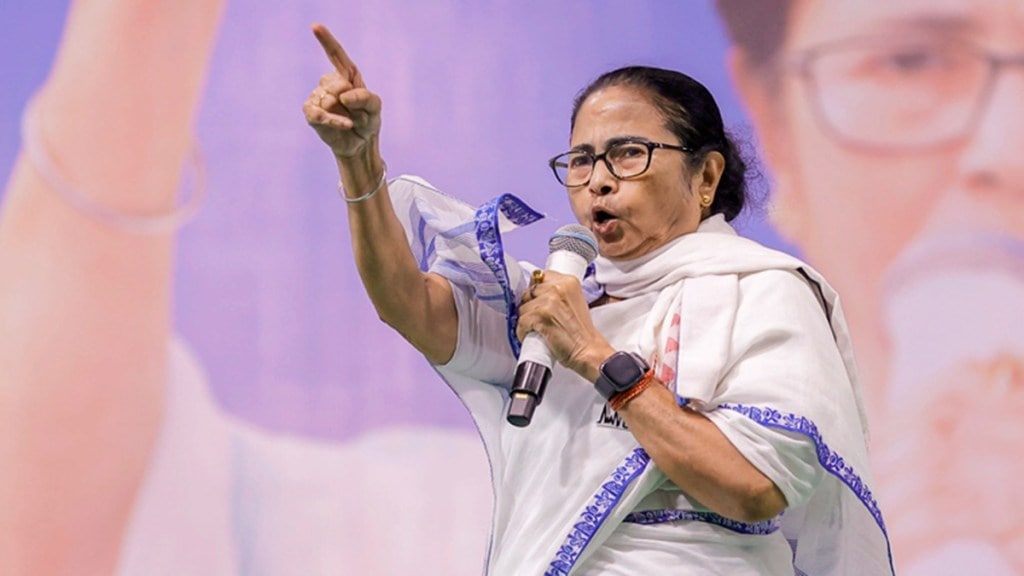

West Bengal police have issued a public advisory after fraudsters started using Chief Minister Mamata Banerjee’s photograph in fake loan advertisements that have been gaining significant traction on Facebook, Instagram and WhatsApp. The police, in a detailed post on X (formerly Twitter), explained how the scam works and advised people on what to do if they encounter such fraud.

The police also warned that strict legal action would be taken against anyone misusing the Chief Minister’s name or image to run such advertisements.

Fake loan ads circulating online

“Misuse of the name of honourable Chief Minister of West Bengal for online loan frauds,” wrote West Bengal Police in all caps, stating that fraudsters are falsely using Mamata Banerjee’s image to lure people with offers such as instant loans, loans without a CIBIL score, government-approved financial schemes and guaranteed loans without verification.

The post included an important clarification, stressing that no such loan scheme has been announced, endorsed or approved by the Chief Minister or the West Bengal government.

“These advertisements are completely fake and fraudulent. The use of the Hon’ble Chief Minister’s name or image is unauthorised and illegal.”

The police department also outlined the steps typically followed by fraudsters. According to the advisory, scammers first circulate ads on social media platforms and then redirect users to fake apps, websites or WhatsApp numbers. Victims are then asked to share personal details. “Ask for personal details, Aadhaar, PAN, OTP, bank details. Demand processing fees or advance payments. Disappear after receiving money or misuse the victim’s identity.”

The public, West Bengal Police said, is advised to refrain from clicking on suspicious links, installing unknown loan apps or sharing OTPs, bank details, or identity documents. The police also urged the public to verify loan offers through authorised banks, NBFCs, or official government websites.

“What to do if you come across such fraud? Do not respond or make any payment. Report immediately to Cyber Crime Helpline: 1930; http://cybercrime.gov.in; Preserve screenshots, links, phone numbers, and transaction details for investigation,” the post directed the public.

West Bengal Police added that legal action would be initiated against those involved in impersonation, cheating, cyber fraud and misuse of public authority names and images. “Public cooperation is essential to prevent cyber fraud. Stay alert. Stay safe,” the public advisory, shared a few hours ago, added.

PUBLIC ADVISORY

— West Bengal Police (@WBPolice) December 28, 2025

MISUSE OF THE NAME OF HON’BLE CHIEF MINISTER OF WEST BENGAL FOR ONLINE LOAN FRAUDS

It has come to the notice of West Bengal Police that fraudsters are circulating misleading advertisements and social-media content, falsely using the name and photograph of…

How to identify fake loan apps and avoid financial fraud?

Fake lending apps often promise instant loans with minimal documents, no credit checks, or guaranteed approval to attract users and lack a physical address. They usually circulate through social media ads, WhatsApp messages, or SMS links and redirect users to unknown apps or websites.

Once installed, these apps ask for sensitive information such as Aadhaar, PAN, bank details, or OTPs, and may demand processing fees upfront. In many cases, the fraudsters disappear after receiving money or misuse the personal data shared by users.

To avoid financial fraud, users should download loan apps only from trusted sources and verify whether the lender is registered with the RBI or a recognised bank or NBFC. Avoid clicking on suspicious links or responding to unsolicited loan offers on social media. Never share OTPs, bank details, or identity documents with unknown individuals or apps. If an offer sounds too good to be true, such as “no CIBIL check” or “government-approved instant loans”, it is likely a scam.