The Indian hospital industry is growing rapidly with the help of government interventions such as Ayushman Bharat Digital Mission and also rising health consciousness and healthcare expenditure.

According to a report, there is a huge gap of demand-supply with only 0.5 hospital beds per thousand against the global average of 3. There is a need for addition of more hospitals in India.

Here is a list of the top 3 hospital stocks in India. This is based purely on market capitalisation. This is not a fundamental analysis of the stocks, nor a recommendation of any kind.

#1 Apollo Hospitals Enterprise

First on list is Apollo Hospitals with a market capitalisation of Rs 1,098 bn.

Founded by Dr. Prathap C. Reddy in 1983, Apollo Hospitals is India’s leading integrated healthcare provider. It offers life-saving treatments, diagnostic and preventive care, as well as pharmacy services. With a network of 73+ hospitals, it’s the largest private healthcare system in India.

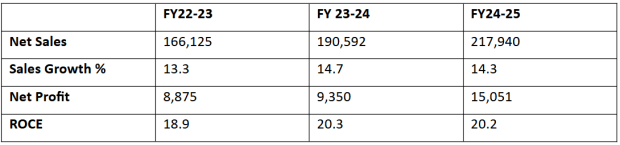

Apollo Hospitals Enterprise Financial Snapshot (FY23-25)

On the financial front, the company reported revenues of Rs 58,421 m in Q1 FY26, against Rs 50,856 m in the corresponding period of last year. The net profits of the company jumped to Rs 4,274 m in Q1 FY26, from Rs 3,040 m YoY.

Moving forward, Apollo Hospitals is adding over 3,500 high-quality beds across 11 cities, reinforcing its presence in underserved regions and high-demand urban clusters.

New hospitals in Gurgaon, Mumbai, Pune, Varanasi, and several other locations are being developed with a deep focus on critical care, precision medicine, and surgical excellence. These investments are guided by a cluster-based strategy that enables efficient care delivery.

#2 Max Healthcare

Next on our list is Max Healthcare with a market cap of Rs 1,084 bn.

Max Healthcare Institute is one of the top healthcare organisations in the country. The company operates 22 healthcare facilities (5,200+ beds) across the NCR Delhi, Haryana, Punjab, Uttarakhand, and Maharashtra.

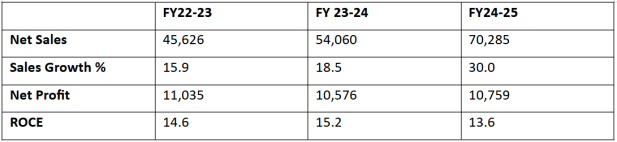

Max Healthcare Financial Snapshot (FY23-25)

On the financial front, the company reported consolidated sales of Rs 20,276 m in Q1 FY26, as against Rs 15,430 m in the corresponding period of last year. The company reported a net profit of Rs 3,080 m, against Rs 2,363 in Q1 FY25.

Moving ahead, the company sees a potential to expand capacity by 8,200+ beds, with 4,700 beds being added in next 3-4 years. It’s looking at 3,000 beds addition via brownfield expansion, which are ROCE accretive.

The company is also looking at greenfield hospitals in attractive & compelling territories with high returns. It has acquired land parcels with potential to add 1,000 beds in Gurgaon and 550 beds in Lucknow.

Max Healthcare is likely to see strong growth driven by capacity expansion, specialty focus, digital transformation.

#3 Fortis Healthcare

Next on our list is Fortis Healthcare, an integrated healthcare delivery service provider in India, with a market cap of Rs 788 bn.

The healthcare verticals of the company primarily comprise hospitals, diagnostics, and day care specialty facilities.

The company operates 33 healthcare facilities (including JVs and O&M facilities) across 11 states.

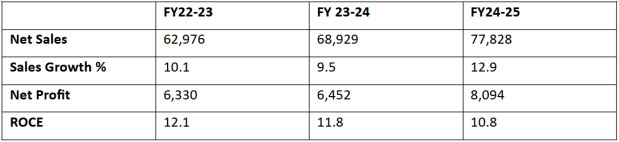

Fortis Healthcare Financial Snapshot (FY23-25)

On the financial front, the company reported revenues of Rs 21,667 m for Q1 FY26, up from Rs 18,589 m in the corresponding period of last year.

Net profits at the company were placed at Rs 2,639 m in Q1 FY26, from Rs 1,734 m in the corresponding period of last year.

As part of an inorganic growth strategy, the company recently, through its wholly-owned subsidiary acquired Shrimann Superspecialty Hospital in Jalandhar, which added 228 beds to its network.

This deal strengthens Fortis’ position in Punjab further from about 800 beds to more than 1,000 beds. The company, in July 2025, signed an operation and maintenance services pact with Gleneagles Indi Gleneagles India.

According to the pact, Fortis will operate the business of about 700 beds in 5 hospitals and a clinic under the Gleneagles India chain. With these additions, the company now operates 33 health care facilities, comprising over 5,700 beds across 11 states.

Conclusion

Looking forward, the rising share of the population aged over 45 years, coupled with income growth, is expected to catalyse higher demand for quality healthcare services.

According to Care Ratings, this demand will likely translate into sustained investments across the entire value chain, from medical education and training to hospital infrastructure and digital healthcare technologies.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.