Mahindra & Mahindra’s (M&M’s) Q4FY21 results were slightly below consensus estimates as Ebitda margin came in at 14.7% (down 227bps q-o-q). Margins were dragged by the automotive segment (Ebit margin: 5%, down 243bps), while FES was resilient (Ebit margin: 22%, down 139bps). Management shared a new product plan (5-years) for SUVs (9 products) /LCVs (14 products); pure EV options (6 products) would also be developed.

Investments into electric (Rs 30 bn) signal clarity of strategy as M&M would be able to build a learning curve advantage vis-a-vis domestic peers who are investment shy on EVs. Mahindra & Mahindra management’s aggression to gain market share in FES business is likely to sound sweet to investors and their long-term growth outlook also remains bullish (15-20% CAGR over the next 3-5 years). Valuations remain attractive. Maintain Buy.

Key highlights of the quarter: Revenues in Q4FY21 grew 48% y-o-y to ~Rs 133 bn due to ~60% improvement in FES revenue, while automotive sales grew ~43%. Ebitda margin improved 107bps to 14.7% even as gross margin faced headwinds (commodity rise, regulatory costs) and dropped to 30.8% (down 487bps). Superior fixed cost reduction supported margins (other expenses down 399bps y-o-y). Adj. PAT jumped 211%. M&M took an impairment charge of ~Rs 8.8 bn.

Maintain BUY: The change in management and the evolution of focused capital allocation strategy (RoE>18%) has been well appreciated by investors. The strategy now is entering growth acceleration phase; we expect H2 to witness strong pick-up across PVs (led by new launches) as supply-chain woes fade away.

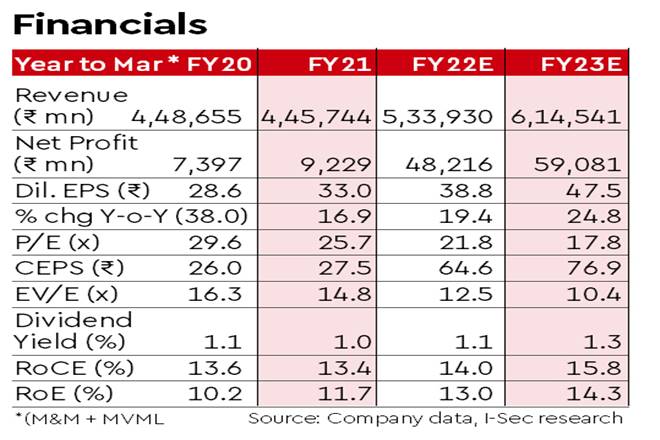

We revise our EPS estimates by -1%/2.8% for FY22e/23e, respectively, maintain our target multiple at 8.5x FY23e Ebitda (Rs 710/share) and value subsidiaries at Rs 330/share to arrive at SoTP-based target price of Rs 1,040/share (earlier: Rs 1,045). We maintain Buy on the stock.