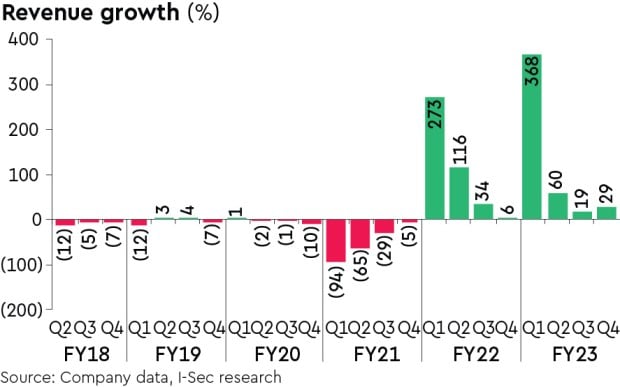

Shoppers Stop’s (SHOP) revenue performance has been in line with the expectations of both the author and the consensus. SHOP is focusing on key growth vectors, including private label, beauty, loyalty programmes, retail expansion, re-innovation, and technology, and has been successful in delivering on these areas. The highest-ever gross margin of 43%, which is higher than the average of 39% for the last 7 years, is encouraging and reflects an improvement in the revenue mix.

The launch of the plus-size apparel brand ‘U R You’ in the private label is positive, as it fills the gap in a niche (high growth) segment. In beauty business, partnership with L’Oreal International (LID), CLARINS, EARTHI and NARS is positive as it will likely help SHOP to add strength in segment where it enjoys competitive advantages. Retail expansion at 4% CAGR over last 4 years is unimpressive. We expect SHOP to accelerate store addition in tier 2-3-4 cities, led by success in private label brands. Under Venu’s leadership, SHOP has been able to (i) enhance focus towards private label brands, (ii) improve departmental store throughput, (iii) drive growth in beauty segment and (iv) category extensions (in loungewear, athleisure, innerwear etc.).

Revenue grew 29% y-o-y driven by double-digit volume growth and price hikes. Average transaction value and ASP grew 6% and 9% y-o-y. Revenue from private label and beauty segment grew 35% y-o-y and 29% y-o-y. In private brands, Bandeya (men Indian wear), Karrot (kids wear) and Stop (women western wear) grew 129% y-o-y, 60% y-o-y and 74% y-o-y. Revenue contribution from the loyalty program (First Citizen) stands at 77% of offline sales and 39% of online sales. Gross margin expanded 304bp y-o-y to 43.2% led by mix improvement (higher contribution from private brands).