The Reserve Bank of India’s Monetary Policy Committee voted unanimously to keep key interest rates unchanged for the 10th consecutive time, instead of raising reverse repo rates, citing global uncertainties and inflation concerns. RBI kept repo rates unchanged at 4% and reverse repo rate at 3.35%. RBI Governor Shaktikanta Das said food inflation has remained within its projections and is expected to soften; however, the hardening of crude oil prices remains an upside risk. The committee also continued to stick with an accommodative stance to support the economic recovery.

“The MPC decided by a majority of 5 to 1 to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward,” the central bank said. The central bank said the Consumer Price Index inflation is expected to soften in the upcoming fiscal to 4.5% in comparison to CPI inflation projection of 5.3% for the current year.

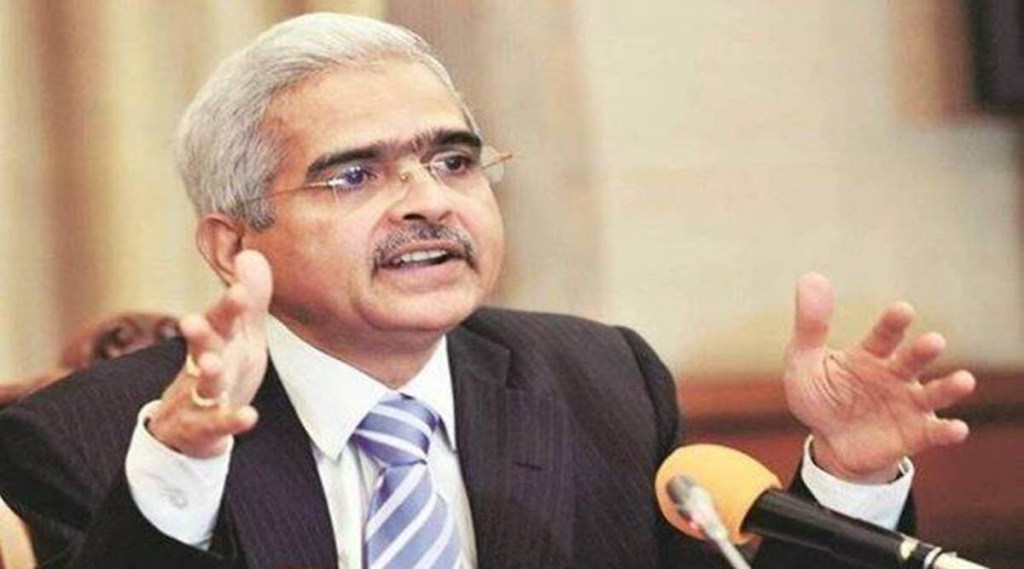

At a press conference after the RBI policy announcement, Governor Shaktikanta Das said RBI’s inflation projections are benchmarked to international crude oil prices, adding that it has considered both upside and downside scenarios in its projections for CPI inflation. Crude oil, which spiked to $93 a barrel last week, hitting a seven-year high, contributes as imported inflation to India’s inflation basket.

“The MPC notes that inflation is likely to moderate in H1:2022-23 and move closer to the target rate thereafter, providing room to remain accommodative. Timely and apposite supply side measures from the Government have substantially helped contain inflationary pressures. The potential pick up of input costs is a contingent risk, especially if international crude oil prices remain elevated,” the central bank said.

“While the bank flagged risks to inflation from supply bottlenecks and high imported price pressures, it still noted that demand-side price pressures are benign, and headline inflation is likely to trend lower over the coming months. We think such dovish messaging on inflation makes it difficult to envisage the RBI hiking rates in the near term,” Rahul Bajoria, Barclays Chief Economist said.

RBI Governor Das, however, said he will not spill out when the central bank will move towards neutral interest rates until it takes a decision on it. He added that the central bank will take a calibrated and well-telegraphed action. Barclays expects repo rate hikes to begin from Q3 2022 and expects policy rate hikes of 50 bps to 4.5% by end-2022. Yes Bank said it sees two repo rate increases in the fiscal year 2022-23 though predicting a timeline is difficult at this point.

“In terms of its forecasts on inflation, RBI indicates a glide path for inflation going down to the 4% handle in Q3 and Q4 FY23. While the RBI contends that the growth momentum remains positive, the stance however indicates that the RBI is willing to wait longer to see the growth becoming durable and sustainable,” Indranil Pan, Chief Economist at Yes Bank said.