By Suhel Khan

For anyone who is investing in the Indian stock markets or wishes to learn the ropes of it, a name synonymous with “visionary investing” will always find its way into conversations. The name is Mukul Agarwal, founder of Param Capital Group, known for his bold investment strategies and a significant impact on the capital markets.

The ace investor who we also call as on of the Warren Buffetts of India, recently bought stakes in quite a few stocks. However, the latest addition to his portfolio is what has got the conversations in the investment circles heated up.

As per the exchange filings made for the quarter ending December 2024, Mukul Agarwal has bought over 10% stake in 2 less known companies. One of which is a premium car rental company while the other one holds a leading position in the metal recycling industry.

Let us try and see what about these companies just that grabbed Agarwal’s attention enough for him to buy an over 10% stake in them.

Siyaram Recycling Industries Ltd

Siyaram was incorporated in 2007, and the company’s core business is segregating brass scrap, manufacturing brass ingots, billets, and brass rods, and producing brass-based components.

The company was listed in December 2023 and currently has a market cap of Rs 330 cr.

One of the reasons for Agarwal buying this stock could be the bounce back that the company has shown in the recent times.

The company’s sales were at Rs 275 cr at the end of March 2023, which dropped to Rs 215 cr in September 2023 and further to Rs 198 cr in March 2024.

However, the sales were up to Rs 246 cr again for the quarter ending September 2024. The company still hasn’t declared the numbers for the quarter ending December 2024 but given that Mukul Agarwal has already bought a 10.10% stake in the company, the investment community’s hopes are up.

Siyaram has also jumped back to life when it comes to net profits. At the end of March 2023, the company saw losses of Rs 1 cr. The profits at the end of September 2023 were Rs 4cr, which fell to Rs 3cr at the end of March 2024. And for the Quarter ending September 2024, the net profits were at Rs 8cr.

That’s a jump of 167% in the profits in just 6 months. That is a number that could have grabbed Agarwal’s attention.

EBITDA (earnings before interest, taxes, depreciation, and amortization) went from Rs 5 cr for the quarter ending March 2023 to Rs 14 cr for the quarter ending September 2024, which means it grew at a compounded quarterly rate of around 19%.

The operating profit margin (OPM) which was 2% at the end of March 2023 was at 6% at the end of September 2024.

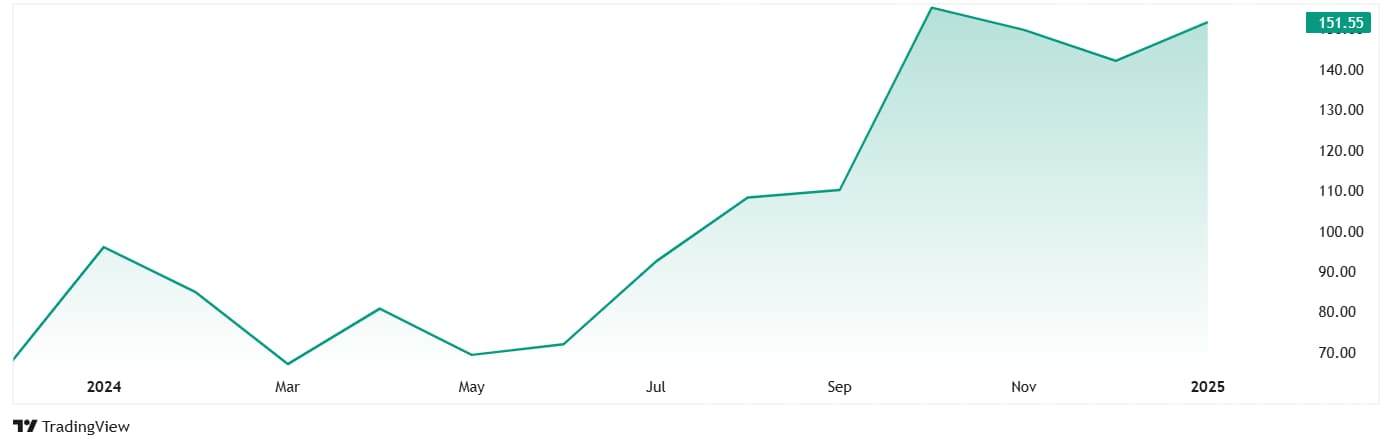

As for the share price, the current price is Rs 152 (as on 29th January 2025), which is 167% higher when compared to its listing price in December 2023 of around Rs 57.

The company’s share is trading at a current PE of 30x while the industry average when compared to peers is 34x. Since the company is recently listed, it would not make sense to derive a long-term median PE, but the industry median for the last decade has been at 19x.

Autoriders International Ltd (AIL)

AIL provides services of self-driven cars and chauffer driven car and was incorporated in 1994.

AIL is one of the few providers of self-drive rental cars in the country and maintains a fleet of chauffeur-driven cars. In addition, it also offers airport transfer services and domestic and international tour packages.

So, what could have been the reason of Mukul’s interest in this stock?

As per a report on India Brand Equity Foundation (IBEF), India’s premium car rental market is seeing a significant increase in demand, particularly in major cities such as Mumbai, Bangalore, and Delhi. Executive travellers, especially from the tech sector, as well as younger demographics like millennials and Gen Z, are increasingly opting for high-end vehicles for special occasions and domestic travel.

Which makes this business something to look forward to in the coming years.

The financials also show that the company is raring to get back up on the horse after the covid fall.

The company’s sales grew at a CAGR of 5% from Rs 66.3 cr in FY 2019 to 82.6 cr in FY24.

The net profits are something that caught Agarwal’s roving eye. The net profit in FY19 was Rs 1.04 cr which grew to Rs 9.44 cr in FY24, making it a CAGR of 55%.

EBITDA also grew from Rs 9.04 cr to Rs 23.81 cr between FY19 and FY24, which makes it a CAGR of 22%.

The operating profit margin (OPM) improved form 14% in FY19 to 29% in FY24.

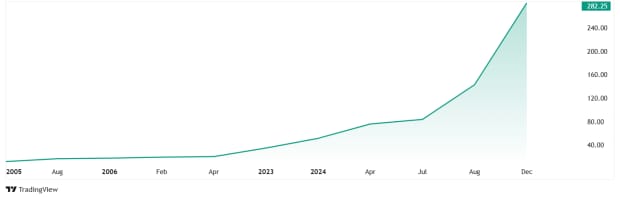

The company’s historical share price is not available on screener.in or the BSE website, but the price in December 2023 was around Rs 30, and as on 29th January 2025 it is at Rs 282. That is a jump of 840%.

The company’s share is trading at a current PE of 1.9x while the industry average when compared to peers is 24x. The 10-year median PE for the company is 0.6x and the industry median for the same period is 23x.

Is the 10% Stake Worth Following?

While the stocks Mukul Agarwal has picked these big stakes in may not be the most obvious choices to many investors, one must remember that Agarwal is one of the Warren Buffetts of India and has a proven track record of identifying strong and steady winners over the years.

The financials of some of these companies might not stand out when compared to more popular picks, but this is precisely what distinguishes India’s Warren Buffetts from the rest. They can spot potential in companies that the average investor might overlook.

While their exact strategy or insights remain a closely guarded secret, keeping a close watch on the stocks that attract the attention of such seasoned investors is always a wise move.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.