A recent LinkedIn post has sparked a conversation about how multinational beverage brands localise their products across different markets. A consumer shared an experience of accidentally purchasing an imported can of Fanta from Malaysia while grocery shopping and noticing stark differences between its nutritional profile and the Indian version.

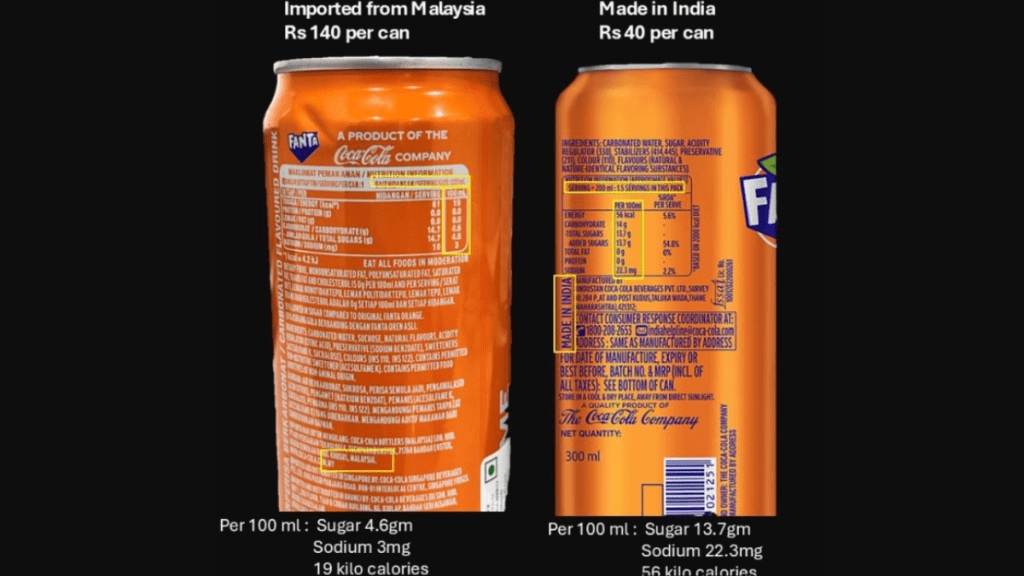

The first noticeable gap was the price. The Malaysian Fanta can cost Rs 140, while the Indian version was priced at Rs 40. However, the real surprise was in the nutritional labels. The Malaysian variant contained 4.6g of sugar per 100ml, whereas the Indian edition had nearly three times more at 13.6g. The sodium content also differed significantly, with the Malaysian version containing just 3mg per 100ml compared to 22.3mg in the Indian variant—over seven times higher. Another discrepancy was in the serving size labeling. The Indian can, which holds 300ml, marked a serving as 200ml, while the Malaysian one transparently labeled the full 320ml as a single serving, making it easier for consumers to understand their intake.

The differences raise questions about how much of this is standard product localisation and how much is market-driven optimisation. While brands often tweak formulations based on regional regulations, taste preferences, and pricing strategies, the significant variation in sugar and sodium levels suggests deeper considerations. Is the Indian version formulated this way due to consumer preferences, or is it influenced by cost constraints and regulatory flexibility? Are brands making adjustments purely to optimise margins in price-sensitive markets, or is this an industry-wide practice that consumers are just beginning to notice?

This debate ties into concerns that consumer awareness advocates, including Revant Himatsingka, known as Food Pharmer, have been raising about differences in food and beverage formulations across global markets. While regulatory norms vary from country to country, consumers are now questioning whether such drastic differences should exist, especially when they seem to come at the cost of health.

The Coca-Cola Company, which owns Fanta, has yet to respond to these observations. However, as consumer scrutiny increases, brands may find themselves under pressure to justify their market-specific product strategies. With health-conscious buyers paying closer attention to labels, the larger question remains: are such differences truly market-driven, or do they reflect a gap in regulatory oversight and consumer rights?