Sobha’s share price has corrected by 60% over the last 3 months. This is owing to the company’s net debt levels having risen by Rs 6.6 bn in 9MFY20 to Rs 30.9 bn (net D/E of 1.3x) and COVID-19 induced concerns over residential sales grinding to a halt. Although the company has clocked steady Q4FY20 gross sales volume of 0.9msf worth Rs 6.9 bn and FY20 sales volumes of 4.1msf worth Rs 28.8 bn (down 8% y-o-y in value terms), the company is headed into choppy waters going ahead.

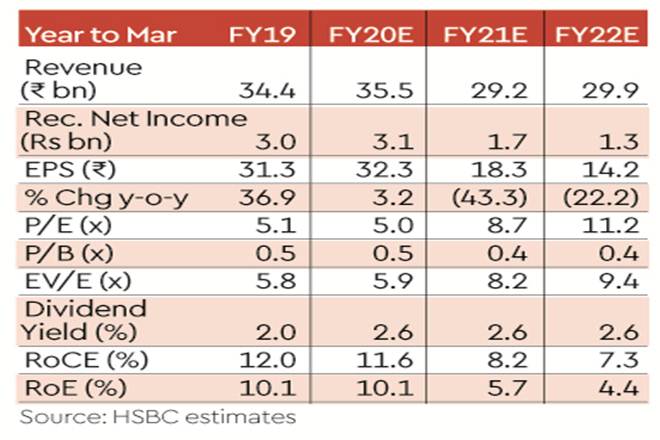

The likely economic fallout of COVID-19 is home buyers deferring their home-buying decisions for 6-9 months which spells trouble for Sobha as it has a residential heavy business model coupled with high debt. We have cut our FY21/22e volume estimates by 40% and 20% respectively and now value the company’s legacy land bank at 50% discount to market value. Accordingly, we have cut our FY20 SOTP-based target price to Rs 261 (earlier Rs 522) and retain our Buy rating.

Q4FY20 Bengaluru sales strong, other markets steady: Sobha’s Q4FY20 gross sales bookings of 0.91msf worth Rs 6.9 bn were driven by sales in Bengaluru, which accounted for 73% of the sales volumes. Other markets clocked a relatively stable performance on q-o-q basis. For FY20, Sobha’s share of sales bookings worth Rs 23.8 bn was down 8% on y-o-y basis.

Net debt has increased sharply in FY20: In 9MFY20, Sobha’s consolidated net debt has increased sharply by Rs 6.6 bn which has not been accompanied by a ramp-up in sales volume across geographies. Although the company has mentioned that net debt has reduced marginally in Q4FY20 (absolute figures not available), the likely COVID-19 induced slowdown on residential sales in FY21, is a cause for concern.

COVID-19 to impact sales volumes: While a halt in construction activity in Q1FY21 may help to balance the anticipated fall in collections in the short-term, we expect residential volumes to remain weak in Q2FY21 and only see some pick-up during the festive season in Q3FY21. We have cut our FY21/22e volume estimates by 40% and 20% respectively to 2.7msf and 3.6msf to reflect the slowdown. While the company has a large land bank of over 2,000 acres, significant chunks are legacy ones in Hosur, Kerala and Chennai which are not monetisable in the current scenario and hence we have assigned a 50% discount to market value for the company’s land bank.

What can save the day? Sobha continues to have a strong brand in South India with a timely execution record. In a scenario where residential demand recovers to pre-COVID levels in H2FY21, the company may be able to rein in debt levels with its 14msf of planned launches and monetising of its existing inventory across projects.