By Sandeep Wasnik

Peru is one of the most dynamic economies in Latin America and experienced significant growth over the years. Unfortunately, since 2016, Peru has been plagued with political instability and social crisis, as well as global inflation, have significantly impacted Peru’s economy. The situation resulted in higher prices for products included the standard family basket and a lower estimate of economic growth till end of 2022, whereas the Peruvian economy shown the growth by less than 2.9%, recording an inflation rate of more than 8%, driven by price increases of 15.21% for the food and beverages, 11.30% for transportation and communications, 9.49% for restaurants and hotels, 4.23% for lodging, water, electricity, gas, and other fuels, and 6.66% for a variety of other goods and services stated by the Instituto Nacional de Estadística e Informática. (National Institute of Statistics and Informatics).

According to Ministry of Economy and Finance (MEF) forecasts that the Peruvian economy will grow 2.5% at the end of 2023, sustained by the greater primary supply in the favor of exports, the reactivation of the sectors associated with tourism, and the resilience of the internal demand in an environment of dissipation of social conflict and the implementation of government measures to reactivate the economy within the framework of the “Con Punche Perú” Plan and to address the climate emergency. But what is the “Con Punche Perú” Plan?

“Con Punche Perú” Plan

The “Con Punche Peru” strategy was announced by the Ministry of Economy and Finance (MEF). This Plan was developed in a challenging worldwide context marked by sluggish global economic expansion and ongoing inflationary pressures. The Peruvian economy was recovering locally, however it varied greatly between sectors and slowed down recently. Additionally, a number of economic indices have been negatively impacted by the recent escalation of social strife.

The plan is composed of 19 measures, mainly focused on social protection and the promotion and redress of investments. These measures, which will be executed over a period of six months, according to the MEF, involve an amount of more than S/5900 million and are divided into three phases with specific amounts per measure. “Con Punche Perú” Plan has three central axes: supporting family economies, reactivating regions, and reactivating the most affected sectors, mainly tourism and agriculture.

Peru’s International Trade

Peru has signed several trade agreements that aim to further access to the country’s main trading partners, including the Andean Community, Mercosur, Pacific Alliance, EFTA, European Union, and others. Peru is also a member of the World Trade Organisation (WTO) and the Asia-Pacific Economic Cooperation (APEC), with various bilateral treaties based on reciprocal most favored nation status.

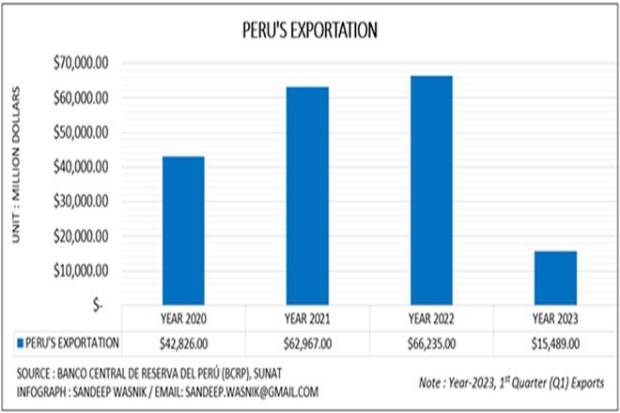

According to Banco Central de Reserva del Perú (Central Reserve Bank of Peru), Peru exported nearly US$66235 Million to the world in Year-2022, Year-2021 – US$62967 million, Year-2020 – US$42826 million. However, in “Year-2023” the exports recorded for the first quarter (Q1) is US$15489 million, as shown in an infographic.

