For a lower middle-class earner with a small family, earning Rs 1 lakh a month—even in metro cities—can feel like a reasonably comfortable income. With this level of income, a person can manage rent or a small home loan EMI, children’s school fees, groceries, utility bills, and routine daily expenses.

However, dining out frequently, taking an annual vacation, or building large savings may not be possible within this budget. Even so, overall life can still be considered fairly balanced.

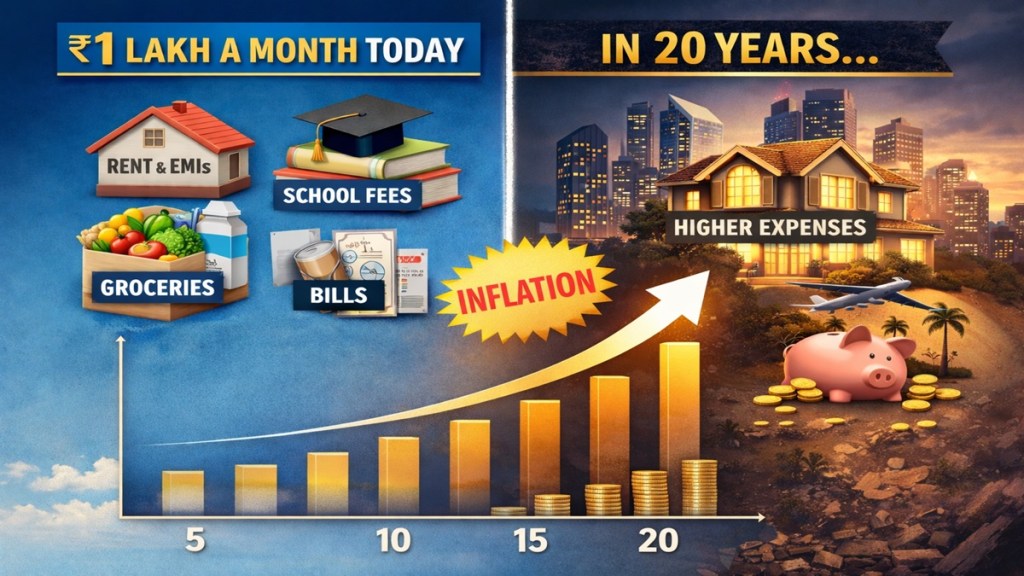

But the real question isn’t whether life is manageable with Rs 1 lakh today. The real question is, how much money will be needed to maintain the same lifestyle 20 years from now? This is where most people go wrong, because we estimate the future based on today’s salary and expenses. This is where the real story of inflation begins.

Inflation isn’t something that suddenly empties your pockets overnight. It works gradually, silently affecting things every year. The impact seems small in daily life—milk is a little more expensive, school fees are a few thousand rupees higher, medical bills are heavier than before. But when these small increases in expenses accumulate over 20 years, the impact becomes enormous.

Now, understand the math:

Current monthly expenses: Rs 1,00,000

Inflation: 6% annually

Time: 20 years

According to this simple calculation,

Today’s Rs 1 lakh a month becomes approximately Rs 3.20 lakh a month after 20 years.

That is:

Current annual expenses: Rs 12 lakh

The same expenses after 20 years: Rs 38–40 lakh annually

Note—this isn’t a luxurious lifestyle. This is the same life, just adjusted for inflation.

Here, another major misconception is also shattered. Many people think that if expenses increase, their life will also improve. But the reality is that most of the increase goes towards basic necessities. House rent and maintenance increase every year. The cost of treatment, medicines, and health insurance often increases at a rate of 8–10%. Children’s school and college fees continuously become more expensive. Everyday expenses like milk, vegetables, electricity, gas, and transportation continue to put pressure on the budget.

Simply put, 20 years from now you won’t be living a more luxurious life—you’ll just be paying more bills. This is the real truth about inflation, and without understanding it, future planning remains incomplete.

The biggest mistake in retirement planning

Now, let’s talk about retirement. Most people summarize their retirement planning in a single sentence:

“I will build a corpus of Rs 1 crore for retirement; that will be enough.”

But the real question begins here: Rs 1 crore in which year’s money?

A goal set in today’s money doesn’t hold the same value in the future because inflation erodes the purchasing power of money over time.

If we assume an average annual inflation rate of 6%, then today’s Rs 1 crore will be equivalent to approximately Rs 3.2 crore in 20 years to maintain the same purchasing power. This means that if you want your life after retirement to be as comfortable as it is today, you will need a corpus of approximately Rs 3.2 crore, not Rs 1 crore, in 20 years. This difference is not small, and ignoring it can prove to be the biggest mistake in retirement planning.

“My salary will increase” — Why is this thinking risky?

Often, people postpone worrying about retirement by thinking, “Why worry now? My salary will keep increasing.” But the pattern of life tells a different story.

The reality is that after the age of 40, salary growth usually slows down. Changing jobs becomes more difficult, and new opportunities become fewer. During this period, health-related expenses and family responsibilities tend to increase. At the same time, the capacity to take risks decreases because stability becomes more important.

The result is that at a time when expenses are rapidly increasing due to inflation, the pace of income growth slows down. This is why smart retirement planning is based not on future salaries, but on preparing today. The real planning starts here.

Retirement planning isn’t just about setting a target number. It means understanding inflation, estimating future expenses, and starting to invest accordingly today. For those who grasp this reality in time, retirement can become a period of peace and security, not a source of worry.