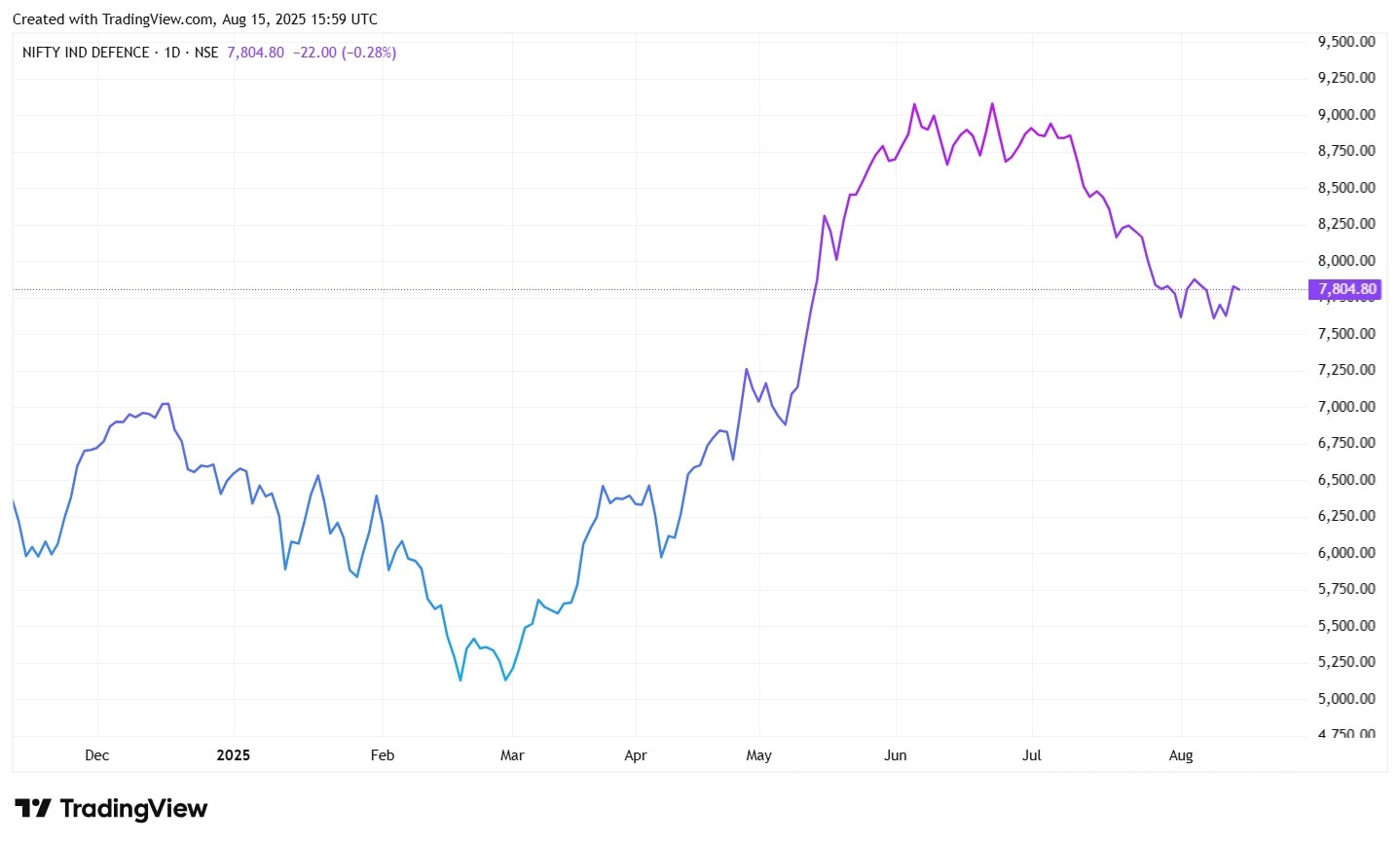

Are defence stocks still relevant? This is one of the most commonly asked questions these days. After a sharp surge, defence stocks have come in for some selling. Even then, over a year, the Nifty India Defence Index is up by 11.4%. (Source: NSE)

Generally speaking, stocks from the defence sector are trading at premium valuations However, there are a few stocks that are still relatively cheaper. Foreign Institutional Investors (FIIs) have been adding two such defence stocks.

Let’s find out more about these companies and perhaps why FIIs continue to buy into them.

#1 BEL: The Defence Giant with a Bulletproof Order Book

Bharat Electronics Ltd. (BEL) is a leading manufacturer and supplier of electronic equipment to the defence sector. The company develops advanced electronic equipment, systems, and solutions for the defence sector, which includes fire control systems, radar systems, weapon systems, network and communication-centric systems, electronic warfare systems, and more.

During Q1FY26, FIIs increased their holding in this company by 1.01% points, taking the total holding to 18.56%. Within the defence sector, this stock has the highest FII holding. Let’s see what is perhaps driving FIIs so strongly towards BEL.

Solid Order Book

One of the reasons why FIIs may be keen on BEL could be its solid order wins.

On 3 July, the Defence Acquisition Council (DAC) approved BEL’s Quick Reaction Surface to Air Missile project. The company is expecting to get the order by the end of FY26. The potential order size is around ₹30,000 to ₹40,000 crore.

