Karur Vysya Bank

Related News

The man who built IndiGo — and quietly walked away with Rs 40,000 crores

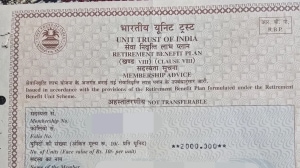

Man discovers uncle’s 30-year-old UTI bond bought for Rs 20,000; Netizens predict ‘Crores’ – but the real value will shock you

iPhone 16, iPhone 15 discounted under Rs 60,000 in India: Complete buying guide for New Year 2026

IndiGo flight status today: Around 160 flights cancelled in Delhi, Bengaluru as airline moves toward stabilising ops

Dhurandhar OTT release date and platform: When and where to watch Ranveer Singh’s spy thriller online