL-15 whereas Pan Masala could only manage to be in the list of top 5 categories.

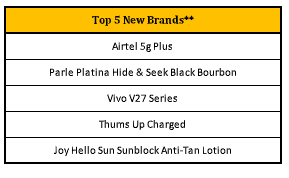

TATA IPL 16 witnessed the addition of 61 new brands and 18 new categories during the first 25 matches as compared to the same number of matches in IPL 15. ‘Airtel 5G Plus’ emerged as the top brand among the 61 new brands, followed by Parle Platina Hide & Seek Black Bourbon. While, Joy Hello Sun Sunblock Anti-Tan Lotion, Vivo V27 Series, and Thums Up Charged simultaneously took the third, fourth, and fifth spots. It is interesting to notice that of the top five new brands, two came from the telecom sector and three were from the food and beverage sector.

Talking of ad volumes, these top five categories collectively accounted for 58% of IPL 16’s ad volumes, while the top five advertisers contributed 39% of those volumes during the league’s 25 matches. Sporta Technologies (Dream 11) kept the top spot and managed to rank among the top five advertisers for all 25 games, the report claimed. Interestingly, Sporta Technologies is the only common advertiser in IPL-15 and IPL-16.

It must be noted that the count of channels during IPL 16 have increased to 25 from 21 during IPL 15.

However, the report also stated that a total of 40 different categories are missing in the current season of IPL vis-a-vis IPL 15. Big spenders including advertisers from edtech, fintech, e-commerce categories have been missing from the ongoing IPL tournament, which initially created a bit of a panic situation. The association of unconventional and new brands and advertisers has given a sigh of relief to the revenue game of IPL 16. Gaming and Pan Masala were the only categories that increased by 2% and 8%, respectively, between IPL 16 and 15, the report noted.

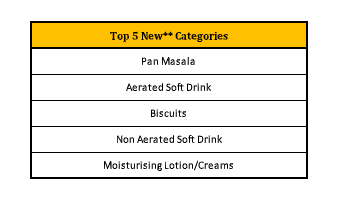

The top five new categories include pan masala, aerated soft drinks, biscuits, non-aerated soft drinks, and moisturizing lotions/creams.

As per the industry, the record viewership on both the platforms, namely, Star Sports and JioCinema has been the key reason for the gradual increase in the number of advertisers associating during the tournament. As per JioCinema, the free streaming of the TATA IPL 2023 for all viewers in India resulted in a record-breaking number of views in the first week – over 375 crore views. This followed the first weekend which clocked 147 crore views, yet another record for being the highest-ever opening weekend for the TATA IPL on digital.