BEL is also expecting an order worth ₹6,000 to ₹10,000 crore for the configuration of subsystems for developing Next-generation Corvettes (NGC). Around 5 or 6 subsystems are being ordered, which are expected to be delivered by Q3 or Q4 of this fiscal year.

BEL, along with Hindustan Aeronautics Ltd. (HAL), is developing electronics Line Replaceable Units (LRUs) for 83 aircraft. This order is worth ₹1,000 crore. Also, BEL is expecting the next order for 97 aircraft for which the order value will be around ₹3,000 crore.

The total order book of BEL stood at ₹74,859 Crore as of 1 July 2025.

Firing on All Cylinders: A Look at the Q1 Numbers

Sales at BEL increased from ₹4,244 crore in Q1FY25 to ₹4,440 crore in Q1FY26, rising around 4.6% YoY. The operating profit margin grew from 22% to 28% during the same period. The net profit went up from ₹791 crore to ₹969 crore during the period, registering a 23% YoY growth.

During the June quarter, the company grew its margins owing to a good product mix and reduced their costs by increasing in-house manufacturing. The management has commented that they are anticipating an EBITDA margin of around 27% for FY26.

Financial Snapshot

| Particulars | Q1FY25 | Q1FY26 |

| Sales | ₹4,244 Cr. | ₹4,440 Cr. |

| Net Profit | ₹791 Cr. | ₹969 Cr. |

| Operating Profit Margin | 22% | 28% |

Coming to the valuation…

The stock is trading at a PE of 51.2x while its industry median is at 65.9x. This is one of the few stocks in this industry that has a lower P/E than the industry median, underscoring its relatively cheaper valuation. The Price Earnings to Growth (PEG) ratio of BEL is 1.7, which is, however, slightly higher than the industry median of 1.3.

One-Year Stock Price Chart

#2 Data Patterns: A High-Tech Player with a Growing Arsenal of Orders

Data Patters (India) operates in the defence and aerospace electronics sector.

It offers indigenous electronic products which are used in aircraft, ships, missiles, helicopters, and other defence products. Some of the products that Data Patterns mainly focuses on are advanced light helicopter radars, fire control radar for Su-30 and MIG-29.

The company offers radar warning receivers, airborne software-defined radios, jammer pods, and other similar products for electronic warfare. For communication systems, it offers airborne programmable radio hardware, manpack radio, VUHF manpack, etc.

FIIs have a 12.78% stake in Data Patterns at the end of the June quarter, and during the quarter, they increased their stake by 0.03% points.

Staggering Order Book

Similar to BEL, Data Patterns also has a solid order book. The total order book as of 30 June 2025 stood at ₹814 crore. The order book has grown compared to the end of FY25, when it stood at ₹730 crore.

Some of the major orders received during Q1FY26 are –

- AMC Orders for Brahmos – ₹105 crore

- AMC orders for MOD – ₹28 crore

- Development orders from MOD – ₹12 crore

- Radar Development order from DoS – ₹11 crore

- Avionics production order from DRDO – ₹4.8 crore

Additionally, the company is expecting orders worth ₹2,000 to ₹3,000 crore for the coming two years.

The growing order book might be one of the reasons why FIIs are holding on to this defence stock so closely.

A Temporary Blip? Decoding the Q1 Slowdown

During the first quarter of FY26, even when the order book shot up, the sales and profits declined. The sales of the company dropped from ₹104 crore in Q1FY25 to ₹99 crore in this June quarter, declining by 4.5%. The operating profit margin also decreased from 36% in Q1FY25 to 32% in Q1FY26. Net profit declined by 22.2% from ₹33 crore to ₹26 crore.

Financial Snapshot

| Particulars | Q1FY25 | Q1FY26 |

| Sales | ₹104 Cr. | ₹99 Cr. |

| Net Profit | ₹33 Cr. | ₹26 Cr. |

| Operating Profit Margin | 36% | 32% |

Strong EBITDA Margin

The EBITDA margin was at 32% during the quarter, and the management expects it to remain between 35% to 40% during the entire fiscal year.

The company also expects its revenue to grow at a 20 to 25% CAGR for the next two to three years.

Coming to the valuation…

Data Patterns is trading at a PE of 65.7x, which is at par with the industry median of 65.9x. The PEG is at 2.07, significantly higher than the industry median of 1.25.

One-Year Stock Price Chart

Another Stock on FIIs Radar

Hindustan Aeronautics Limited (HAL): Even though FIIs reduced their stake in this company by 0.18% points during the Q1FY26, it continues to be one of the three top defence companies when it comes to the scale of FII holding. The total FII holding in this company stood at 11.9% at the end of the June quarter.

The stock is trading at a PE of 36.7x, way lower than the industry median of 65.9x. However, the PEG ratio is higher at 2.03, while the industry median is 1.25.

Wrapping up

FIIs seem quite optimistic about the defence stocks in India. Probably, the recent geopolitical scenario fueled the interest even more. Even though the market has rallied significantly during the past few months, and valuations seem stretched, these select stocks showcase growth prospects driven by strong order books, EBITDA margins, and relatively cheaper valuations as well.

Disclaimer

We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Maumita Mitra is a seasoned writer specializing in demystifying the world of investment for a broad audience. She has a keen eye for detail and a knack for explaining complex financial concepts in the simplest manner possible.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.