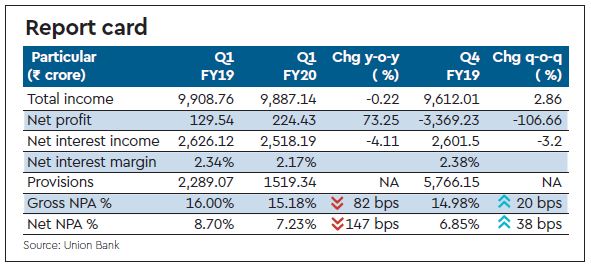

The Union Bank of India’s net profit increased 73.25% to Rs 224.43 crore for the quarter ended June. Aiding the bottomline was a drop in overall provisioning costs, which stood at Rs 1519.34 crore for Q1FY20, down 33.63% from Rs 2,289.07 crore in the same quarter last year.

The bank’s asset quality witnessed a slight deterioration, with gross non-performing assets (GNPA) rising 20 basis points on a sequential basis to 15.18% of the loan book at the end of June while net NPAs rose 38 bps sequentially to 7.23%.

However, the bank projects gross NPAs at 12% of the total loan book and net NPAs at below 6% by March 2020, MD & CEO Rajkiran Rai said at a post-earnings press conference.

Rai further said that absolute gross NPA figure could come down by almost Rs 5,000 crore in case of resolution of a few corporate accounts undergoing insolvency proceedings. The bank’s cash recovery could be close to Rs 3,300 crore. The bank currently has stressed accounts worth Rs 26,000 crore undergoing resolution via the Insolvency and Bankruptcy Code, Rai said.

Total fresh slippages during the quarter were at Rs 3,090 crore, of which Rs 292 crore were from retail loans, Rs 891 crore from agriculture sector, Rs 977 crore from micro and small and Rs 930 crore from medium and large enterprises.

The bank wrote off loans worth Rs 2,237 crore during the quarter ended June against Rs 1,426 crore in the same period last year.

On the bank’s capital raising plans, Rai said, the state-run lender expects to raise anywhere between Rs 2,000 crore-Rs 3,000 crore this financial year, most likely through QIP. The bank is in the process of shortlisting advisers on the same. The bank also expects around Rs 250 crore through sale of non-core assets, Rai said.