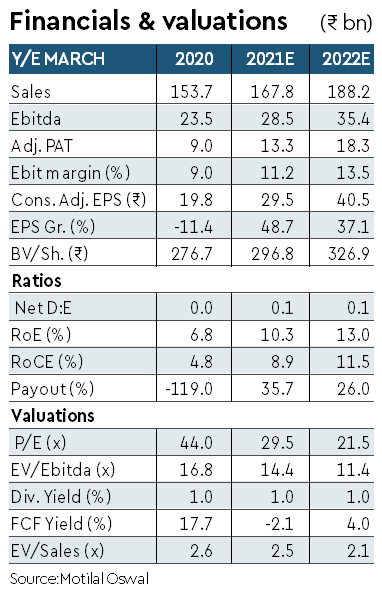

After three years of earnings decline, we expect Lupin’s (LPC’s) earnings growth to improve over FY20-22e, based on robust ANDA pipeline (including limited competition products like g-Albuterol/g-Fostair) and sustained outperformance in the domestic formulation (DF) market. Accordingly, we expect return ratios to form a trough in FY20, and thereafter, to be on an uptrend. We are yet to see benefit of the cost rationalisation exercise implemented by LPC.

We have cut our EPS estimate by 14.5/5% for FY21/FY22e to factor in the COVID-19 led slowdown in DF and delay in better operating leverage. We value LPC at 22x 12M forward earnings to arrive at a price target of Rs 1,000. We remain positive on LPC due to (a) better visibility of approvals/increased market share in niche products, and (b) LPC reaching end of remediation measures at its key sites under regulatory issues. Maintain Buy.

Weak performance for the quarter

Revenues in Q4FY20 were down 1.1% y-o-y to Rs 38.5 bn. US sales were down 13.5% y-o-y to $212 m (42% of sales). APAC sales were down 16% y-o-y to Rs 1.4 bn. On the other hand, DF sales (31% of sales) were up 13.3% y-o-y to Rs 11.9 bn. Also, EMEA sales were up 7.4% y-o-y to Rs 3.5 bn. API sales increased 12% y-o-y to Rs 3.3 bn.

Gross margin (GM) declined 610bp y-o-y to 63.5% led by change in the product mix. Ebitda margin at 13.7%, was down at similar rate of 630bp y-o-y as higher employee cost was partially offset by lower other expenses. Ebitda came in at Rs 5.3 bn, down 33% y-o-y.

Lupin had exceptional items. It also had forex gain of Rs 1.3 bn for the quarter. Adj. PAT was flat at Rs 2.7 bn, due to lower tax rate. FY20 sales/Ebitda/Adj. PAT was at Rs 154/24/9 bn. Revenues were up 4.8% while Ebitda/Adj. PAT were down 8%/11% y-o-y.

Highlights from commentary

No queries are pending for g-Albuterol; expected launch in 2HFY21. g-Fostair should also be launched in Europe in 2HFY21.R&D spend should be similar at absolute level of Rs 15 bn for FY21.

Valuation and view

The COVID-19 led weakness in Acute therapies would impact DF growth slightly over the near term. Also, benefit of cost efficiency is yet to kick in. We expect 40% earnings CAGR over FY20-22E, led by niche launches (gAlbuterol — no more queries pending with the USFDA; g-Fostair in EU), improving market share in Levothyroxine in the US, and better-than-industry growth in DF. Maintain Buy.