By Pankaj K Agarwal

Many active equity funds in India still beat their benchmarks. However, as the Indian equity markets become more efficient, this may become an exception rather than a rule as is the case with many developed countries. In this scenario, “Indexing” or investing in a fund that does not attempt to beat but closely mimic a benchmark can be a powerful strategy. But indexing is possible with both index funds and ETFs. The question is which one is better?

First, the similarities. Both index funds and ETFs have an underlying index to track. Both have lower expense ratios than actively managed funds and both classify as passive investments. However, they are very different in a number of ways!

Lower expense ratio

First, the expense ratio of index funds is much higher than ETFs. Second, while index funds offer SIP facility, ETFs do not, because the investor does not deal with the fund but a counterparty in ETFs. However, ETFs can always be purchased in the stock exchanges just like shares. Third, index fund units can be sold at end-of-day NAVs whereas ETF units can be sold at real-time NAVs prevailing. So you can trade ETFs intra-day too, just like stocks.

However, the downside of tradability of ETF units is that you end up paying brokerages and taxes too. Fourth, index funds are available with growth option with automatic reinvestment of dividends; whereas ETFs have only the dividend option, and the investor has to necessarily receive dividend in her bank account and herself (re)invest manually. This could be quite a hassle. Finally, when you invest in an index fund, the AUM of the scheme increases, while the same doesn’t hold true for ETFs.

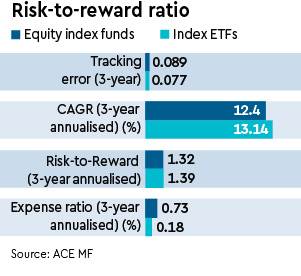

So, which of the two is better for passive investing? Well, judging by performance numbers over the last three years, index ETFs trump index funds on all counts with higher returns and reward-to-risk ratio and lower tracking error & expense ratios. However, the low expense ratios of ETFs may go up since the investor will also bear brokerages and demat account charges too. Yet, the added advantage is the ability to trade ETFs intra-day.

The scale looks quite balanced overall. Index funds offer more convenience whereas ETFs allow intra-day trading. So if you are a knowledgeable, hands-on and experienced investor who likes to trade too, you may consider ETFs. For the rest, index funds seem a better choice for indexing.

The writer is professor of finance, IMS Ghaziabad