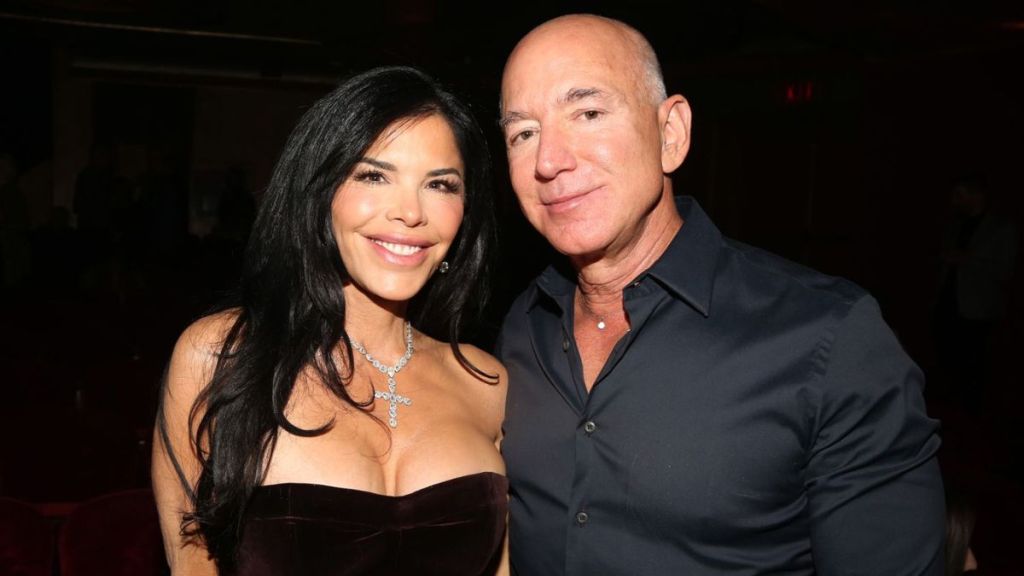

Amazon founder Jeff Bezos sparked widespread outrage this week as details of his lavish wedding to Lauren Sanchez came to light. Netizens have since dubbed it an ‘obscene oligarchy’ with many including US Senator Bernie Sanders contending that the billionaire businessman had a ‘real tax rate of just 1.1%’. Signs have appeared across Venice (and online) calling for one of the world’s richest men to “pay more taxes”. The wedding venue was also shifted at the last minute from the historic Scuola Grande della Misericordia in central Venice to another location on the outskirts of the city as residents and protest groups launched intense protests.

This is oligarchy. This is obscene. While 60% live paycheck to paycheck & kids go hungry, Jeff Bezos, worth $230 billion, goes to Venice on his $500 million yacht for a $20 million wedding and spends $5 million on a ring while his real tax rate is just 1.1%. End this oligarchy,” Sanders wrote on X earlier this week.

The claim has since been echoed by many online and links back to a 2021 ProPublica report that outlined his “striking” tax avoidance. The publication noted that the Amazon founder had seen his wealth increase by $127 billion between 2006 and 2018 while reporting a total of $6.5 billion in income.

“The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune….In 2011, a year in which his wealth held roughly steady at $18 billion, Bezos filed a tax return reporting he lost money — his income that year was more than offset by investment losses. What’s more, because, according to the tax law, he made so little, he even claimed and received a $4,000 tax credit for his children,” the report had contended.