Shipping stocks have rebounded as tensions on key trade routes have increased, pushing up freight rates, especially for tankers. Although tensions have eased recently, freight rates are expected to remain stable due to the ongoing mismatch in demand and supply dynamics.

Longer routes have also led to increased rates, as companies have opted for longer routes, primarily via the Cape of Good Hope. Two companies listed on the Indian stock market have benefited from rising freight rates, with positive returns in the last months.

But is the rally starting, and what is expected of their performance this fiscal year?

Let’s take a look…

#1 Shipping Corp of India

Shipping Corporation of India is a public sector undertaking in which the Government of India holds a 63.75% stake. It is India’s largest shipping company in terms of capacity. The company operates in both the transportation of goods and passengers.

Strategic Role and Fleet Strength

It has a diversified fleet of 57 vessels. This includes Bulk carriers, Crude oil tankers, Product tankers, Container vessels, Passenger-cum-Cargo vessels, LPG carriers, and Offshore Supply Vessels.

The company also manages 36 third-party ships for various government departments and organisations, earning service income. This includes the Maldives and the Andaman and Nicobar Islands, to provide maritime services among the islands.

Furthermore, it serves projects of national importance by partnering with ONGC and the Geological Survey of India (GSI) for offshore services. It also supplies vessels for Indian Government operations. This includes the Mars Orbiter Mission of ISRO and defence missions, via an agreement with DRDO.

The average age of the company’s vessels is 11-12 years. This helps in getting better charter rates and achieving higher operational efficiency. The Group has recently deployed its vessel on a direct “India – Middle East Shipping Service” linking the eastern and western coasts of India with Middle East ports and other Persian Gulf locations.

Tanker-Led Profit Growth in FY25

From a financial standpoint, revenue rose 11% year-on-year to ₹56.3 billion in FY25, while net profit grew 24% to ₹8.4 billion. Tanker services revenue increased 6% YoY to ₹36 billion, accounting for 64% of revenue. This was followed by a liner segment, whose revenue increased 45% to ₹10.4 billion.

It accounts for 18% of the top line. The bulk carrier segment revenue rose 7% to ₹7.1 billion, making up 13% of the total. In contrast, revenue from the technical and offshore segment declined by 1% to ₹2.8 billion, accounting for the remaining 5%.

On the profitability front, tankers account for 79% of the overall profit. Profit from this segment rose 12% to ₹6.8 billion. The liner segment followed, with a 19% share in profits and a bottom line of ₹1.7 billion.

Meanwhile, technical and offshore services saw a 45% decline in profit to ₹0.32 billion, and the bulk carrier segment incurred losses of ₹0.22 billion. From a valuation perspective, it trades at a price-to-equity (P/E) multiple of 12.2x, well above the 10-year median of 6.2.

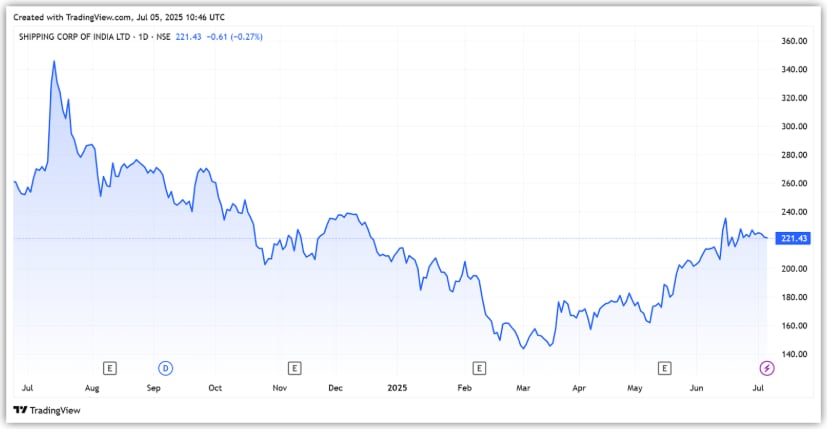

Shipping Corporation Share Price

#2 Great Eastern Shipping Company

The Great Eastern Shipping Company is the largest shipping company in India, with over seven decades of operation. It also operates in offshore oilfield services through its subsidiary, Greatship (India).

The Company has maintained a strong presence in the market with its diverse and extensive fleet of vessels, which includes tankers, product and gas carriers, and dry bulk carriers. As of May 31, 2025, the Company owns and operates 38 vessels with an average fleet age of 14.70 years.

Historically, the company has operated a fleet of young ships, which gives it a competitive advantage and reduces associated costs. About 58% of the fleet capacity operates in the product/crude oil tanker segment, 10% in the gas tanker segment, and the remaining 32% in the dry bulk segment.

Flat Revenue, but Long-Term Drivers Stay Intact

Having a presence in both segments helps it maintain stable financial performance in case of declines across segments. Revenue remained flat at 54 billion, while profit fell 10% to ₹23.4 billion.

The company stated that FY24 was an exceptional base due to disruptions in the Red Sea, which drove up rates. As the rates eased, profitability took a beating. Product tanker rates dropped 33% YoY to $24,700/day from $37,000/day.

Tanker Exposure and Spot Strategy Shape Outlook

Going forward, management estimates that the overall freight market, particularly in the tanker segment, will remain strong in the medium term. The company noted that demand-supply dynamics continue to support tanker earnings.

Between CY25 and CY27, global ton-mile demand for tankers is projected to grow at 4-6% annually. At the same time, net fleet additions are expected to remain limited at 2–3%. This imbalance is likely to keep charter rates higher, especially in crude and product tankers, which together make up nearly 58% of its fleet capacity.

The company also expects demand in the dry bulk segment to remain stable, supported by a rebound in Chinese imports and ongoing logistical inefficiencies. GE believes that its LPG carriers, deployed on long-term charters, will continue to deliver steady cash flows.

On the offshore front, Greatship India is set to benefit from the repricing of three rigs over the next 18 months. Two of these are expected to begin short-term contracts after the monsoon in FY26, while the third has secured a 3-year ONGC contract starting late FY26.

With nearly 58% of its fleet deployed in the tanker segment, strong charter rates are expected to support cash flow further. The company plans to expand its fleet when vessel prices become attractive.

Around 80% of the company’s shipping fleet will continue to operate on spot charters. While this brings some volatility, it allows GE to quickly capture the upside in improving rate environments.

From a valuation perspective, it trades at a P/E ratio of 6 times, which is lower than the 10-year median of 7.

Great Eastern Shipping Company Share Price

Conclusion

SCI and GE Shipping have both benefited from improving freight dynamics and supply constraints. While SCI relies on its strategic role and strong tanker-led growth, GE Shipping offers exposure to spot market upside. Valuations have moved up, but with demand staying firm and limited fleet additions ahead, both stocks could be contenders to add to the watchlist.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.