By Indranil sen gupta

& Aastha Gudwani

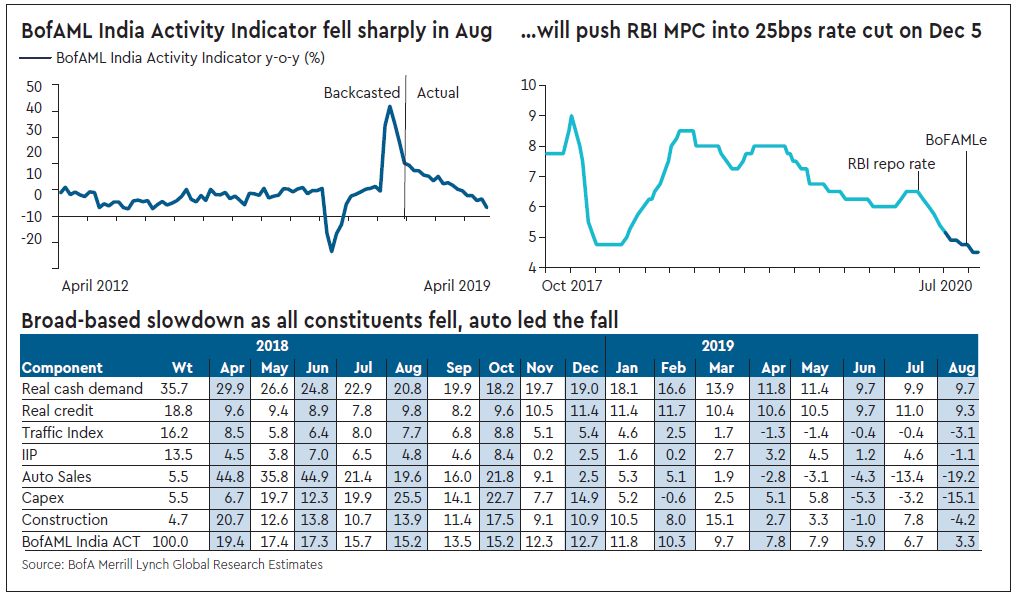

Our updated BofAML India Activity Indicator continues to point to a broad-based slowdown for another quarter. This likely poses a further 30bps downside risk to our 6.2% FY20 GDP growth forecast. (We will review after getting a sense of the October 27 Diwali demand.)

Growth as per our India Activity Indicator dropped to 3.3% in August from 6.7% in July and 7.2% in April-June (see graphic). All its seven components slowed down from July. With the Diwali festival due earlier on October 27 from November 7 in 2018, activity should logically have picked up. Note our monthly BofAML India Activity.

Indicator is a comprehensive high-frequency indicator of seven components to gauge growth momentum of the Indian economy. We expect RBI MPC to cut another 25bps on December 5 (see graphic) despite tracking October inflation at a relatively high 4.6% on a temporary onion price hike. As banks link their lending rates on retail/SME loans (~40% of bank book) to external benchmarks, like the RBI repo rate, this should reduce the cost of credit before the October-March ‘busy’ industrial season intensifies.

RBI stepping up durable liquidity to contain lending rates: We continue to expect the RBI to step up infusion of durable liquidity ($20bn FYTD, $40bn FY20 BofAMLe) to contain lending rates in the ‘busy’ season. Despite the recent step up in public spend pushing the money market into a substantial temporary surplus; RBI has bought $7+bn of FX recently to ensure adequate durable liquidity. Unless FPI flows revive, we expect it to resume OMO by the winter.

The MoF may cut income tax to stimulate demand if the on-going Diwali festival demand turns out to be really weak. We estimate that the Direct Tax Code’s new income tax slabs, as reported in the media, will likely cost about 0.8% of GDP. Given that the corporate tax rate cut has already cost the fisc 0.7% of GDP, the bar for an income tax rate cut remains very high, in our view.

Edited excerpts from BofAML’s India Activity Indicator (October 16, 2019)

Sen Gupta is Chief India economist, and Gudwani is India economist, BofA Merrill Lynch. Views are personal