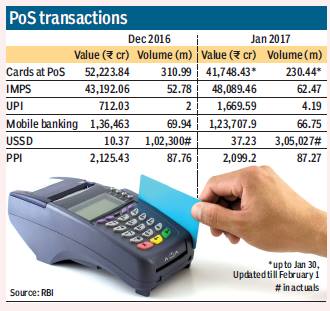

The value of transactions at point-of-sale (PoS) machines dropped over 25% in January after peaking in December in the wake of demonetisation. The aggregate value of credit and debit card transactions between January 1 and 30 was Rs 41,748.43 crore, as against Rs 52,223.84 crore for December, data released by the Reserve Bank of India (RBI) showed.

The volume of PoS transactions also fell to 230.44 million from 311 million in December, even as the average ticket size of transactions rose to around Rs 1,812 from roughly Rs 1,680.

The figures suggest that in January, consumers went back to using cash for some transactions as the Reserve Bank of India gradually eased restrictions on cash withdrawals.

You may also like to watch:

[jwplayer rlVYi67i]

In December, card-based transactions had risen over 48% from their November levels and even surpassed the R51,121 crore clocked in October, which marked the peak of the festive season.

The Budget for 2017-18 saw the government announcing a mission targeting 2,500 crore digital transactions for the year through Unified Payments Interface (UPI), Unstructured Supplementary Service Data (USSD), Aadhar Pay, immediate payment service (IMPS) and debit cards.

In his speech, finance minister Arun Jaitley said banks have a target to introduce 10 lakh new PoS terminals by March and they will be encouraged to introduce 20 lakh Aadhar-based PoS terminals by September.

These plans may meet behavioural resistance from consumers, if the slowdown in January is anything to go by.

The value of transactions made through the UPI channel, however, continued to grow, rising more than twice from its December level to R1,669.59 crore.

The volume of such transactions rose to 4.19 million in January from 2 million in December.

The growth in UPI transactions came at the cost of growth in mobile wallet usage. Transactions made through wallets dropped marginally to R2,099.2 crore in January from R2,125.43 crore in December.

The USSD channel, meant for feature phone users, grew steadily on a low base, to R37.23 crore in January from R10.37 crore in the previous month.