GfK, an NIQ Company, releases insights into the consumer durables sector covering January to October 2023 versus the same period in 2022. GfK market intelligence’s POS Offline Retail Tracking data reveals a 9% surge in smartphone value but notes a marginal 2% decline in volume. The overall impact of the volume decrease is mitigated by an 11% growth in Average Selling Price (ASP).

This nuanced combination of metrics highlights a trend within the smartphone market, showcasing the consumer durable sector’s resilience and ability to maintain value growth despite a slight dip in volume.

“The industry’s expansion can be credited to a noticeable consumer inclination toward premium products spanning diverse categories. Lower-town segments are significantly shaping this trend by seeking convenient tech and durable products to enhance their overall lifestyle comfort. The decrease in Average Selling Prices (ASPs) during the festive season has resulted in a comprehensive upswing in sales this year, underscoring the dynamic evolution of consumer preferences,” Anant Jain – head of customer success management, India GfK – an NIQ Company, said.

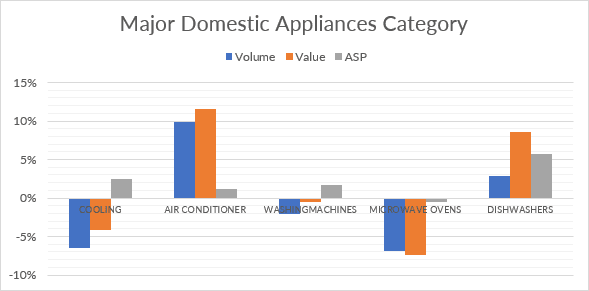

Major Domestic Appliances (MDA) and Small Domestic Appliances (SDA) exhibited varied growth rates. Cooling products experienced a shift with a 6% reduction in volume and a 4% decrease in value, leading to a category average selling price increase by 2%.

Air conditioners showcased robust growth, with a 10% increase in volume and a 12% rise in value. Washing machines witnessed a minor 2% decline in volume and a marginal 0.5% decrease in value, reflecting around a 2% increase in industry ASP.

Microwave ovens faced headwinds, experiencing a 7% dip in volume as well as value with almost flat industry ASP. Meanwhile, dishwashers exhibited growth in both volume (3%) and value (9%), along with an increased ASP of 6% during the same period.

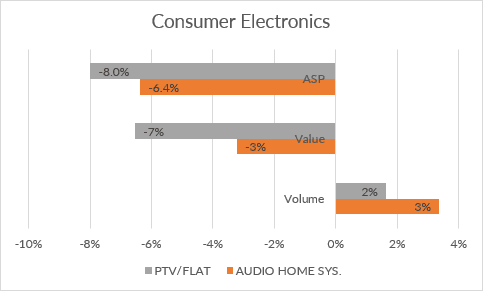

Within the Consumer Electronics sector, trends surfaced across different product categories. The audio home systems category revealed a nuanced narrative characterised by a 3% increase in volume with a corresponding 3% decrease in value.

This paradoxical scenario was further accentuated by a decline in ASP at -6%. Meanwhile, the Panel Television category experienced a 2% growth in volume, but this positive trajectory was counterbalanced by a substantial 7% contraction in value due to an increased mix of smaller size Public Television (PTV) sales compared to the previous period.

The categories of desk computing, mobile computing, and media tablets displayed intriguing and dynamic trends, showcasing the evolving landscape of consumer preferences and market dynamics, offering valuable insights for industry stakeholders and enthusiasts alike seeking to navigate and understand the multifaceted nature of the consumer electronics sector.