Ever wonder why you only hear about amazing stocks after they have already made someone a fortune? Honestly, almost every investor thinks about this.

Every time the big names like Agrawal, Damani, Kela or Porinju flash on the screen, you cannot help but wonder, “What’s their secret? What am I missing?”

The world’s greatest investor, Warren Buffett, answered this years ago. He once said that we are always looking for the next shooting star when there are perfectly good constellations shining right in front of us.

And that is the difference between us and the Warren Buffetts of India. They are not into the game of instant gratification. They find those hidden gems early on, when nobody else is paying attention, and then they watch their investments quietly grow.

Here are 2 such underdog stocks that have caught the attention of the Warren Buffetts of India.

TAAL Enterprises Ltd (TAAL)

TAAL, incorporated in 2013, was in the business of providing Aircraft Charter Services, which had to be stopped due to an unfortunate aircraft accident.

Currently the company in the process of merging its wholly owned subsidiary, TAAL Tech India Private Limited with itself giving birth to a whole new business that provides not only Air charter services but also Engineering services, embedded systems, and IoT solutions.

With a market cap of Rs 757 Cr, the company is almost debt free.

Add to this the company’s current ROCE (Return on Capital Employed), which is 32%. Which means on every Rs 100 the company puts into the business as capital, it makes Rs 32 on it in profits.

TAAL’s sales grew from Rs 149 cr in FY19 to Rs 187 cr in FY24, which is a compounded growth of 5%. For the first 3 quarters of FY25, the company has already recorded sales of Rs 140 cr.

The EBIDTA (earnings before interest, taxes, depreciation, and amortization) was Rs 31 cr inn FY19 and Rs 47 cr in FY24, which makes it a compound growth of about 9%.,

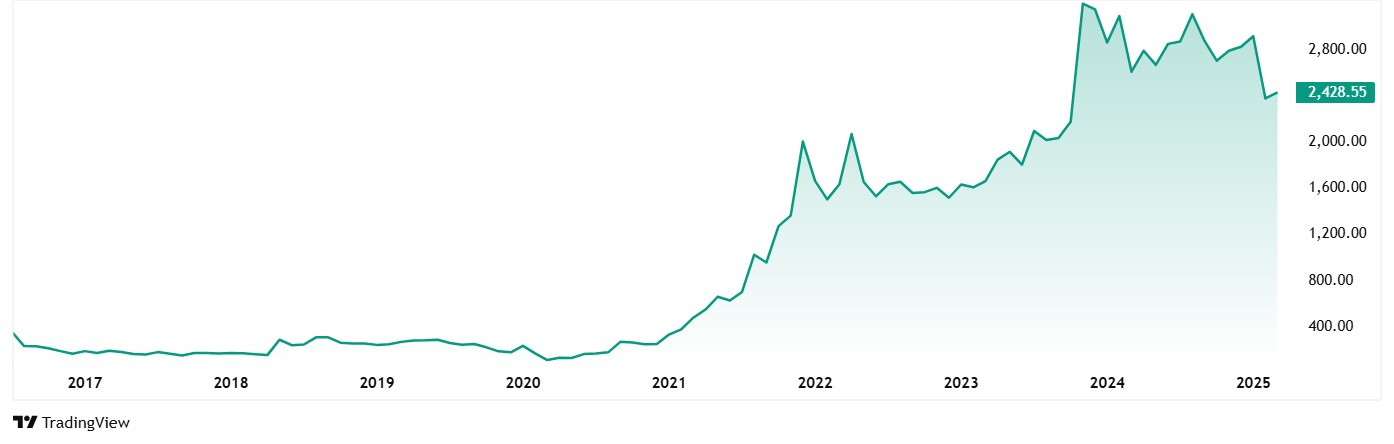

Even though the business saw some turbulent times, the share price for Taal Enterprises Ltd has shown tremendous growth and could be one reason of the interest the Warren Buffetts of India have shown in the stock.

The share price of TAAL was Rs 123 in March 2020 and as on the closing for 7th March 2025 the price was Rs 2,429. This makes it a 1,875% absolute jump and 82% compounded growth.

At present, as far as the valuations go, TAAL’s shares are trading at a PE of 16x while the industry median when compared with peers is 30x. The 10-year median PE for TAAL is 15x while the industry median for the same period is also 15x.

TAAL also currently has a dividend yield of 1.03%, making it the only one in peer comparison to have a yield more than 0%.

It is probably these numbers that drew the Warren Buffetts of India like Raj Kumar Lohia, Mukul Agarwal and Porinju Veliyath towards this company.

Trendlyne.com shows history as far behind as 2016 in case of Mukul Agarwal, when he had a 2.16% holding in the company, which is today a holding of 8.92%.

