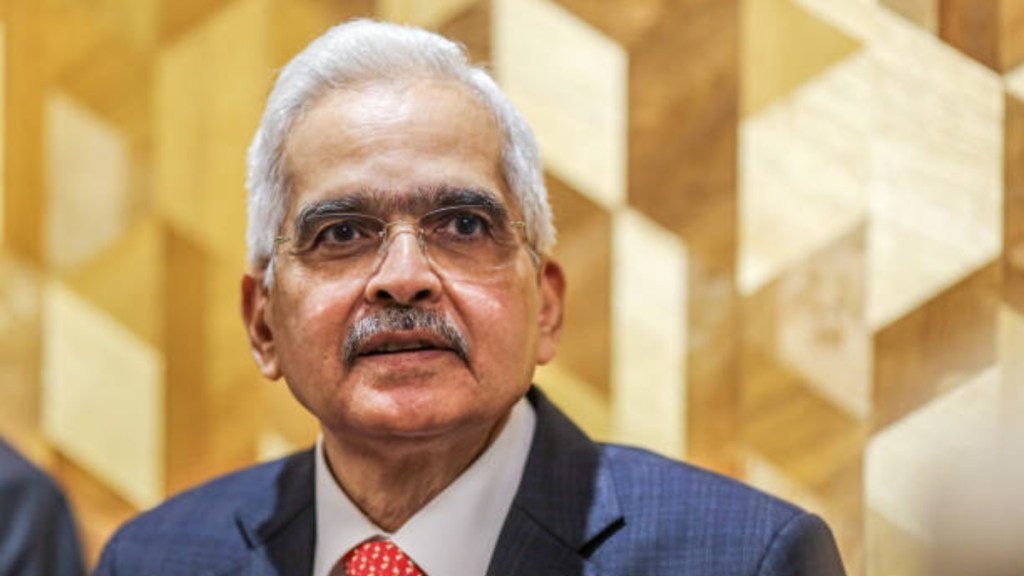

In his opening remarks at his first media interaction as Reserve Bank of India governor in December 2018, Shaktikanta Das said, “The RBI is a great institution, it has a very rich legacy. I will try and uphold the professionalism, the core values, the credibility and the autonomy of the institution.”

As his six-year tenure comes to an end today (December 11), Das, 67, has indeed walked the talk. His journey from the bustling corridors of North Block to the hallowed halls of Mint Street has been a testament to his exceptional skills as an administrator and his deep understanding of the Indian economy. The soft-spoken career bureaucrat, who is the second governor in the RBI’s history to be at the helm for at least six years, also made a huge contribution in smoothening the relationship between the apex bank and government, which had hit rock bottom during his predecessor Urjit Patel’s tenure.

Remarkably, he leaves the banking sector in the pink of health, with non-performing assets at a decadal low of below 3%.

One of Das’s defining challenges was the economic crisis triggered by the Covid-19 pandemic. Under his leadership, the RBI implemented unprecedented monetary easing, slashed the repo rate to a historic low of 4% in 2020, and introduced measures like loan moratoriums and liquidity infusion packages. These steps were instrumental in cushioning the economy from the severe shocks of the pandemic.

Das, who was granted an extension in 2021 for another three years, played a crucial role in addressing several high-profile banking crises, including the collapse of Yes Bank and Punjab and Maharashtra Cooperative (PMC) Bank. His timely interventions, including restructuring and mergers, averted systemic risks to the banking sector.

RBI under Das never shied away from taking strong action even against big banks like Bank of Baroda, Kotak Bank, or Bajaj Finance. He was also stern with microfinance institutions when he realised that the freedom being given to them to set interest rates was actually turning out to be ‘usurious.’

A vocal advocate for India’s digital revolution, Das has championed initiatives like the Unified Payments Interface (UPI), which has transformed the country’s payment landscape. He also steered policies that enhanced the reach of digital banking and financial inclusion, particularly in rural areas.

His tenure has seen a delicate balancing act between fostering growth and controlling inflation, especially amid global pressures like rising crude oil prices and geopolitical tensions, earning him the description of being a master of one of the finest balancing acts who listens to all but takes his own decisions.

Das has won several global accolades in recognition of his contribution to the field of central banking. Das was named the top central banker globally by Global Finance magazine for the second year in a row in October this year. He received an A+ grade for his outstanding performance in inflation control, economic growth, currency stability, and interest rate management.

While handing him the Central Bank Governor of the Year Award, the Central Banking, London, had summed up his career well. “His tonsure has been marked by a series of grave challenges, starting with the collapse of a major non-bank firm, moving through the waves of corona virus, and then, in 2022, Russia’s invasion of Ukraine and its inflationary impact. But it has also been a time of spectacular innovation for the RBI and India as a whole.”

Das leaves at a crucial juncture when the second quarter growth rate is at a seven-quarter low while consumer price inflation is at a 14-month high. He described the threat of inflation through allegories like elephant and horse, but ultimately, he could not remove the monkey off his back.

What he managed exceedingly well was to withstand the pressure from the government to cut rates in his final policy. As he said in his policy statement, “In the life of a central bank, there is no room for knee-jerk reaction. Our effort has been to remain in line with the curve, never fall behind the curve, and I think we are following that trend. Go well, Mr Das.