With the recent changes in debt funds taxation, Equity Savings Funds are now increasingly seen as a debt fund alternative.

Let’s take a closer look at this category to understand if these funds are right for you.

What are Equity Savings Funds?

Equity Savings Funds are debt-oriented hybrid funds which invest in a mix of debt, arbitrage and equity. They usually have a (net) equity exposure of 20-40% with debt and arbitrage accounting for the remaining 60-80% – thus broadly resembling a portfolio with 30% Equity and 70% Debt.

For any fund to qualify for equity taxation, the exposure to Indian equities must be above 65% of the overall portfolio.

Equity Savings Funds enjoy equity taxation as the funds use arbitrage (which delivers returns similar to debt funds but is considered equity from the tax angle) along with pure equity exposure to maintain overall equity exposure above 65%.

Also Read: Go for systematic withdrawals now

Are equity savings funds right for you?

Here is a simple 3-point checklist to help you decide.

Check 1: You are okay with a slight increase in volatility

As roughly 30% of the portfolio is in equities, you may witness temporary declines if equity markets correct. While these declines are much lower compared to pure equity funds, they can be significant especially during phases of large equity market declines (read as declines over 30%).

So how volatile can these funds get?

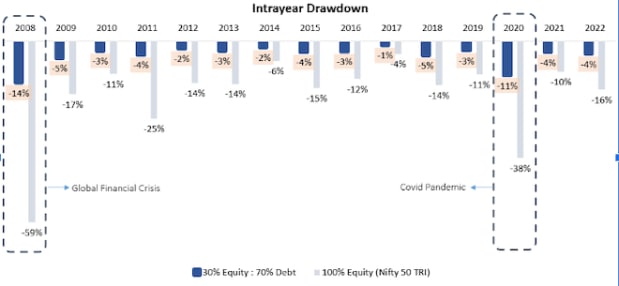

As the equity savings category became popular and got standardised only post-2018, we will use a 30% Equity: 70% Debt portfolio as proxy to get a rough sense of performance over the last 15 years.

Historically, the intra-year declines of our hypothetical equity savings portfolio have ranged between -1% and -5% in normal years. During years of major market declines, the declines were much higher at -14% (2008 Global Financial Crisis) and -11% (2020 Covid Pandemic).

Therefore, if you are investing in Equity Savings Funds you need to be okay with

- Regular Temporary Declines of 1-5% almost every year

- Rare but Larger Temporary Declines of 10-15% once every 7-10 years

Check 2: You have at least a 3-5 year time frame

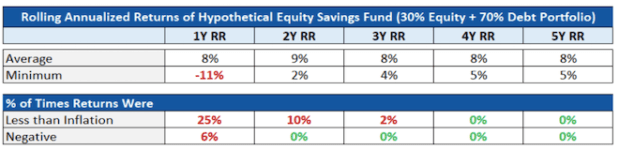

The impact of the temporary declines is generally higher in the initial years of your investment journey. Historically over 1-year periods, a 30E : 70D portfolio delivered negative returns 6% of the time. One-fourth of the time, the returns were poor (lower than inflation of 5%).

The returns were never negative over 2-year periods. But 10% of the time, the returns were lower than inflation.

The outcomes got much better for 3-year+ time frames.

- In a 3-year period, there were no negative returns, and sub 5% returns occurred only 2% of the time

- In the extended timeframes of 4 to 5 years, there were no instances of negative or sub-inflation returns!

So, you need to have at least a 3-year investment horizon with the flexibility to extend by 1-2 years.

Also Read: Corporate bonds look attractive now

Check 3: You are looking for better post-tax returns than debt funds

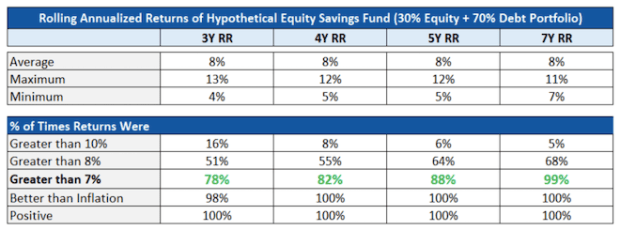

Over 3-5 year timeframes, the equity savings portfolio delivered 8% returns on average. The returns were almost always better than inflation. And 80-90% of the times, the returns were greater than 7%!

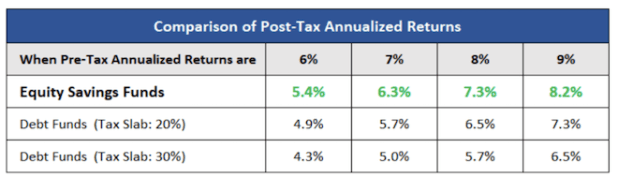

While these returns seem similar to what you may get from debt funds, they become much more attractive from a post-tax perspective.

As equity savings funds come under equity taxation, gains from investments held for more than a year get taxed only at 10% (assuming overall equity gains exceed Rs 1 lakh; 0% tax if gains are below Rs 1 lakh).

Debt funds, meanwhile, are now taxed at the tax slab irrespective of the holding period. If you are in the higher tax bracket (20% or above), this taxation advantage could add an extra 0.5% to 1.5% in annualized returns.

If you check all three boxes, you can go for Equity Savings Funds!

However, watch out for…

- High Expense Ratios

Currently, most funds in the equity savings category have expense ratios that are on the higher side (may come down in the next few months if SEBI’s new Total Expense Ratio proposal gets implemented).

Having said that, currently there are still a few good funds available at relatively lower expense ratios.

- High Credit & Interest Rate Risk on the Debt Side

Most funds in this category run high credit quality portfolios (predominantly AAA & Equivalent) and have low modified duration. Therefore, both credit risk and interest rate risk have broadly been on the lower side. However, keep an eye on any future changes.

Summing it up

Equity Savings is a debt-oriented hybrid category with 60-80% into debt/arbitrage and the rest in equity. The funds under this category enjoy equity taxation (as gross equity exposure exceeds 65%).

Suitable as a debt fund alternative if you tick the below three boxes

- You have a 3-5 year time frame

- You want to earn better post-tax returns compared to debt funds

- You can withstand temporary declines in the short term

This column has been written by Shrinath M L, Senior Research Analyst at FundsIndia

Disclaimer: The views expressed in this article are that of the respective authors. The facts and opinions expressed here do not reflect the views of www.financialexpress.com. Please consult your financial advisor before investing in mutual funds.