Dheeraj Kumar Lohia bought a 2% stake in the company as per the exchange filings made for the quarter ending December 2024.

Porinju Veliyath bought a 1.08% stake in the company in the quarter ending March 2024, and today has a 1.70% stake in it.

IRIS Business Services Ltd (IBSL)

Incorporated in 2000, IRIS Business Services Ltd offers Regtech solutions to regulators and enterprises.

IBSL is a RegTech SaaS company that helps enterprises, business registers, regulators, central banks, stock exchanges, BFSI, and other organizations meet their regulatory compliance requirements through technology-driven solutions like Artificial Intelligence, Machine Learning, and Robotic Process Automation.

With a market cap of Rs 750 cr, the company has a strong list of clients including Tadawul, SBI Mutual Fund, NSE, SPP Southwest, Colruyt, Bpost, Imerys, Midwest Energy, Forbes Marshall, Nelco, Terra Gen, etc.

Madhusudan Kela has been holding a little over 5% in the company since May 2019, which is the farthest history available on trendlyne.com.

Narayan and Sudha Murthy’s Catamaran Ventures LLP also bought 1.51 stake in IBSL as per the exchange filings made for December 2024.

Once again, like TAAL above, IRIS also has a strong grasp on every rupee it spends as capital and has a ROCE of 27% and is also almost debt free.

The sales have gone form Rs 40cr in FY19 to Rs 102cr in FY24, which is a compounded growth of 21%.

The EBIDTA was a negative Rs 1cr in FY 19 while the company recorded Rs 15cr for FY24. That is impressive growth.

The net profit seems like an area of concern, but the company seems to be doing something right, as from losses of Rs 6cr inn FY19 the company has come a long way to profits of 9cr in FY24.

And between April 2024 and December 2024, the IBSL has already reported profits of over Rs 10 cr.

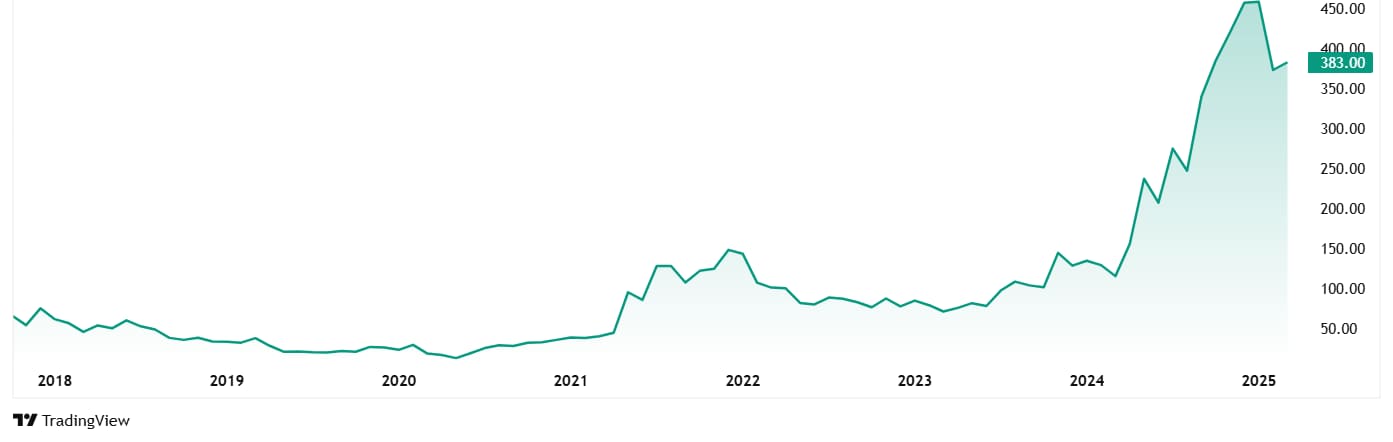

The share price of IBSL also a big jump of around 1,800% from Rs 20 in March 2020 to Rs 378 as on closing of 7th March 2025.

The one red flag for IBSL could be that even after seeing repeated profits for some quarters, the company is not paying out any dividend.

As for the valuations, IBSL’s shares are trading at a PE of 50x while the industry median is 32x. The 10-year median PE for the company is 52x, while the industry median for the same period is 26x.

Catch Them When They Are Young?

The two companies we have looked at today – TAAL and IBSL and not merely stock picks for the Indian Warren Buffetts. These stocks probably check many if not all the check boxes in the book of these Warren Buffetts of India.

Now, these are names that turn heads with their every move in the market. Plus, they have proven their ability to find future multibaggers many times in the past.

So, it would make good sense to add these stocks to the watchlist and keep a close eye on them.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.