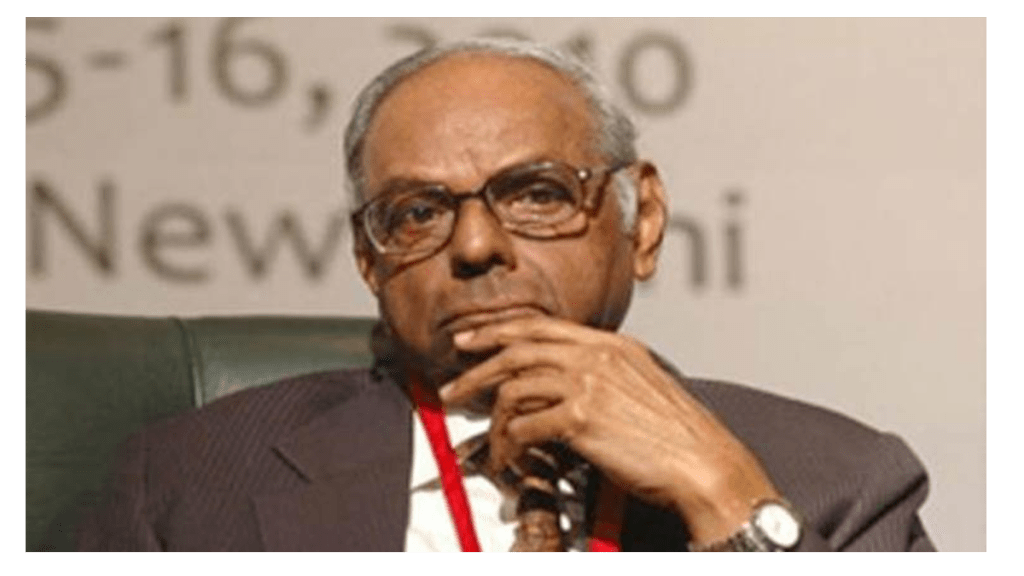

How can India cut down its merchandise trade deficit and ensure it not only sustains the momentum in its services exports but also builds on it? The answer to this in a flailing but connected global economy may not be easy. Therefore, Dr C Rangarajan, economist and former governor of the Reserve Bank of India, calls for a closer monitoring of these two and other elements of the current account in the days and months ahead.

Much has been written about the latest data from the Reserve Bank of India (RBI) about India’s current account deficit (CAD) for the January-March in 2022-23 which was down to 0.2 per cent of the Gross Domestic Product (GDP). In teetering trying times, this does seem a hard to ignore happy statistic for India, though one quarter is hardly adequate to draw deeper conclusions. Nonetheless, the RBI referring to this sequential decline in CAD attributes it mainly to “moderation in trade deficit coupled with robust services exports.”

To Dr Rangarajan, “this reflects the balance of payments situation in a very unusual year. We have to really reflect a lot more about the what is the fundamental trend in terms of India’s exports and imports,” he says.

The real problem, he says, is that the merchandise trade deficit is still high and it is in some sense that the surpluses in the services sector are covering up for the high merchandise deficit and he therefore reminds: “We should therefore focus a lot more on what is happening to the merchandise trade deficit.”

This may not be easy in an interconnected world for global trade with a flailing global economy. Consider this: Germany has already slipped into a technical recession, Britain and Italy are busy grappling with high inflation and the core inflation is a worry in the US also. Even if not a recession, there are concerns about a slowdown in the rich world. Therefore, to Dr Rangarajan, at this juncture for India, a close monitoring of the performance on merchandise trade deficit reduction and on sustaining the services exports becomes crucial.

Hence, the need to critically examine each component of the current account and what is driving each element – be it the remittances or the trends in merchandise trade.

The Numbers

Data from the ministry of commerce and industry in April showed that merchandise exports in March 2023 were at $38.38 billion, as compared to $44.57 billion in March 2022. Merchandise imports in March 2023 were $58.11 billion, as compared to $63.09 billion in March 2022.

For the year as a whole, merchandise exports for the period FY2023 (April-March) were $447.46 billion as against $422.00 billion during FY2022 (April-March). Merchandise imports for the period FY2023 (April-March) were at $714.24 billion as against $613.05 billion during FY2022 (April-March).

The merchandise trade deficit for FY 2022-23 (April-March) was estimated at $266.78 billion as against $191.05 billion during FY 2021-22 (April-March).

On services trade, the estimated value of services export (based on quick estimates) for March 2023 is $27.75 billion, as compared to $26.95 billion in March 2022. Similarly, the estimated value of services imports for March 2023 at $14.07 billion as compared to $15.35 billion in March 2022.

For the year as a whole, the estimated value of services export for FY2023 (April-March) at $322.72 billion as compared to $254.53 billion in FY2022 (April-March) and imports for FY2023 at $177.94 billion as compared to $147.01 billion in FY2022 (April-March).

The services trade surplus for FY2023 (April-March), again based on quick estimates, at $144.78 billion as against $107.52 billion in FY2022 (April-March).