The poster boy of India’s electric vehicle (EV) revolution is currently navigating a brutal collision with market reality. Over three frantic days in December 2025, Bhavish Aggarwal, the founder and CEO of Ola Electric, offloaded approximately 9.65 cr shares through a series of bulk deals.

The total value of the divestment? A staggering Rs 324.6 cr.

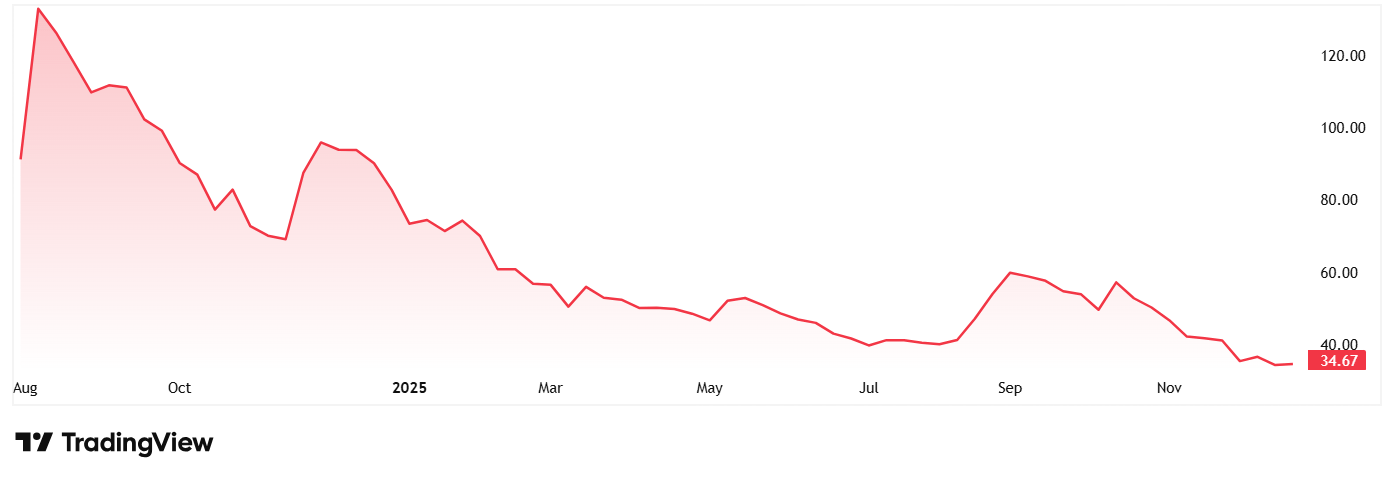

For a stock already reeling from a 60% year-to-date decline, this insider selling spree felt like a vote of no confidence to many retail investors.

However, the company’s story is very different… One of financial hygiene and the elimination of a dangerous pledge overhang.

72-hour timeline: The Rs 324 cr sell off

The share sale was not a single transaction but a systematic withdrawal that punished the stock price in real-time. Here is how it all went down.

- December 16: Aggarwal sold 2.62 cr shares at an average price of Rs 34.99, raising roughly Rs 92 cr.

- December 17: The pace increased with the sale of 4.19 cr shares at Rs 33.96, worth approximately Rs 142.3 cr.

- December 18: A final tranche of 2.83 cr shares was sold at Rs 31.90, raising Rs 90.3 cr.

By the time the dust settled, the stock had crashed to a fresh all-time low of Rs 30.79, a huge 80% drop from its record peak of Rs 157 in August 2024.

The Krutrim conflict: Funding the future at the cost of the present

Why would a founder sell nearly 6% of his promoter group’s equity at a price 55% below the IPO issue price of Rs 76? The answer lies in personal leverage. Aggarwal reportedly raised over Rs 250 cr in loans by pledging his Ola Electric shares to fund his latest venture, the AI startup Krutrim.

As the share price dropped throughout 2025, those pledged shares became what the market calls a “stock-specific risk,” threatening margin calls and further volatility. Ola Electric’s official stance is that this was a “one-time, limited monetisation” intended to fully repay the Rs 260 cr promoter-level loan.

By doing so, Aggarwal released all 3.93% of pledged shares, moving the company toward a zero-pledge structure.

Q2 Autopsy: When cost-cutting cannot hide revenue collapse

While the company keeps harping about zero-pledge governance, the core business metrics tell another story. And this of rapid decay. In the second quarter of FY26, Ola Electric reported revenue from operations of Rs 690 cr. That is an appalling 43% year-on-year drop from Rs 1,214 cr in Q2 FY25, a worrisome figure for investors.

The company recorded a net loss of Rs 418 cr for the quarter ending September 2025. Now while that is a slight improvement from the Rs 495 cr loss previous year, this shrinkage was driven mostly by aggressive cost-cutting and not by growth in volumes.

Operating expenses fell by 52%, but the top-line contraction suggests that Ola’s “growth story” is no longer just stalling but it is actively shrinking.

The fall of the incumbent: Surrendered dominance

One of the most shocking developments for investors in case of Ola, is the complete collapse of the company’s market dominance. Once the undisputed leader of the electric two-wheeler market, Ola Electric has now fallen from grace to fifth position. And traditional competitors did not miss the chance to grab the space vacated by Ola:

- TVS Motor and Bajaj Auto surged in volumes by capitalizing on their superior service networks and long-term brand trust. Their customer loyalty paid off.

- Ather Energy continues to hold a strong premium position, while Hero Vida impressed by its sheer resilience.

- In November 2025, Ola’s sales dropped to about 8,400 units (Source: VAHAN Registration Data), which could be called a historic low compared to the tens of thousands of units it once moved monthly.

Why Investors should be worried: The triple threat to retail capital

Now while the company says this was a one-time monetization and it was to move to a zero-pledge governance model, the red flags cannot be ignored.

- Founder Focus: Aggarwal’s decision to sell Ola shares at record lows to fund Krutrim AI has not landed well with investors. Probably because it signals that his primary capital and attention is now shifting. Retail investors may not appreciate a listed company being treated as a piggy bank for a founder’s other ventures.

- Service Backlog: In many regions of the country, failure on regulatory compliance and subsequent service bans have severely damaged the brand’s reputation.

- Governance Optics: Bulk deals of this magnitude establish a low-price ceiling. When a founder sells at Rs 32, it becomes psychologically difficult for the market to justify a valuation at Rs 76.

The verdict: A value trap in the making

For investors, the removal of the pledge is a cosmetic fix for a structural crisis. Ola Electric has entered what one can call a vicious cycle where falling market share reduces the cash available for R&D and service expansion, further damaging market share.

Until the company can show a reversal in delivery trends, the stock remains a high-stakes gamble. The Zero Pledge status is a welcome change, but it does not fix a broken balance sheet or a disgruntled customer base. For now, the safest place for retail capital is on the sidelines.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks/securities/funds discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.