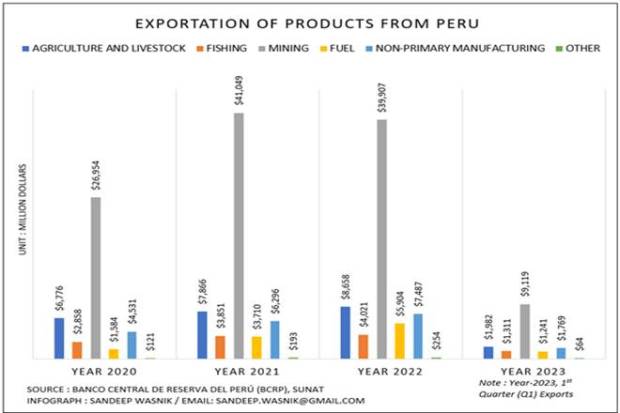

The exports of mining products were recorded at US$39907 million in Year-2022, which is comparatively less as compared to Year-2021 (US$41049 million). However, the exports of Agriculture and Livestock increased, whereas in Year-2021 were recorded at US$7866 million and in Year-2022 were recorded at US$8658 million. The infographic shows the exports of products from Peru.

Sea Port Infrastructure Investment

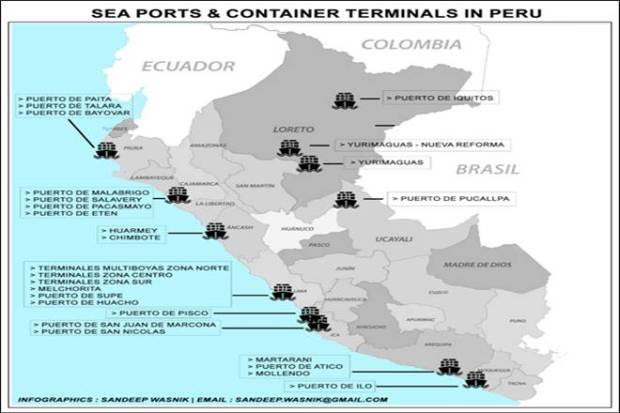

Peru’s economy has historically been linked to its coastline; hence the quality of its port infrastructure is highly valued. According to transport infrastructure regulator OSITRAN (Organismo Supervisor de la Inversión en Infraestructura de Transporte), The data published by OSITRAN in February 2023, the largest investments made were in the Multipurpose North Terminal of the Port of Callao (US$ 452 million), followed by the South Pier of the Port of Callao (US$ 440 million), Matarani Port Terminal (US$ 290 million), Paita Port Terminal ($ 260 million), General San Martin Port Terminal in Pisco (US$ 182 million), and Salaverry Port Terminal (US$ 131 million), Paita Port Terminal (US$ 260 million), General San Martín Port Terminal in Pisco (US$ 182 million) and the Salaverry Multipurpose Port Terminal (US$ 131 million).

Callao’s port has a long history, it contributes to over 70% of Peru’s cargo and is located in Greater Lima, due to Callao port the Peru’s international trade has grown dramatically since the turn of the century, with foreign trade increasing from US$7 billion in 2001 to more than US$66 billion by 2022.

Chancay port is a mega port approx 73 km away from Callao port, which is currently under construction, the port area is 992 hectares (2,400 acres) and will be able to handle up to 1 million TEUs (twenty-foot equivalent units) of cargo annually. The project, which is being led by China’s state-owned conglomerate Cosco Shipping Ports and Peruvian mining company Volcan, is anticipated to cost roughly US$3.6 billion.

In 2019, Cosco Shipping Port acquired a 60% stake in Terminales Portuarios Chancay from Peruvian mining corporation Volcan Compania Minera, a subsidiary of Swiss commodity trading group Glencore, to develop the Chancay port. It is the Cosco group’s first deepwater port in South America. Chancay port is part of China’s “Belt and Road” initiative, a global infrastructure plan designed to improve China’s international trade routes.

The port will be part of an industrial complex that includes a 1100-ha logistics park and connects to the Pan-American Highway, this is expected to boost Peru’s economy by generating 1,300 construction jobs, 5000 permanent jobs and increasing trade, once it’s finished in 2024.

San Juan de Marcona port entails the construction of a new port terminal for public use that complies with international standards and is focused on providing storage and shipping services for iron and copper concentrates. It can handle up to 47 million metric tonnes of minerals and supplies from the primary mining projects in the country’s southern region.

The author is Latin American and the Caribbean Countries market Advisor and Consultant, also Director of International trade and Investment of Grupo 108.

Disclaimer: Views expressed are personal and do not reflect the official position or policy of the Financial Express Online.