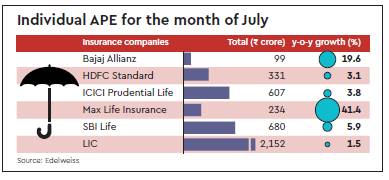

The Life insurance industry ended the month of July on a positive note as its individual annual premium equivalent (APE) stood at 7.8% year-on-year at Rs 4,987.5 crore. While private life insurers saw their individual APE at 13.2%, state-run Life Insurance Corporation of India (LIC) saw its individual APE lower than private players at 1.5% (`2,151.7 crore) in the month of July, data from Edelweiss showed.

“Overall growth (individual APE) showed some signs of improvement, up ~8% y-o-y in July (albeit still below the 20–23% run rate in FY18). While private players’ growth accelerated to 13% y-o-y, LIC grew at a mere 1.5% y-o-y (15% in FY18) that restricted overall growth. Divergence was seen among players —improving growth at ICICI Prudential Life (albeit below trend) and softer growth at SBI Life and HDFC Life,” says the Edelweiss report.

It also added that going forward, we expect the growth momentum to improve as the base effect wanes.

In the current financial year, life insurance had seen muted growth as first few months of financial year the business is usually low and only picks only after first quarter of the fiscal.

Market participants are confident that, business will pick-up in the months to come. Players like Bajaj Allianz, Birla Sun Life, Max Life Insurance, HDFC Standard Life Insurance, TATA AIG, Bharti AXA Life continued to see its APE growth in positive.

“Despite volatility in the Indian equity markets, share of unit linked insurance plans (Ulips) remain strong for the major private players. We hope that going forward, we continue to see demand of both Ulips as well as traditional products,” said a top official from a leading insurance company.

According to data from the Insurance Regulatory and Development Authority of India (Irdai), first-year premiums of life insurance companies in July remained negative, 1.02% at Rs 20,219.26 crore , as against `20,427.68 crore in the corresponding period last fiscal.

“Private insurance players reported improved growth momentum in July 2018 premium — individual APE grew 8% y-o-y with private players registering 13% growth and LIC merely 1.5%. In our view, the ongoing shift towards financial savings will sustain and help industry log sustained growth,”said the report.