First it was rare earth magnets, now it’s fertilisers.

China has halted shipments of speciality fertilisers used to increase the yields of fruits, vegetables, and other remunerative crops to India for the last two months, according to media reports.

However, China, a global supplier of agricultural inputs, continues to export them to other nations.

China has been restricting suppliers of speciality fertilisers to India for the last four to five years. However, this time, it’s a complete halt.

Speciality fertilisers, including water-soluble, micronutrient, nano and bio-stimulant variants, are non-subsidised products that improve soil health and nutrient efficiency.

India typically imports 150,000–160,000 tonnes of such fertilisers in the June–December window.

Local production remains limited due to a lack of technology and low historical demand.

However, many firms are active in this space and rising demand is prompting interest in setting up domestic manufacturing.

With China halting the supply of fertilizer, here are 3 stocks set to benefit…

#1 Deepak Fertilisers and Petrochemicals Corporation

First on the list is Deepak Fertilisers and Petrochemicals Corporation.

The company is a leading Indian manufacturer of fertilisers and industrial chemicals. The company operates across key segments including mining chemicals, industrial chemicals, and crop nutrition, with plants in Maharashtra, Gujarat, Andhra Pradesh, and Haryana.

In the speciality fertiliser segment, DFPCL offers a wide range of 48 products such as water-soluble fertilisers, bio-stimulants, micronutrients, and secondary nutrients. These products are backed by strong R&D and extensive field trials at over 50,000 farmer demo plots.

The R&D efforts have shown clear improvements in crop yield and quality across cotton, sugarcane, onion, fruits, and vegetables.

Now, with China pausing exports of speciality fertilisers, Deepak Fertilisers is well-positioned to fill the gap and cater to growing domestic demand.

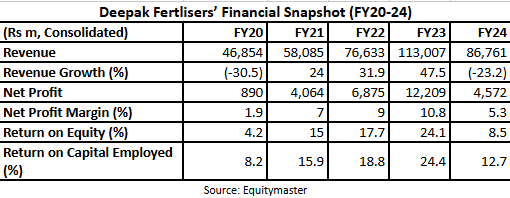

Coming to financials, sales and net profit have grown at a 5-year CAGR of 5.2% and 44.2%, respectively. The returns have been strong, with the RoE and RoCE averaging over 13.9% and 16%, respectively.

Going forward, the company has earmarked a large investment of Rs 43.5 billion (bn) to increase its capacity of ammonia to 628,700 MTPA by FY26.

Additionally, it has planned a capital expenditure of Rs 22.01 bn to reach 862,900 MTPA production of technical ammonium nitrate by FY26.

#2 Nagarjuna Fertilizers and Chemicals

Next on the list is Nagarjuna Fertilizers and Chemicals.

The company manufactures and markets plant nutrients, micro irrigation equipment, and agri-informatics services.

Its product line covers everything from basic nutrients like urea and ammonia to more advanced offerings like Diammonium Phosphate (DAP), Muriate of Potash (MOP), and chelated micronutrients.

The company operates through three key verticals, straight nutrition, nutrition solutions, and management services.

Its growing role in speciality fertilisers, especially chelated micronutrients and customised blends, puts it in a strong spot amid China’s halt on such exports.

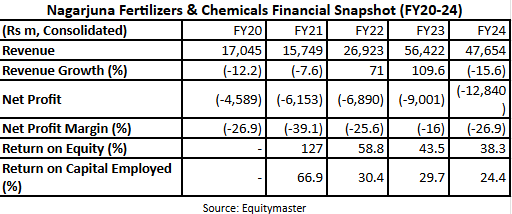

From FY20 to FY24, the company achieved a CAGR degrowth of 19.7% in sales, while it’s still a loss making company.

Going forward, the company plans to expand its reach.

#3 UPL

Last on the list is UPL.

UPL is a leading player in crop protection and plant nutrition with operations in over 130 countries. The company manufactures a broad range of products, including fertilisers, pesticides, and speciality chemicals tailored to modern farming needs.

In the speciality fertilisers space, UPL is making strides through its innovative range of products that focus on nutrient efficiency and plant health.

One such product is UPL Foltron, a 100% water-soluble fertiliser powered by nanotechnology, crafted to improve nutrient absorption, boost plant immunity, and enhance fruit size and quality.

UPL also offers Gainexa, a liquid fertiliser with Ortho Salicylic Acid that helps crops better absorb nutrients, improves photosynthesis, and leads to higher yields.

These are part of its broader Innovative Nutrition programme, which delivers targeted nutrition and faster crop recovery.

With China restricting exports of water-soluble and nano fertilisers, UPL’s advanced formulations could see stronger demand.

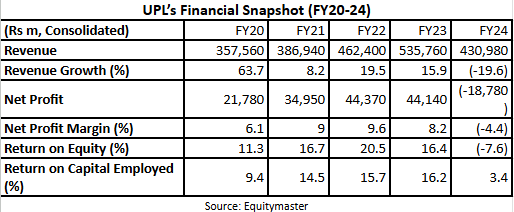

UPL’s revenue has grown at a 5-year CAGR of 14.6%. However, the company reported a loss in FY24. This robust growth has led to a strong RoCE and RoE averaging 26% and 23.7% over the last 5 years

Going forward, the company plans to expand its capacity.

Conclusion

The Indian fertilizer industry is projected to grow to US$ 16.58 bn by 2032, with a 4.2% CAGR from 2024 to 2032, according to IMARC Group. In FY24, fertilizer production reached 45.2 million (m) tonnes, driven by effective policies.

As the world’s second-largest producer of fruits and vegetables, India benefits from government initiatives like PM-KISAN and PM-Garib Kalyan Yojana, which improve farmer liquidity and fertilizer investment, with support from the UNDP for enhancing food security.

This is likely to give a strong push to fertiliser companies.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.