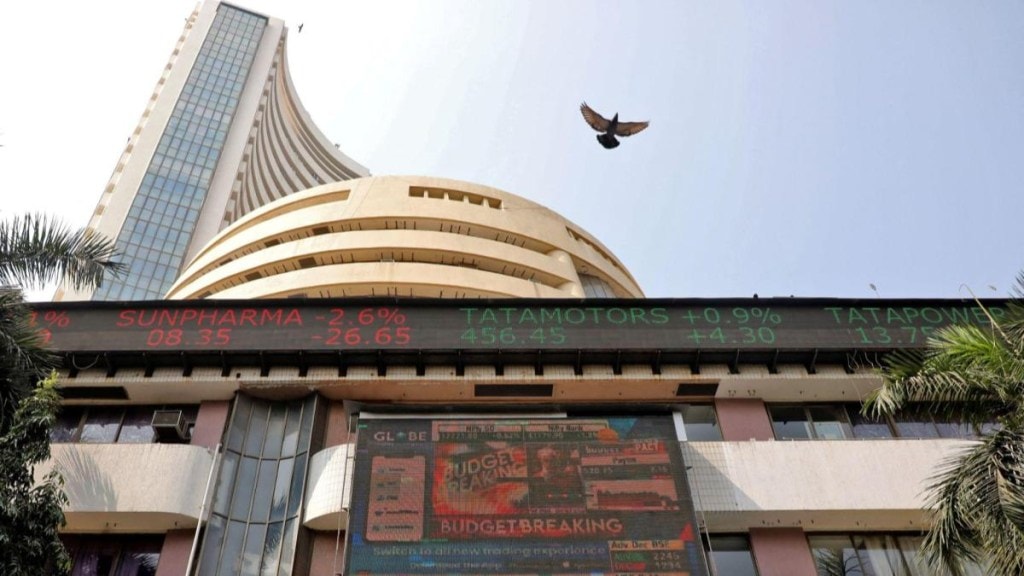

It is a sharp reversal for the markets in afternoon trade. The Sensex has slipped over 300 points intra-day and the Nifty slipped 0.3%. The small and midcaps are also under pressure in afternoon trade.

The Indian stock market started Tuesday’s session on a flat note. The Sensex opened at 80,508, down 0.12%, while the Nifty slipped to 24,563, losing 0.09%. The Nifty Bank also began in the red at 55,441.10, down 0.13%.

“That yesterday’s promising upswing stalled near 24,590 is sign of a caution calling for pull back early in the day. However, daily oscillators are positioned favourably, encouraging us to look for 25,000 or more, despite several intermediate challenges at 24,670. Alternatively, inability to float above 24,590 will deflate the upside momentum, but we may not see a rush to the 200-day SMA, now positioned at 24,049, unless 24,450 gives away,” said Anand James, Chief Market Strategist at Geojit Investments.

Three reasons why the markets are under pressure today

Some of the key reasons why the market is seeing renewed selling pressure in afternoon trade include-

Putin-Trump meet: The overhang with regard to what’s going to happen on the tariff front continues. All eyes are now on August 15 meeting between the heads of Russia and US. When Donald Trump and Putin meet, the big focus will not only be on the concessions that Russia is able to broker for itself, but the statement and stance on Russian crude is also very pertinent. US has penalised India with an additional tariff for buying Russian crude.

FII selling continues: Another continued concern for the markets is the FII selling. Foreign investors have sold over Rs 60,000 crore worth of equities since mid-July. One of the big reasons for the outflow has been the tariff-related uncertainty and the future of India-US trade and what it means.

Valuation worries: India’s valuation is also another matter of concern for investors. Even after the correction, India is at a significant premium to many of its EM peers. This has led to certain apprehension amongst investors.

Technical outlook

“We believe 24,525/80500 and 24,450/80,200 would act as key support zones for day traders. Above these levels, the uptrend is likely to continue towards 24,700-24,800/81000-81300. On the other hand, below 24,400/80000, the sentiment may turn negative. In such a scenario, traders may prefer to exit their long positions. For Bank Nifty, we are expecting to remain within the trading range of 56000 and 55000. Buying is advisable between 55200/55100 with a stop loss at 54900,” said Shrikant Chouhan, Head Equity Research, Kotak Securities.

Q1 earnings in focus

The earnings season is in its final stretch, but the next 24 hours are packed with heavyweight results. Companies set to announce their April-June numbers today include Hindustan Aeronautics, ONGC, Hindalco, Apollo Hospitals, Jindal Steel & Power, and Zydus Lifesciences.

A long list of mid- and small-cap names will also declare results including NSDL, Suzlon Energy, NHPC, Lloyds Metals & Energy, Rail Vikas Nigam, FSN E-Commerce (Nykaa), Oil India, MRF, Bharat Dynamics, Cochin Shipyard, and Granules India.

Stocks under the spotlight

Traders will also be watching Adani Group stocks, IHCL, Hindalco, Ashoka Buildcon, Tilaknagar Industries, Bata India, and Astral, among others, for company-specific developments and announcements.