The Indian mining stocks had a volatile and uneven ride so far in 2025. Domestic demand for coal and key minerals has remained robust, aided by infrastructure outlays, steady energy requirements, and changing policy reforms. Production levels are healthy, and the sector’s key fundamentals are stable.

But the market has gone the other way.

In early April, the US imposed reciprocal tariffs on China. Although Indian mining exports were not directly affected, the announcement created global risk aversion. The overall market sentiment became cautious. Indian mining stocks suffered as investors scrambled to de-risk—not due to worsening business metrics, but due to increased uncertainty.

This is the type of setting experienced investors anticipate. The sector has experienced such corrections in the past—moments when fear dominated performance—only to mount strong recoveries when sanity was restored. Provided that business fundamentals are still in place, today’s volatility can indeed be tomorrow’s entry point.

Even so, not all falling stocks represent bargains. Particularly in capital-intensive sectors such as mining, headline earnings frequently do not tell the whole story. That is where EV/EBITDA comes in. It takes into consideration debt and operating performance—providing a clearer snapshot of th valuation of the company.

In this note, we use that lens to find three of India’s most affordable mining stocks, with a market capitalization of more than Rs 500 crore and positive EBITDA. To investors who are willing to lean into fear and look beyond the din, these companies could hold long-term potential.

Coal India is mainly engaged in mining and production of Coal and also operates Coal washeries. The major consumers of the company are power and steel sectors. Consumers from other sectors include cement, fertilizers, brick kilns etc.

The current valuation of Coal India stands at an EV/EBITDA multiple of 4x, which reflects comparatively favorable pricing versus peers. It is currently trading at par with its 10-year median EV/EBITDA of 4.2x.

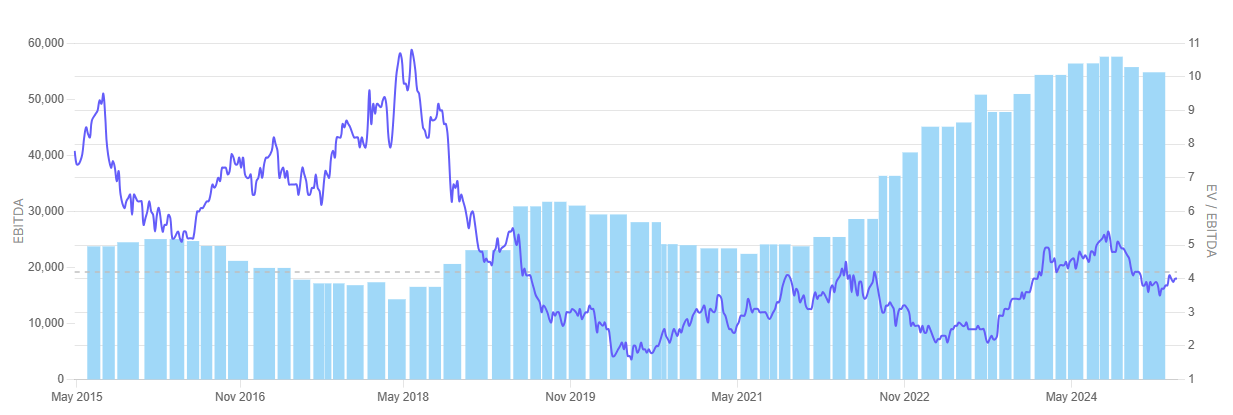

Coal India EV/EBITDA Ratio Over Last 10 Years

On closer inspection of the chart, Coal India’s EBITDA has climbed consistently since 2021, touching multi-year peaks in early 2024. However, its EV/EBITDA multiple has remained around 4x—well off pre-2018 levels when it tended to move above 6x. This difference between good earnings and humble valuation suggests the stock may be undervalued despite enhanced fundamentals.

On March 4, 2025, when Coal India was trading at Rs 360, Geojit gave a price target of Rs. 393, the stock already crossed that target and is currently at Rs. 400 (as of April 21, 2025). This renders the report’s price target obsolete, although its observations regarding long-term growth drivers such as gasification and renewables remain valid.

