As the case is every few years, there is once again increasing talk of the long-awaited demise of the dollar in terms of its influence in the world.

With the United States national debt rapidly approaching $32 trillion (about a third of global gross domestic product) and expected to explode in the next two decades, the argument goes that at some point, nobody would want to buy US government debt, particularly as it is backed only by the “full faith of the US government” and not any hard assets; in other words, if the US were to default on its debt, holders of Treasuries have no right to collect anything. (And given that Donald Trump is rearing his head again, a year before presidential elections are due, the “full faith of the USgovernment” today is an increasingly bad joke.)

Also Read: Normal or below-normal?

This explains why, from time to time, there are waves of belief that the dollar will collapse upon itself—either replaced with a single contender competing with the dollar (in the early 2000s, the Euro; more recently,pre-Covid, the yuan); or that gold will come back as a medium of exchange; or that cryptocurrencies, which, theoretically at least, are not dependent on any government’s credibility, will control the financial world.

Most recently, the drift is that, as part of the fallout of the Ukraine invasion, more and more countries are tiring of the US’s hegemony, and are looking to increasingly try and denominate trade in their own currencies (yuan, ruble, even our own pusillanimous rupee). This argument got a shocking boost this week when French president Emmanuel Macron, returning from China, said he believes that Europe should reduce its dependence on the dollar, which is a little odd since only about 20% of trade invoicing from/to Europe is in dollars, as compared to more than 80% for the rest of the world.

But, in any case, it is not trade but capital that controls the world, and holders of capital, irrespective of their nationality, want to hold their assets in dollars because rather than the full faith it is the “full firepower of the US government” that is focused determinedly behind the needs of global capital (whatever they be and wherever they are located). Since 1991, the US has engaged in over 250 military interventions, in all cases (some obviously—Iraq; some less so—Vietnam) to acquire and/or control resources or markets. The US military budget is more than three times that of China and more than the sum of the ten next largest militaries in the world. And, you can be sure that that the number (and likely the ratio) is only going to go up. And to my mind, it is rather obvious that the jackboot of the US military-industrial complex will ensure that the dollar’s chokehold on global finance will sustain.

Also Read: Private equity investments muted

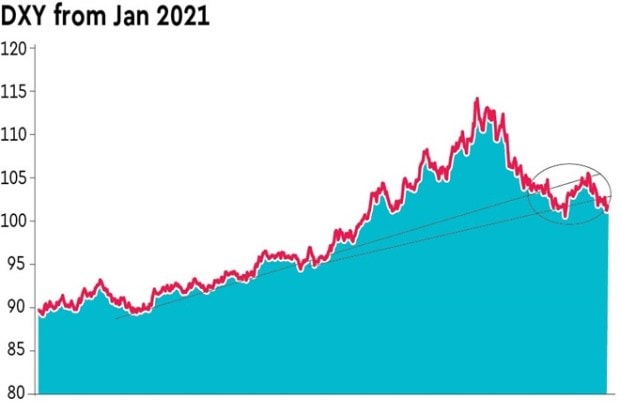

Of course, and irrespective of its fundamental hold over the world’s capital, the value of the dollar will rise and fall with market perceptions. Since mid-2021, for instance, the market became convinced that the US Federal Reserve was not paying enough attention to inflation in the country and would have to raise interest rates, which expectation drove the dollar higher and higher. As it happens, the market was correct and the Fed had to crank up rates very rapidly till, by late last year, rates were much higher and the story shifted to a possible US recession, which would lead to lower rates; this pushed the dollar down again. The picture is a lot cloudier now, although the betting seems to be that US rates have peaked and may well be coming down over the next year or so.

Thus, the dollar is once again looking shaky. Importantly, the chart of the dollar index does seem to suggest that the dollar is in a dangerous zone. It has fallen nearly 10% from its recent peak, and appears to be tracing a head and shoulders pattern, which, if broken, could see it fall a further 5-6% (towards 95).

This sort of decline would certainly impact the rupee, which, in any case, appears to have been showing some intrinsic strength, independent of the Reserve Bank of India’s support. Could we be seeing sub-80 values on USD-INR?

To be sure, the dollar index (DXY) could certainly bounce back from the current support level, but it would need to pick up a real head of steam to break through the upper line—likely as not, it will continue to hover in the 81.xx to 82.xx level for some time, but it certainly feels as if the next major move will be in the direction of a stronger rupee.

The author is CEO, Mecklai Financial www.mecklai.com