With elevated inflation and the resultant tightening of the monetary policy undermining purchasing power of large sections of people, consumption, the principal pillar of the economy, is expected to weaken significantly in the second half of the current fiscal. But that may not still impel the government to announce a big consumption booster in the Union Budget 2023-24.

The NDA government has given support to the poor during the pandemic but has been resistant to the calls for any major reliefs for the middle and upper middle-class, given its avowed focus on creating an investment-driven virtuous cycle for economic recovery. Even recently, finance minister Nirmala Sitharaman has reiterated this strategy in Parliament, in what has dampened expectations of any major fiscal concessions aimed at reviving private consumption. That any such fiscal largesse would run contrary to the monetary policy plank of the Reserve Bank of India may also weigh on the minister’s mind.

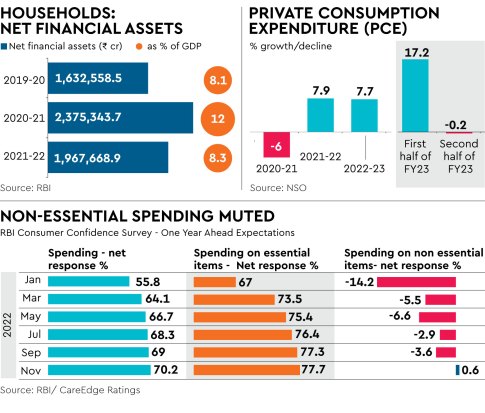

In the National Statistics Office’s first advance estimates of national income for FY23, private final consumption expenditure is pegged to contract by 0.2% in the second half of the current fiscal. Pent-up demand is seen to be subsiding although the rural economy could see some demand pick-up in the next fiscal.

Net financial assets of households had dropped to 8.3% of GDP in 2021-22 from 12% in 2020-21 and 8.1% in 2019-20.

Apart from a hike in the income tax exemption threshold, the wishlist for consumers includes a higher deduction for housing loans to offset the impact of rising EMIs, more breaks for long-term savings like insurance and pension, lower duties on high-end electronics, measures for job creation, some respite from rising fuel and commodity prices as well as income support in terms of higher allocation to schemes like Mahatama Gandhi National Rural Employment Guarantee Act.

But with limited fiscal space, it is unlikely that Sitharaman will go for all-out tax incentives and instead, the Budget may focus on welfare spending measures such as ensuring sufficient allocation for food and fertiliser subsidies as well as a focus on the MG-NREGS and infrastructure development which have a greater multiplier effects on the economy.

Past Budgets of the current government as well as interventions during the Covid-19 pandemic have also followed a similar trend where it has stayed away from fiscal profligacy but has chosen indirect measures to boost spending power of people through schemes like Housing For All, PM Kisan Yojana and financing support to micro, small and medium enterprises.

Sachchidanand Shukla, chief economist, Mahindra Group said that if the government cuts down spending or adheres to fiscal consolidation, there will be less inflationary pressures on the economy and so lesser pressure on the RBI to curb inflation. If inflation goes down, the real income of consumers will go up and help consumption, he said.

“There is also need to provide relief to people at the bottom of the pyramid, who have undergone a series of shocks during the pandemic and have seen sharp rise in prices of food and fuel due to the ongoing war. The government has already provided relief to this segment by sacrificing customs revenue by extending concessional customs duties on edible oil and hiking the food and fertiliser subsidy,” he noted, while contending that tax exemptions and benefits like hiking the `5 lakh income tax exemption limit is not very meaningful and will not help a large part of the consuming class.

Upasna Bhardwaj, chief economist, Kotak Mahindra Bank expects there will be certain finetuning of existing policies, which could be beneficial for consumers. It is expected that there will be some tax benefits in the housing segment to offset the rising interest rates, which has impacted borrowers and raised EMIs.

” The food and fertiliser subsidy Bill are also likely to remain elevated to ensure there is free food as well as support to farmers. We expect the food and fertiliser Bill at `2 trillion each in FY24 as against `3.3 trillion (food) and `2.2 trillion (fertilisers) in FY23,” she said.

Bhardwaj also expects adequate allocation to MG-NREGS as well as to infrastructure projects such as construction linked activities, which would provide an indirect support in terms of jobs and livelihoods as well as additional measures for MSMEs to support their financial requirements as they are yet to shrug off the impact of the pandemic.

Radhika Rao, senior economist at DBS Group Research said the rural economy is likely to be one of the focus areas, especially after real wage growth stagnated in 2022 due to high inflation, increase in input prices and volatility in weather conditions.

Apart from increasing allocation to MG-NREGS, she said further impetus to allied schemes such as crop insurance, rural road infrastructure, low-cost housing, power and utilities, food-processing industry could be other focus areas.

“Backstopping urban employment focus by channelling resources towards skill/ vocational training and upgradation. Higher investments into health and education are likely to remain one of the key demands,” she further said.

However, experts believe that a full fledged populist Budget is unlikely even though state elections and the general elections are coming up next year, noting that there is not sufficient fiscal space. Possible measures could be announced mid-year or a promise could be made in the Vote on Accounts next year as was done in the interim Budget 2019-20.