The report identifies Coal India’s proposals to establish a coal-to-synthetic natural gas project in association with Bharat Petroleum Company (BPCL), another public sector undertaking, and develop strategic mineral assets with Indian Rare Earth (IREL). It also refers to the commissioning of a 50 MW solar power plant at Northern Coalfields and a government incentive of Rs. 1,350 crore for its three coal gasification projects.

Coal India is also thinking of long-term diversification through various strategic efforts. These include partnership with BPCL for a coal-to-synthetic natural gas project and IREL partnership for developing strategic mineral assets.

NMDC is engaged in exploration and production of Iron Ore along with Diamond, production and sale of Sponge Iron and generation and sale of wind power.

NMDC is priced at an EV/EBITDA multiple of 4.9 times, which puts it on the fair side of the valuation band in comparison to the other metal stocks. It is currently trading above its 10-year median EV/EBITDA of 3.4 times.

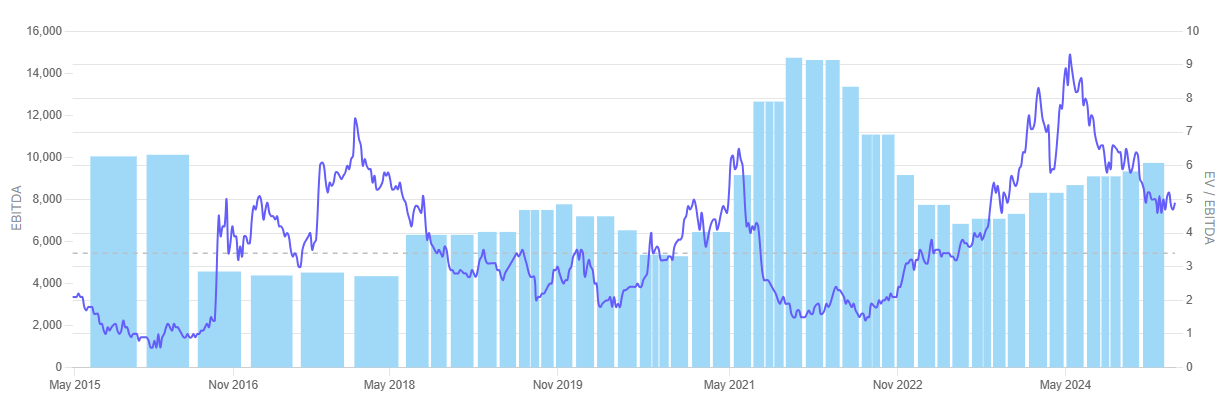

NMDC EV/EBITDA Ratio Over Last 10 Years

A closer look at the chart shows that NMDC’s EV/EBITDA multiple (purple line) has been steadily increasing since mid-2022, while even as EBITDA (blue bars) has experienced modest recovery. As compared to previous cycles—especially in 2020-21 when EBITDA reached its peak but valuations fell (a typical feature of commodity stocks)—the current configuration suggests better investor confidence. That being said, being above its 10-year median may imply that the scope for further upside is more tied to earnings growth than multiple expansion.

NMDC will invest about Rs 70,000 crore in the next five or six years to increase its iron ore production capacity by two times to 100 million tonnes.

It is planning to add capacity by constructing a pellet plant, a blending yard, and a pipeline terminal in Vizag, while the land is already purchased from Rashtriya Ispat Nigam. It is also anticipating a major capacity build-up from units like SP-III and others, with production of 53–54 million tonnes planned in FY26.

Further sidings and evacuation infrastructure are being developed to tackle logistics bottlenecks. The management feels that these initiatives put NMDC on a course for a quantum jump in volumes and scale of operations.

Vedanta is a diversified natural resource group engaged in exploring, extracting and processing minerals and oil & gas. The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminium, iron ore and oil & gas.

