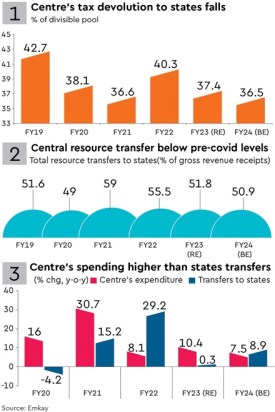

With the increasing imposition of cesses and surcharges by the Union government, the states’ share in the divisible tax pool has stayed below the 15th Finance Commission’s recommendation of 41%, and is expected to be around 36% in FY24 (BE).

Apart from the tax devolution, transfers for centrally-sponsored schemes and Finance Commission grants, which also form a part of the Union government’s transfer to states, have fallen sharply after the pandemic.

Also read: Fintech-led digital lending to surpass traditional lending by 2030: Report

The total resource transfers, as share of the gross revenue receipts of states, has also fallen in the period after the pandemic and will be below 50% by the end of FY24.