TVS Motor Company (TVSM) has announced its acquisition of iconic British motorcycle, Norton, as it purchased assets of Norton Motorcycles (in administration), in an all-cash deal worth GBP16 mn. TVSM has been progressing well in the domestic premium product market (>150cc) with brand Apache in a tie-up (for sub-500cc segment) with BMW.

In the medium term, the deal provides: (i) strong brands, which aid entry into the lucrative cruiser bike segment; (ii) established engine (>500cc) technology; and (iii) new export opportunities.

In the near term, however, top investor concerns revolve around:

(i) the possible impact of COVID-19 on the sector and (ii) whether cashflow constraints could affect business in the medium term. We believe TVSM is likely to encounter these headwinds; however, the Norton deal indicates management focus remains on creating long-term value. We maintain Buy.

Brief about Norton: (a) The all-cash deal with Norton Motorcycles is valued at 2x its EV/revenue on FY18 basis; (b) Norton has brands in segments ranging from performance bikes to cruisers; (c) revenues grew 20% y-o-y in FY18 to GBP6.7 mn; (d) revenue mix is well diversified with exports accounting for ~79%; (e) Norton has been investing in new products; (f) it went into administration following a winding-up petition filed by the UK tax authorities; (g) in the last few years, Norton had been gaining entry in Asian markets which can now be boosted by TVSM.

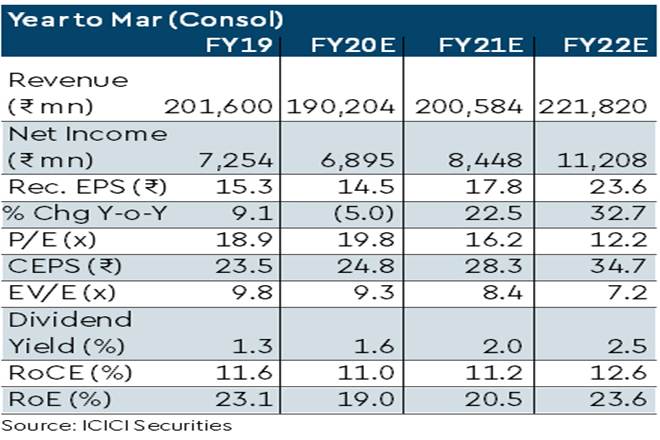

Deal boosts premium capabilities: We believe the Norton acquisition should be looked at from a typical capital budgeting lense (buy vs build). In the context of capabilities and opportunities, it provides TVSM with a much cheaper route to elevate its position. It could provide it a firm launchpad to combine its strong cost and quality focus with Norton’s products, technology and brands to explore the premium domestic market as well as export opportunities on a larger scale. We have unchanged TP of Rs 447/share (valuing standalone business on 22x FY22EPS).