In what came as a shot in the arm for the Narendra Modi government facing Opposition charges of stifling an already-slowing economy by imparting two giant successive shocks to it in the forms of demonetisation and the goods and services tax, US-based Moody’s Investors Service on Friday raised India’s sovereign rating for the first time in nearly 14 years on expectations continued progress on economic and institutional reform will boost the country’s high growth potential. With laudatory commentary on the government’s “wide-ranging” reforms programme which “is midway through”, it raised India’s rating by a notch to Baa2 from the lowest investment-grade ranking of Baa3, putting the country in line with the Philippines and Italy. The US agency also improved its India rating outlook to stable from positive as risks to the country’s credit profile were broadly balanced. A rating upgrade for India would likely boost capital flows into the country because a large part of institutional capital allocation is ratings-driven. It could also serve to reduce the cost of government’s borrowing, apart from improving the access of domestic financial institutions and companies to the global markets for funds. Other agencies like Standard & Poor’s and Fitch are yet to upgrade India, still holding the lowest investment-grade rating for the country. While analysts said an upgrade by one more agency might be needed to make it meaningful, the precedent is that their actions have seldom come very close to each other.

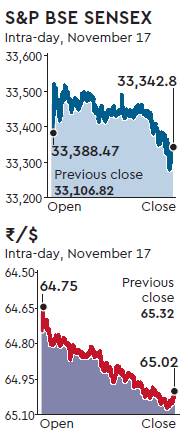

Moody’s positive rating action — the first by it since 2004 and by any of the Big Three rating agencies since January 2007 upgrade of India’s rating to BBB- by Standard & Poor’s — will likely improve the outlook for net portfolio inflows over the next six months, reduce near-term risks for the bond market and boost banks’ ability to raise foreign bonds, Credit Suisse wrote. Moody’s also upgraded ratings of several companies and other entities, including ONGC, Indian Oil Corporation, Hindustan Petroleum and National Highways Authority of India. The rupee and stocks rallied in response to the rating upgrade. The rupee surged around 0.5 percentage to 65.015 a dollar and the Sensex rose 0.71%. India’s policymakers have been openly critical of the rating agencies methodology, which they thought deprived India of well-deserved upgrades based on its reforms zeal, good track record on servicing debts and macroeconomic fundamentals.

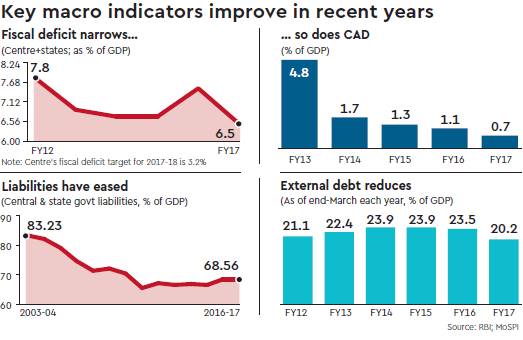

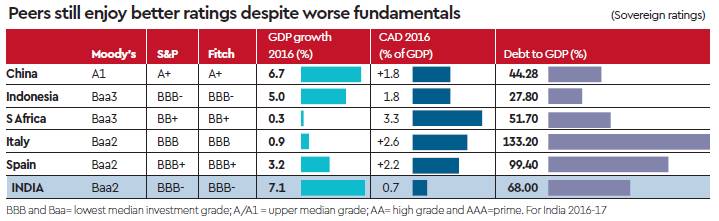

Despite India’s strong growth trajectory and a commitment to fiscal discipline, India is deemed by these agencies as an outlier among emerging-market “peers” for its higher fiscal deficit and debt ratios, Economic Survey 2016-17 noted. Also, the survey said the inclusion of a slow-moving variable like per capita income has unfairly impeded the upgrade of low-middle-income countries. Hailing Moody’s move, finance minister Arun Jaitley termed it a “belated recognition” of several reforms, mainly the structural ones like the GST and insolvency code, undertaken by the government. He added that “those who have doubted India’s economic story will now seriously introspect their position”. Chief economic adviser Arvind Subramanian said: “It’s a welcome development, but we also feel it was long overdue… It’s a recognition of the actions that the government has undertaken like GST, bankruptcy.” The government, he said, “is going to do what it has to do on domestic front — employment growth, economic growth, reviving investment”. Asked if he expected other agencies like S&P and Fitch to upgrade too, he said: “Let’s hope they are not inconsistent amongst each other.”

According to Moody’s , India’s large and stable financing base for government debt will likely contribute to a gradual decline in the general government debt burden over the medium term. “In the meantime, while India’s high debt burden remains a constraint on the country’s credit profile, Moody’s believes that the reforms put in place have reduced the risk of a sharp increase in debt, even in potential downside scenarios.” Moody’s has also raised India’s long-term foreign-currency bond ceiling to Baa1 from Baa2, and the long-term foreign-currency bank deposit ceiling to Baa2 from Baa3. It retained the short-term foreign-currency bond ceiling at P-2 but the short-term foreign-currency bank deposit ceiling has been upgraded to P-2 from P-3. The long-term local currency deposit and bond ceilings remain unchanged at A1.

“Longer term, India’s growth potential is significantly higher than most other Baa-rated sovereigns,” said Moody‘s. It said while a number of important reforms remain at the design phase, those implemented will advance the government’s objective of improving the business climate, enhancing productivity, stimulating foreign and domestic investment, and ultimately fostering strong and sustainable growth. The upgrade for India comes at a time when both Moody’s and S&P have trimmed China’s sovereign rating. Moody’s downgraded China’s long-term local and foreign currency issuer ratings to A1 from Aa3 in May, while in September, S&P cut China’s long-term sovereign credit ratings by one notch to A+ from AA-. Still, China’s ratings are way above India’s despite projection of a slowdown in economic growth in the giant neighbour in the medium term, a fact highlighted by Subramanian in the last economic survey when he referred to the “poor standards” by rating agencies in assessing the economic performance of India and China. Moody’s took note of reforms such as GST, improvements to the monetary policy framework, measures to address bad assets in the banking system, demonetisation, Aadhaar, the targeted delivery of benefits through the direct benefit transfer system and the move to reduce informality in the economy. Other important measures which have yet to materialise include planned land and labour market reforms. GST will promote productivity by removing barriers to interstate trade, it added. It said that a “material deterioration in fiscal metrics and the outlook for general government fiscal consolidation could put negative pressure on the rating”, adding significant deterioration of the health of the banking system as another downward risk.