It has presence across India, South Africa, Namibia, Ireland, Liberia & UAE. Its other businesses include commercial power generation, steel manufacturing & port operations in India and manufacturing of glass substrate in South Korea and Taiwan.

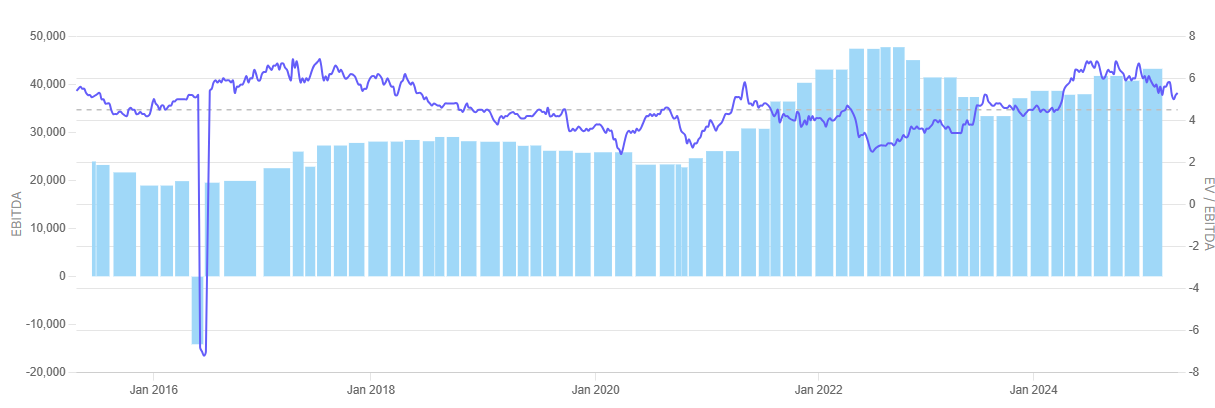

Vedanta is trading at an EV/EBITDA multiple of 5.2 times, placing it among the better-valued players in the mining industry. It is currently trading slightly above its 10-year median EV/EBITDA of 4.5 times. This valuation indicates the stock is fairly priced.

Upon closer inspection of the chart, Vedanta’s EBITDA has been fairly consistent over the years, even during the times of market volatility. This reflects operational stability in spite of macroeconomic fluctuations. One specifically saw a steep earnings decline around FY16, but since then, the company has presented a very strong turnaround, particularly post-2021.

Geojit has assigned a ‘Hold’ rating to Vedanta with a target price of Rs 496, which suggests an upside potential of 20.4% from the then-current market price of Rs 412 (as on 21st April 2025).

Looking forward, Geojit observes that Vedanta is concentrating on cost-effectiveness, strategic investments, and operational increases, like doubling BALCO’s rolled product capacity and advancing with refinery and smelter ramp-ups.

Vedanta management continues to be concentrated on long-term value creation by way of structural cost efficiencies and prudent capital allocation. The group is investing in aluminium, zinc, and power businesses as well as striving for self-reliance in strategic resources.

Leadership reiterated its dedication to deleveraging, streamlining its corporate structure (a demerger may be on the cards), and sustainability as the fundamental pillars for long-term growth.

Conclusion

With 2025 underway, the Indian mining industry is at a crossroads. Demand is robust, supported by infrastructure development, energy transition targets, and the strategic imperative for minerals. However, international events such as US-China tariffs have blunted the edge, resulting in guarded market behaviour.

All listed players are now trading at or near their 10-year EV/EBITDA medians—indicating that while fear has moderated, long-term growth isn’t entirely reflected. Solid earnings and good expansion plans are present, but general risk aversion remains in control.

And since valuations in commodity sectors tend to compress at cycle peaks, the fact that these multiples are still hovering near historical averages suggests we’re not at the top — but likely still in the early to mid-phase of the cycle

The industry’s destiny will rest on industrial demand, policy momentum, and the effectiveness with which companies diversify into renewables, gasification, and critical minerals. Valuations indicate uncertainty—but also quiet potential for those who will wait.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to deep deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.