The rate cut by RBI’s MPC following a mildly expansionary FY20 fiscal budget signalled the intent of a coordinated response to a now increasingly widely accepted narrative of a lingering and probably deepening economic slowdown. A range of what are described as high-frequency metrics is currently sending mixed signals on this slowdown, but the majority still indicate continuing, even—at the outside—robust, if not accelerating, growth.

The 2nd advance estimate (2AE) of India’s FY19 GDP growth was revised down to 7%, from the earlier 1st advance estimate of 7.2% (in early January). The GVA measure of value added in growth was revised down to 6.8% from 7% earlier. RBI, in its February MPC review, had not formally forecasted the FY19 GDP growth, but stated the earlier official GDP growth number of 7.2%.

Firstly, let’s come to the sources of the revision and the segment-wise breakup of the growth, from the output and demand perspectives. From the output side, the downward revision is spread between agriculture, manufacturing, electricity and government spends, offset by higher estimated growth in financial services. The lower agri growth is due to the lower estimated Rabi (winter) foodgrain output.

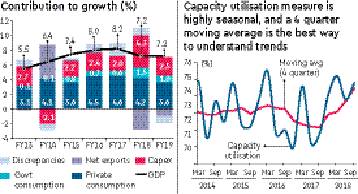

From the expenditure side, the sharpest fall (and contribution) is from gross fixed capital formation (GCF). This is troubling if forecasted correctly, since there were signs of a modest mid-size capex revival.

The revised lower capex growth is validated by the capital goods (and to an extent, infra/construction goods, (I/CG)) segment of the index of industrial production (IIP). The 1AE FY19 GDP forecast estimate of GCF would have been based on April-October FY19 data of IIP, extrapolated into the later months. April-October IIP CG growth averaged 8.9%. Post the 1AE release, the November-December IIP print averaged 1.4%, bringing down the overall April-December average to 7.3%. The I/CG growth average also fell from 8.7% to 8.5%.

Sales growth of a set of 135 corporates classified in the CG segment had dropped quite sharply from 24% year-on-year (y-o-y) in Q2 FY19 to 14% in Q3, also corroborating the narrative of the capex slowdown.

While it is difficult to reconcile the downward revision of the capex growth with that of industry, construction and other segments in the output side of GDP without more granular data, a slowdown in capex activity is emerging as a concern. If there is a further deceleration in the oncoming Q4 FY19 IIP CG prints, FY19 growth might need to be further revised downwards. The current slowdown might also have ripple effects on FY20 growth, with falling capex further lowering India’s potential output growth.

A premonition of this might have been a deciding factor in the MPC majority voting to cut the repo rate at the last review. However, this is where the picture starts getting ambiguous. The proximate cause of concern was a slowdown in the auto sector, with negative growth in passenger vehicles since September, then spilling over into commercial vehicles (CVs) in November. The 8-industry core sector index growth had also slowed to 1.8% in January, a precursor of the month’s IIP.

Adding to this was a worry on exports, where growth had slowed sharply since November. Although partly due to the base effect of very high growth in the corresponding months of 2017, fears of a global slowdown of economic activity in general, and trade in particular, have deepened concerns. Trade activity had slowed sharply in countries with high export intensities—like Germany and China—with the repercussions of a persisting trade conflict. A sharp rise in crude prices with output cuts by OPEC and other oil producers deepened fears of further restricting already weakened structures.

In India, all this came right in the middle of a series of corporate credit events and concerns of a funding squeeze for NBFCs. Market liquidity had also tightened in this period, with, inter alia, a continuing rise in lending rates a likely contributing factor to a potential slowdown.

Having said this, there are also emerging signs that the feared slowdown might be more transient than expected. Manufacturing and services purchasing managers indices look quite robust. Capacity utilisation continued to tick up in Q2FY19. Anecdotal evidence also suggests a revival of mid-size capex in a range of sectors, driven in large part by government spending on infra. RBI has acted to infuse liquidity in a timely manner, but more micro-prudential measures might be needed to lower lending costs for MSMEs, who are more dependent on NBFCs for their borrowing needs.

Tanay Dalal contributed to the article.