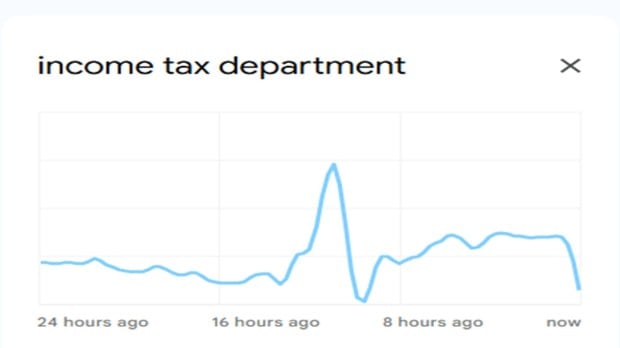

In the second half of every year, income tax–related keywords consistently feature among the top-searched terms on the internet, as more and more people look for answers to their queries related to income tax returns (ITRs). This year, these keywords have trended even more because there have been several developments around income tax — not just the usual ITR filing cycle. The Income Tax Bill, 2025, was passed in Parliament and will replace the 1961 Income Tax Act from April 1 next year. This has generated curiosity among taxpayers who want to understand the new law and how it will impact tax payment and filing from next year.

Another reason behind income tax–related keywords trending is the extension of the ITR filing deadline to 16 September 2025, instead of the usual July 31. Due to several changes in income tax rules, forms, and compliance requirements this year, the government extended the due date by around 47 days.

This year, a record 7.53 crore people filed returns by September 16, the extended normal due date. Filing continued even after that, and so far 8.21 crore returns have been filed for AY 2025-26 as of November 26, 2025. Of these, 8.1 crore ITRs have been verified.

However, according to data from the Income Tax Department’s official portal, out of these 8.1 crore verified returns, only 6.98 crore have been processed so far.

This means over 1.1 crore taxpayers are still in the queue, waiting for their returns to be processed, and many among them are expecting refunds.

Naturally, anxious taxpayers are turning to internet to check the latest updates, refund timelines, and official statements. This is why Google Trends continues to show ‘Income Tax Department’ and other income tax-related keywords among the top-searched terms.

Belated ITR deadline approaching: December 31, 2025

Another reason behind the spike in searches is the upcoming belated ITR deadline.

While the normal filing deadline for AY 2025-26 ended on September 16, 2025 (after extensions), taxpayers still have a chance to file a belated return — but only till December 31, 2025.

A belated return comes with penalties, but filing late is always better than missing the deadline completely.

Penalties for belated ITR filing

Taxable income below Rs 5 lakh: Penalty of Rs 1,000

Taxable income above Rs 5 lakh: Penalty of Rs 5,000

If tax is due, 1% interest per month is charged on the unpaid tax under Section 234A.

If the department owes you a refund — do you still get interest?

Yes. Even if you file a belated return, the government must pay you interest on your refund.

Taxpayers receive 0.5% interest per month, or 6% interest per year, on the refund amount.

This interest is calculated from the date the return is filed — or in some cases from April 1 of the assessment year — depending on the situation.

This is an important relief for those who expect a significant refund but couldn’t file their returns on time.

Steps to file a belated ITR for AY 2025-26:

Filing a belated return is simple and can be completed online. Here’s a step-by-step guide:

- Visit the official income tax portal – Go to the e-filing portal: incometax.gov.in.

- Log in using your PAN and password – Complete OTP verification if required.

- Choose ‘File Income Tax Return’ – Select Assessment Year 2025-26.

- Choose the ‘Online’ mode – This is the easiest option for most taxpayers.

- Select filing type – Choose: ‘Belated Return – Section 139(4)’

- Pick your ITR form –

- For example: ITR-1 for salaried individuals; ITR-2/3 for additional income categories

- Review pre-filled details: Your salary, TDS, and interest income details will be auto-filled. Verify everything carefully.

- Declare income, claim deductions: Add details manually if anything is missing. Cross-check Form 26AS and AIS.

- Pay tax if required: If any tax is pending, pay it with interest before submitting the return.

- Submit and verify your ITR: E-verify using Aadhaar OTP, net banking, or mobile banking. Verification is mandatory — without it, the return is not processed.

Why everyone is looking up tax-related information right now

Apart from delayed processing, refund concerns, and penalties, many taxpayers want clarity before the year ends. Searches on Google Trends show that people want instant answers on refund delays, belated return penalties, steps to check refund status, interest on refunds, how to avoid tax notices, and last-minute tax planning.

With more than 1 crore returns still pending, the anxiety is understandable.

Final takeaway

The Income Tax Department is handling a record number of returns, but with over 1 crore still unprocessed, many taxpayers are searching for answers online. As the belated ITR deadline — December 31, 2025 — draws closer, the search volume will likely increase even more.