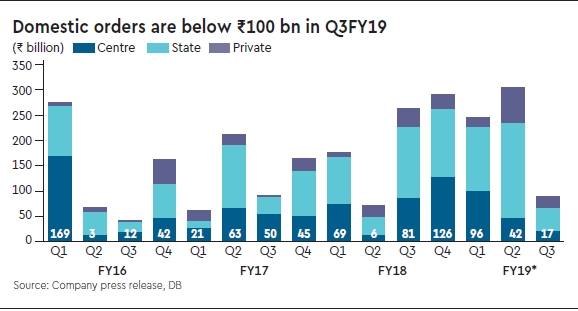

L&T announced orders are down 50% y-o-y to Rs 145 bn in Q3FY19, primarily due to exhaustion of large orders pipeline after a sharp order growth over the past four quarters. The average size of orders dropped below Rs 10 bn/project— down 50% from 6-7 quarter average. We had cut our order inflow estimates by 14-15% in 13-Dec’2018 report as our order tracker shows a sharp reduction in the new order announcements, which should have a bearing on the new order inflows for the next four quarters. We prefer Thermax, Cummins and Siemens in Capital Goods sectors with private capex exposure, whereas L&T and BHEL will get lower preference given expected slowdown in government projects.

L&T’s guidance could be cut to 0-2%

Given announced orders, Q4FY19e orders requirement will be 23-29% y-o-y growth to meet L&T’s 10-12% orders growth guidance, which we believe could be challenging given the election period and slowdown in new project announcements. On DB est, L&T needs to deliver

-5% y-o-y order inflow growth in Q4, thus, resulting in a 1% growth for total orders in FY19e. Hence, its order inflows guidance could be cut from 10-12% to 0-2%, in our opinion.

Also read| Dollar slide: Goldman Sachs to bet on weaker US currency

Q3: Slowing orders, but good execution

We expect total orders of Rs 219 bn for Q3FY19e (-48% y/y), and `293 bn (-39% y/ y) including services segments. We forecast good growth of 19% y/y in execution from past backlog, accompanied with +90bps increase in margins to 11.8% on crossing the margin threshold, leading to 33% jump in profits to Rs 19.9 bn.

Retain Buy — valuations undemanding

We retain Buy despite a low 12% upside to our Rs 1,620 TP as: (i) company is on track to achieve its RoE of 18% by 2021 and took `54 bn debt for buyback to achieve it; (ii) sale of non-core/loss making segments could enhance PAT by Rs 3-4 bn in 2HFY19e; and (iii) E&A sale could enhance returns. We value L&T on SOTP basis using 21x P/E for E&C, 12x for IT, 1.5x P/B for the finance companies and 1.0x for development assets. Key risks are low infra margins, slower capex recovery, the developer projects sold below book and general macro uncertainty.