Bharti and Vodafone-Idea have announced a price increase for their prepaid plans from 3rd Dec’19. RJio has also announced a similar price increase from 6th Dec’19. The increase is across feature phone and smartphone subscribers with an effective price increase of ~30% for both players.

ARPU increase across feature phone and smartphone subscribers

The price hike on smartphone bundle plans is ~30%, implying ~Rs 200 monthly spend on popular 1.5GB – three monthly plans. Both Bharti/Vodafone Idea (VIL) have also increased prices of their minimum recharge plans from Rs 35/65 to Rs 49/79, which should see an est. 30% increase in ARPU to Rs 53 from Rs 40 earlier.

Expect low impact on usage, but could trigger market share loss for VIL

As the price increase would be effective from the next cycle, its effects would reflect gradually over the next 1-3 months, particularly for the 3-month bundled subscribers. While we see some impact on usage, our workings for VIL/Bharti do not factor it in as the absolute increase is yet too small compared to the overall decline in pricing over the last three years and the price increase taken by all the three telcos.

However, given the dual sim card phenomenon, we expect market share loss for weaker players – Vodafone Idea – as this could also trigger sim card consolidation and subsequently, subscriber churn. Bharti, on the other hand, could see lower operating leverage but healthy FCF generation and improving balance sheet with robust 50%+ potential upside.

Vodafone Idea

It should see sharper 3.2x jump in Ebitda —Rs 92.2 bn. The increase in revenue/ Ebitda for VIL works out to Rs 104/92.2 bn (up 26%/218%). Subsequently, this should provide Rs 3/share increase in Ebitda; at revised Ebitda of Rs 134.5 bn (Q2FY20 annualised), a 10x EV/Ebitda could derive Rs 12/share, a strong upside from CMP of Rs 6.8. However, given the continued negative FCF position, worries still linger.

And market share loss could dilute the gains, thus questioning the stability of Ebitda post the price hike. Despite the price hike, VIL’s FCF post capex and interest cost (Rs 178 bn) could still come in at negative Rs 8.5 bn. This highlights the need for more such actions or government sops to attain positive FCF position.

Bharti

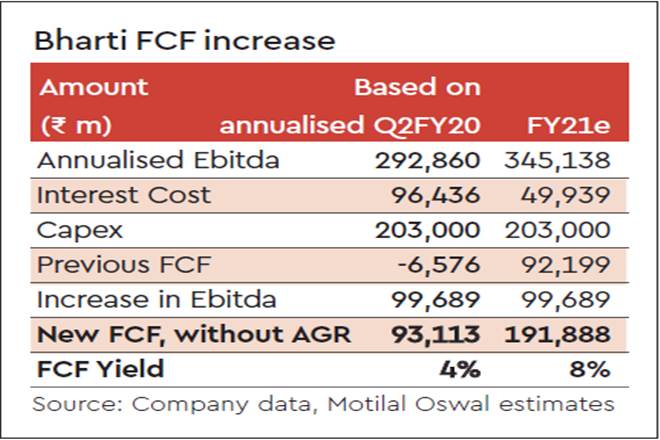

The increase in revenue/Ebitda should be to the tune of Rs 112/99.7 bn (up 13%/34%). Subsequently, this would provide Rs 19/share increase in Ebitda; on FY21e, at revised Ebitda of Rs 450 bn (on FY21 basis) a multiple of 10x EV/Ebitda would imply an estimated TP of Rs 695, a strong 50%+ upside even from CMP. The big upside would be supported by healthy FCF generation.

These price hikes could take FCF yield to 4% based on pre IND-AS 116 annualised Q2FY20 Ebitda and to 8% on FY21e Ebitda. The cash flow could improve net debt to Ebitda below over next 1-2 years with further stock upside.