– By Aditi Nayar

Close on the heels of the year-on-year (YoY) rise in the Government of India’s (GoI’s) fiscal deficit in Q1 FY2024, was the continued double-digit expansion in GST collections in July 2023. While growth in the latter remains healthy, it has been tapering off continuously since the second half of FY2023. This trend has been driven by the flagging collections on imported goods, in stark contrast to the buoyancy seen in the inflows on domestic transactions.

On a gross basis, the GST inflows improved sequentially to Rs. 1.65 trillion in July 2023, the third highest collections in any month so far. This is with the exception of April 2022 and April 2023; collections typically witness a seasonal spike in April every year, reflecting the transactions that happened in March as well as year-end adjustments.

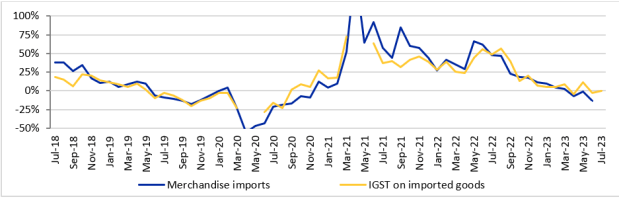

While the YoY growth in GST collections stood at a robust 10.8 per cent in July 2023, this represents a 25-month low. After surging by a sharp 44 per cent YoY in H1 FY2023, the growth in GST revenues on account of imported goods (IGST and cess collections on imported goods) decelerated to 10 per cent in H2 FY2023. Thereafter, it slid to a marginal 0.7 per cent in April-July FY2024, mirroring merchandise imports, which recorded a sharp YoY slowdown starting Sep 2022 amid an elevated base as well as the downtrend in global commodity prices.

On the other hand, GST collections on account of domestic transactions (including imports of services), have consistently grown by double digits, ranging from 11 per cent to 18 per cent over the last eight months. Growth remained robust in April-July FY2024, shrugging off the moderation in the CPI and WPI inflation in Q1 FY2024. This implies that domestic economic activity has remained healthy, as also evinced by the generation of e-way bills. Improved compliance too is helping to shore up the collections.

Interestingly, the IGST collections on imported goods have largely hovered at ~8-9 per cent of the value of merchandise imports (in INR terms), except in a few months related to Covid-19 waves. This leads us to believe that any contraction in the value of merchandise imports going forward with deeper commodity deflation may dampen the revenues from IGST, which is levied on ad-valorem basis. ICRA estimates merchandise imports ($ terms) to decline by ~4-5 per cent YoY in FY2024, amid the decline in global commodity prices, even as domestic demand is likely to outpace external demand.

This will have a non-trivial bearing on the Centre’s CGST revenues. The IGST collected on imported goods typically accounts for a quarter of the aggregate GST collections and nearly half of the total IGST revenues. The latter is eventually apportioned and settled between the Centre and States, with the share of the former recording a historical average of around 46 per cent of total IGST collections.

Therefore, we are apprehensive that subdued imports would dampen the IGST settlement to CGST in FY2024, posing a downside to the GoI’s budgeted CGST target of Rs 8.12 trillion for this year. However, a weaker average USD/INR pair in FY2024 relative to the FY2023 levels could limit the impact on merchandise imports in INR terms.

Accordingly, the growth in GST collections on account of domestic transactions will have to remain robust through FY2024. Given ICRA’s expectations of a healthy growth in consumption and investment demand in FY2024, we do believe that this is feasible.

But how much would GST collections need to average in the remaining months of FY2024, for the Centre to be able to meet its budgeted CGST target for the fiscal? If GST collections average at Rs. 1.65 trillion in the remaining eight months of the fiscal, similar to the July 2023 level, then the total would be just shy of Rs. 20 trillion in FY2024, implying a 10 per cent growth over collections in FY2023. As per our analysis, this would translate into CGST collections of Rs 8.06 trillion, only marginally lower than the budget estimate of Rs 8.12 trillion for FY2024.

While collections in some months may well trail the required level of Rs 1.65 trillion/month, the expected seasonal spikes in October, January and March, should bring the average to the required level.

Fingers crossed that domestic demand will save the day!

EXHIBIT: YoY growth in IGST revenues on imported goods and Merchandise imports (INR terms)

(Aditi Nayar is the Chief Economist and Head- Research & Outreach at ICRA.)

(Disclaimer: Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited.)