Question: What is an updated return of income? When shall a taxpayer be eligible to furnish the same?

Answer given by Dr. Suresh Surana, Founder, RSM India: The Finance Act 2022 introduced the concept of updated return which can be filed by taxpayers in order to rectify their errors in the return already furnished or to furnish a fresh tax return in case no return has been filed earlier.

In accordance with the Section 139(8A) of the Income Tax Act, 1961 (herein after referred to as ‘IT Act’), every taxpayer whether or not they have furnished any original return or belated return or revised return would be eligible to furnish an updated return of income. Such updated return of income can be filed at any time after the end of the relevant assessment year but within 24 months from the end of the relevant assessment year in the Form ITR-U.

For instance, with respect to Financial year 2020-21, a taxpayer can file an updated return on or before 31st March 2024.

Cases in which no updated return can be filed:

It is pertinent to note that an updated return cannot be filed under certain circumstances as indicated below:

* Taxpayer has already furnished updated return of income or the updated return is a loss return (i.e. a person can file an updated return even if he has furnished a loss return initially but the updated return should not be a return of loss).

* Taxpayer intends to file an updated return which leads to a lower tax liability or results in refund or increases the refund previously due on the basis of an earlier return.

* No updated return can be filed for the financial year in which search has been initiated or books of account, other documents or any assets are requisitioned, or a penalty proceeding is initiated, or a survey has been conducted (other than survey in connection to TDS/ TCS).

* In case the assessment/ reassessment/ revision/re-computation is pending or completed.

* In case a seizure or requisition of money, bullions, jewellery, books of accounts or other documents has been made u/s 132/132A against any person, where the seized or requisitioned assets or documents belong to the taxpayer, the taxpayer shall not be eligible to furnish an updated return of income for the financial year in which such search is initiated or requisition is made and any assessment year preceding such assessment year.

* In case the Assessing Officer has information about the taxpayer under specified Acts (i.e., Prevention of Money Laundering Act, Prohibition of Benami Property Transactions Act etc.) or under the Double Taxation Avoidance Agreement or Tax Information Exchange Agreement and the same has been communicated to the taxpayer before the furnishing of the updated return.

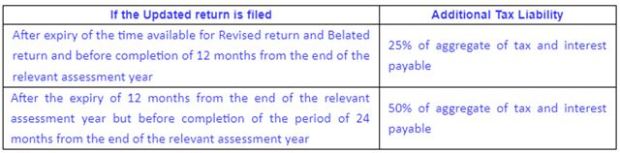

While furnishing such an updated return, the taxpayer would also be required to pay additional tax u/s 140B of the IT Act which would be computed as follows: