Marico’s Q2FY22 pre-quarterly update indicated improving demand trends, with visible pick-up in discretionary and out-of-home consumption (value-added hair oils, premium personal care, digital-first brands) with increasing consumer mobility. Volatile edible oil prices (price cut in July, price hike in August – leading to trade destocking) and partly lower in-home consumption limited Saffola’s volume growth performance. Copra prices further corrected in Q2, leading to sequential GPM improvement, albeit GPM continued to contract on y-y basis due to elevated input-cost inflation. We estimate consolidated Q2FY22F revenue growth of c.+20% y-y (vs. Q2FY21: +9% y-o-y; Q1FY22: +31% y-o-y) and Ebitda/PAT growth of c.+9%/+1% y-o-y.

Demand trends: Improvement especially in discretionary/ out-of-home

India business (c.77% of sales): Two-year volume CAGR was close to double-digits. Value growth should be in low-twenties. Firm re-launched Saffola Chyawanprash with reworked product mix, across formats pan-India and on Scaffolds’ D2C website.

Categories: most performing well; Saffola oil muted

Parachute (c.30% of sales): performance was in line with company’s medium-term expectations. While copra prices have corrected sequentially, Marico has not yet initiated a price cut.

Saffola oil (c.18% of sales): volume growth was muted (on a high Q2FY21 base of c.+20% y-o-y) due to (i) volatile edible oil prices, leading to trade destocking, and (ii) lower in-home consumption.

Value added hair oil (c.17% of sales): delivered double-digit volume growth.

International business (c.23% of sales): Double-digit constant-currency growth. Positive trends in all markets except Vietnam. Vietnam (mostly discretionary portfolio) was impacted by the severe COVID-19 resurgence and curbs.

Margin trends: sequential improvement, y-o-y pressure

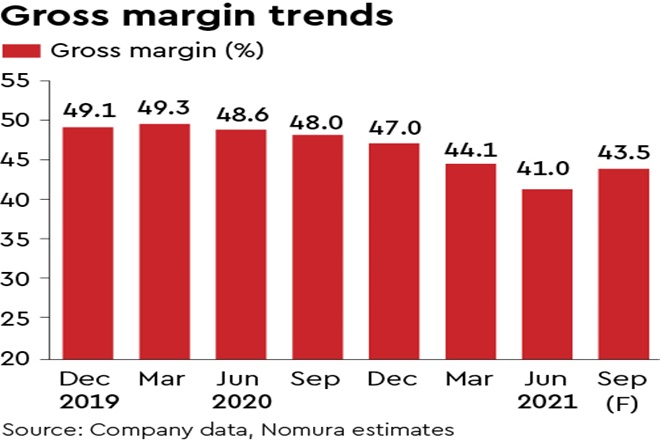

Marico indicated that Copra price corrected further, crude oil price remained firm and edible oil prices swung back to higher levels. Gross margin (GPM) should improve marginally q-o-q while remaining pressured yy due to elevated input-cost inflation (Q1FY22 GPM: 41.0%, Q2FY21 GPM: 48.0%).

We expect Marico to continue to invest in new launches and digital/D2C brands, and expect A&P spending to increase sequentially. Operating margin (OPM) to decline y-y due to effect of pricing growth in topline (Q2FY21 OPM: 19.6%). Mgmt expects to deliver modest PAT growth in Q2FY22 (Q2FY21: +20% y-o-y).

We maintain our Buy rating and target price of Rs 640 with FY21-24F EPS CAGR of 17%. The stock currently trades at 42x Sep-23F EPS (EPS of Rs 13.3).