While the average investor keeps looking for the next big opportunity in newspapers, TV channels and hearsay tips, they only find the big household names. Names that are no surprise to anyone! But the smart ones are on the hunt for less known names that are quietly making waves in the background.

Here are two relatively unknown smallcap stocks that are shining on not one by multiple parameters. Both the companies are shining when it comes to making solid profits on their capital (Return on Capital), and are presently trading at what could be called modest valuations. And the best part is, they are trading at over 45% discount from their all-time high prices. Let us dive in…

Arrow Greentech Ltd

Incorporated in 1982, Arrow Greentech Ltd is in the business of bio-degradable (green) products, high-tech products and having patent income for such products /technology.

With a market cap of Rs 905 cr, the company is the largest manufacturer of Water-Soluble Films in India. It does development, production and marketing of a wide Range of Water-Soluble Films including Mouth Dissolving Strips.

The company has been displaying solid capital efficiency with a current ROCE (Return on Capital Employed) of 54%, while the industry median is 12%. Which means that for every Rs 100 Arrow Greentech spends as capital, it makes a profit of Rs 54 on it, which the overall industry averages just Rs 12.

The 10 Year ROCE for Arrow Greentech is 19% which is again higher that the industry median for the same period, of 13%.

Moving to financials, the company’s sales have grown from Rs 22 cr in FY20 to Rs 243 cr in FY25, logging in a compound growth rate of 62% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Arrow Greentech was a negative Rs 7 cr in FY20 which has shown a turnaround and hit Rs 88 cr in FY25.

As for the net profits, the company recorded losses of Rs 10 cr in FY 20. However, for FY25 the company has logged in profits of Rs 63 cr, which is nothing short of big comeback story.

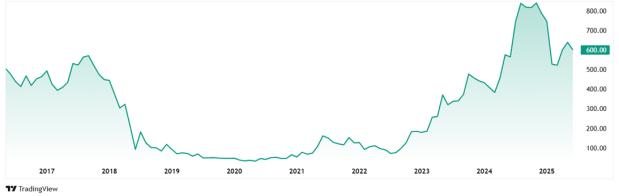

These turnaround figures helped the share prices of Arrow Greentech, which was around Rs 48 in June 2020 and over the last 5 years grew to its current price of Rs 600 (as on 16th June 2025). This is a jump of 1,150%.

Even at the current jump, the stock is trading at a discount of over 45% from its all-time high of Rs 1,099.

As for valuations, the company’s current PE is a modest 14x, while the current industry median is 22x. The 10-year median PE for Arrow Greentech is however slightly more than the industry median for the same period. While the company is at 23x, the industry median is at 21x.

In the latest investor presentation form February 2025, the company’s Chairman and MD, Shilpan Patel said that Arrow Greentech will “focus will remain on developing cutting-edge, high-tech products while exploring and integrating eco-friendly innovations from around the world into our operations in India, paving the way for future business transformation. As we progress, we remain steadfast in our dedication to fostering growth and delivering significant value to our stakeholders.”

Ksolves India Ltd

Incorporated in 2014, Ksolves India Ltd is involved in computer related activities including maintenance of websites of other firms/ creation of multimedia presentations for other firms, etc.

With a market cap of Rs 812 cr the company has offices in the USA, UAE, Noida, Indore, and Pune, and it serves 30+ countries. Ksolves India too is making a mark when it comes to capital efficiency, as the current ROCE for the company is a whopping 172%. Which means, for every Rs 100 it spends as capital, the company makes a profit of Rs 172, which is probably the highest when compared to industry peers. The current Industry median ROCE is 20%.

The 10-year median ROCE for Ksolves is also about 170%, while the industry median for the same period is 22%.

The company’s sales jumped from Rs 10 cr in FY20 to Rs 137 cr in FY25, logging in a compound growth of 68% in the last 5 years.

EBITDA for Ksolves India Ltd has grown at a compound rate of a huge 116% from Rs 1 cr in FY20 to Rs 48 cr in FY25.

When it comes to net profits, the company was at Rs 1 cr in FY20, and for FY25, the profits were at Rs 34 cr, which is a compound jump of 119%.

The share price of Ksolves India Ltd was about Rs 7 when it was listed in July 2020. And as of 16th June 2025, the price is Rs 353, which is a jump of 4,942%.

Rs 100,000 invested in Ksolves India 5 years ago would have been a little over to Rs 50 lacs today.

At the current price of Rs 342, the company’s share is trading at a discount of 46% from its all-time high of Rs 637.

Valuation wise, the company’s share is trading at a modest PE of 24x, while the industry median is 30x. the 10-year median PE for Ksolves India is 33x while the industry median for the same company is 23x.

On the news front, Ksolves has recently secured the largest single order in its history of about $600,000 with a New York based research and analytics services. It has also closed a Salesforce deal with a conglomerate in the UAE, known for its portfolio across retail, luxury brands, automotive, beauty, and hospitality sectors. Among other deals, it secured a major partnership with a billion-dollar leader in broadcast & media tech and acquired its first client for Data Flow Manager (DFM) which is again a billion-dollar valued company.

Big Gains or Big Risks?

Both the companies we looked at today have logged in enviable financials in the last few years. While Arrow Greentech is a turnaround story, the consistent & sustained growth of Ksolves is second to none.

But what both companies have in common is that they are both masters of capital efficiency and have a solid hold on their sales and profits. No wonder it also shows in the gains in stock prices in the last 5 years. Not to forget that they are both trading at over 45% discount.

Now, whether to buy these stocks or not is a decision the investor must make, given the financials and the pedigree the stocks have shown, it makes sense to at least have them on a watchlist. They deserve a close eye, as they might just be the next multibagger.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.